Question: Colin was a professional classical guitar player until a motorcycle accident left him disabled. After long months of therapy, he hired an experienced luthier) and

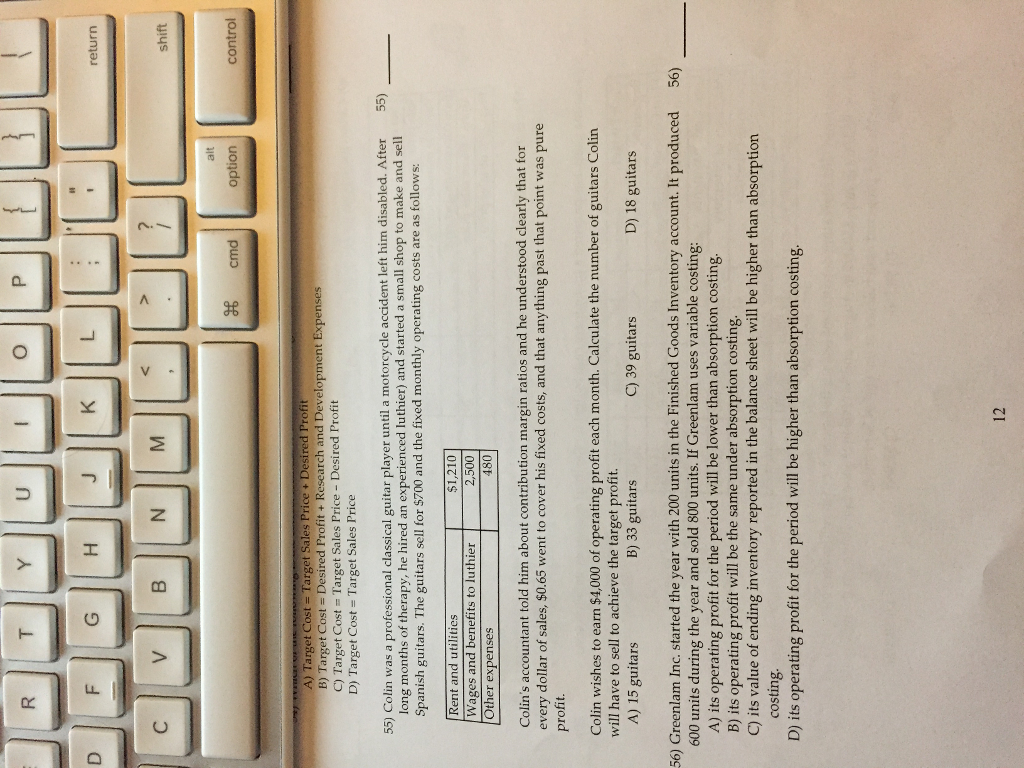

Colin was a professional classical guitar player until a motorcycle accident left him disabled. After long months of therapy, he hired an experienced luthier) and started a small shop to make and sell Spanish guitars. The guitars sell for $700 and the fixed monthly operating costs are as follows: Colin's accountant told him about contribution margin ratios and he understood clearly that for every dollar of sales, $0.65 went to cover his fixed costs, and that anything past that point was pure profit. Colin wishes to earn $4,000 of operating profit each month. Calculate the number of guitars Colin will have to sell to achieve the target profit. A) 15 guitars B) 33 guitars C) 39 guitars D) 18 guitars Greenlam Inc. started the year with 200 units in the Finished Goods Inventory account. It produced 600 units during the year and sold 800 units. If Greenlam uses variable costing: A) its operating profit for the period will be lower than absorption costing. B) its operating profit will be the same under absorption costing. C) its value of ending inventory reported in the balance sheet will be higher than absorption costing. D) its operating profit for the period will be higher than absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts