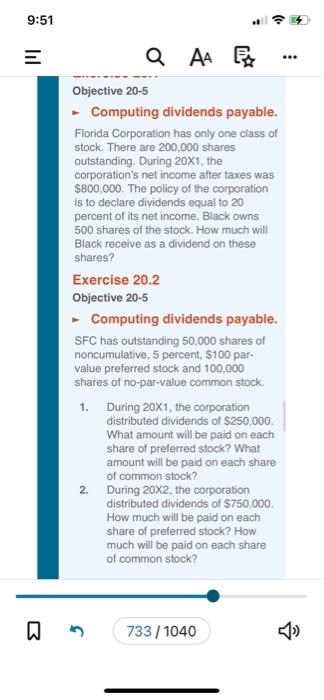

Question: college accounting 20 chapter exercise 20.2 - Computing dividends payable. Florida Corporation has only one class of stock. There are 200,000 shares outstanding. During 201,

- Computing dividends payable. Florida Corporation has only one class of stock. There are 200,000 shares outstanding. During 201, the corporation's net income after taxes was $800,000. The policy of the corporation is to declare dividends equal to 20 percent of its net income. Black owns 500 shares of the stock. How much will Black receive as a dividend on these shares? Exercise 20.2 Objective 20-5 - Computing dividends payable. SFC has outstanding 50,000 shares of noncumulative, 5 percent, $100 parvalue preferred stock and 100,000 shares of no-par-value common stock. 1. During 201, the corporation distributed dividends of $250,000. What amount will be paid on each share of preferred stock? What amount will be paid on each share of common stock? 2. During 202, the corporation distributed dividends of $750,000. How much will be paid on each share of preferred stock? How much will be paid on each share of common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts