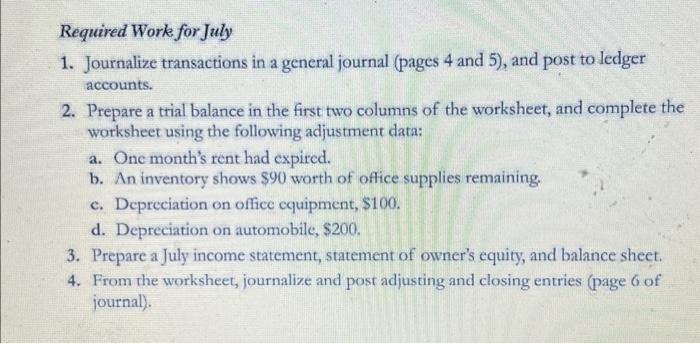

Question: general journal from page 4 to 5 ledger accounts trial balance worksheet income statement statement of owner's equity balance sheet During July, Sullivan Realty completed

ledger accounts

trial balance

worksheet

income statement

statement of owner's equity

balance sheet

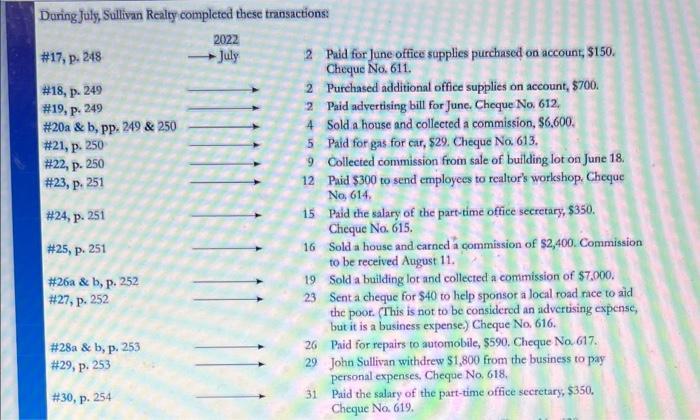

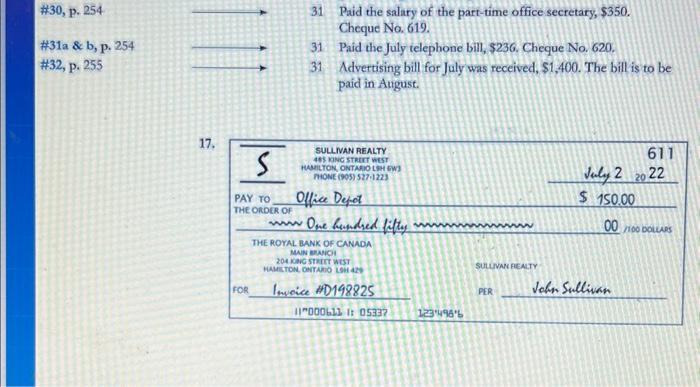

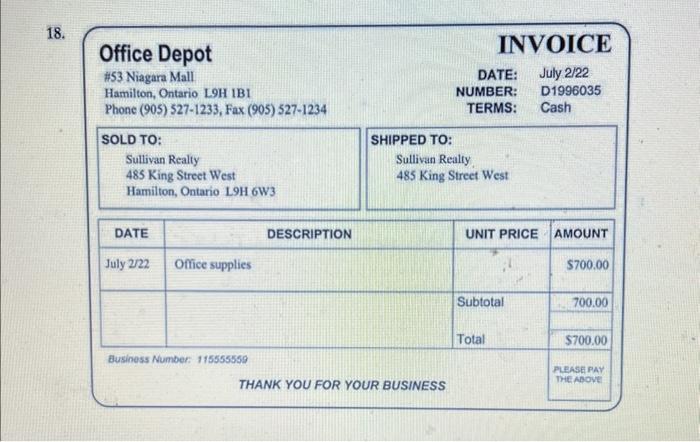

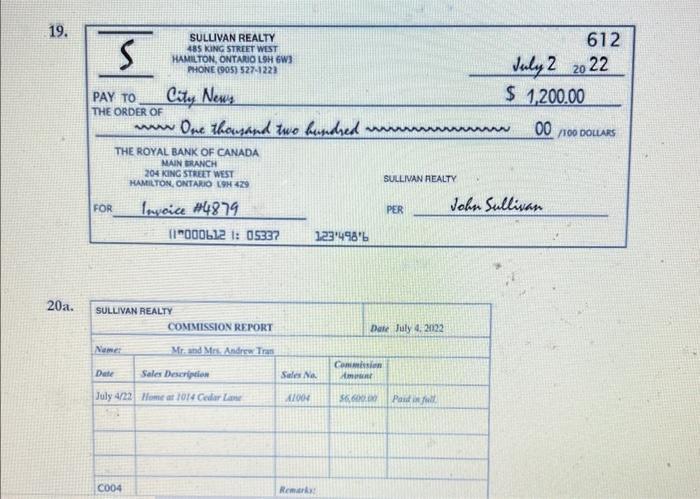

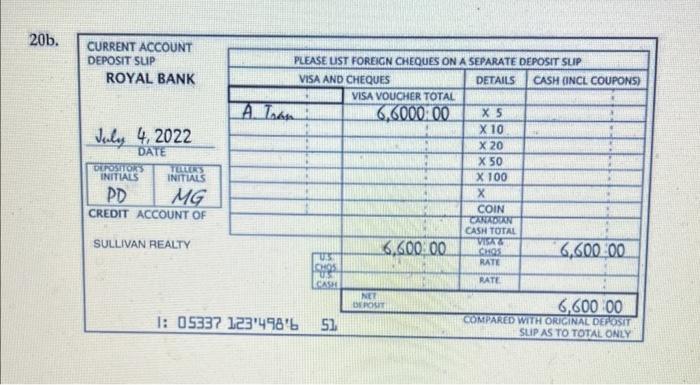

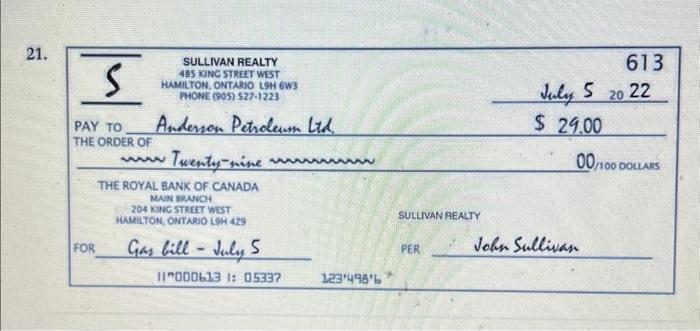

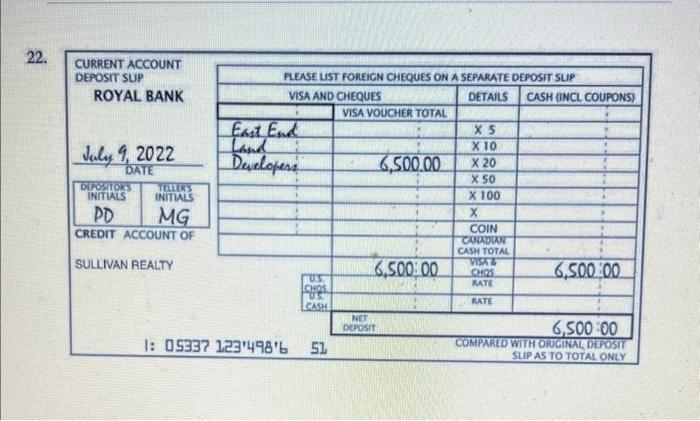

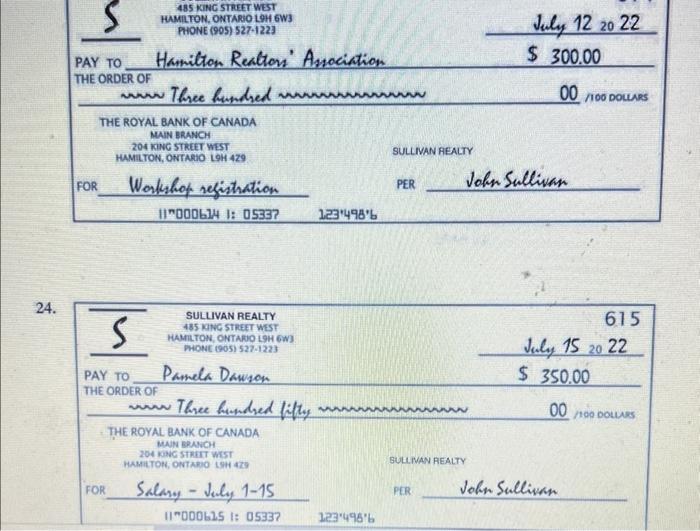

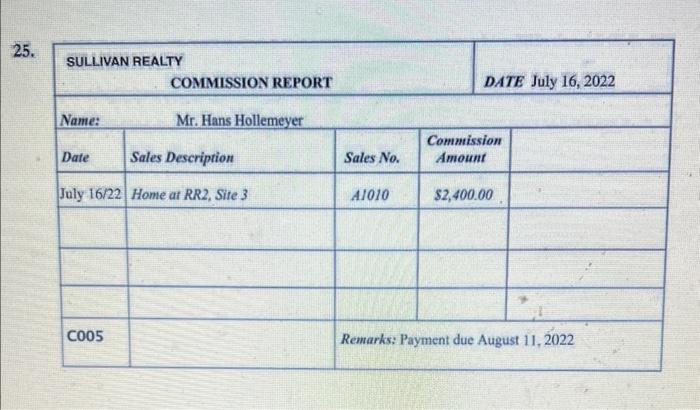

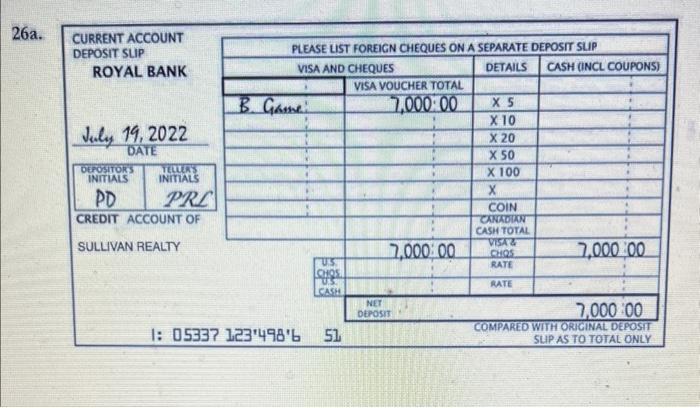

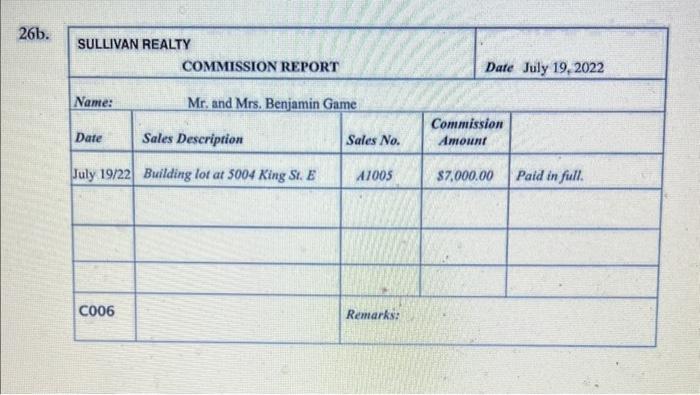

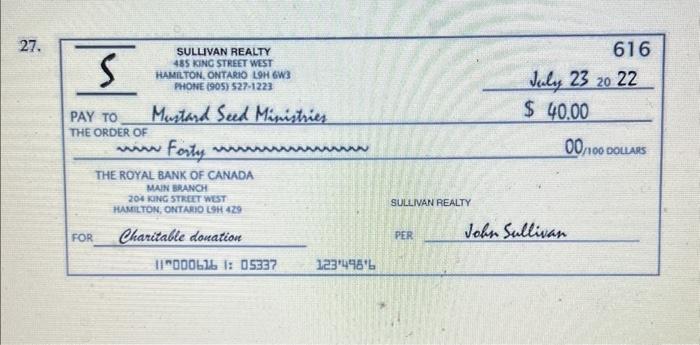

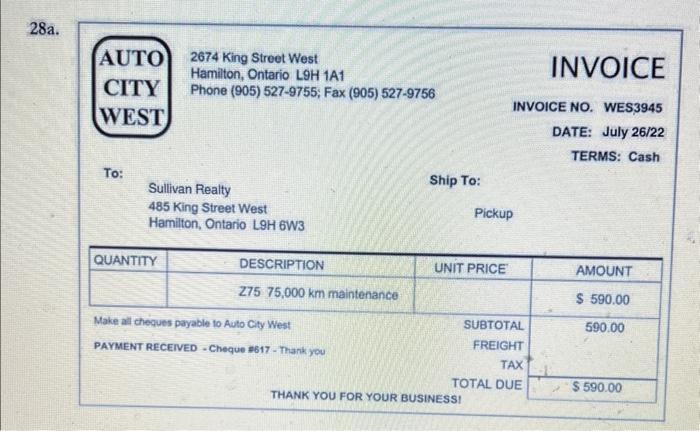

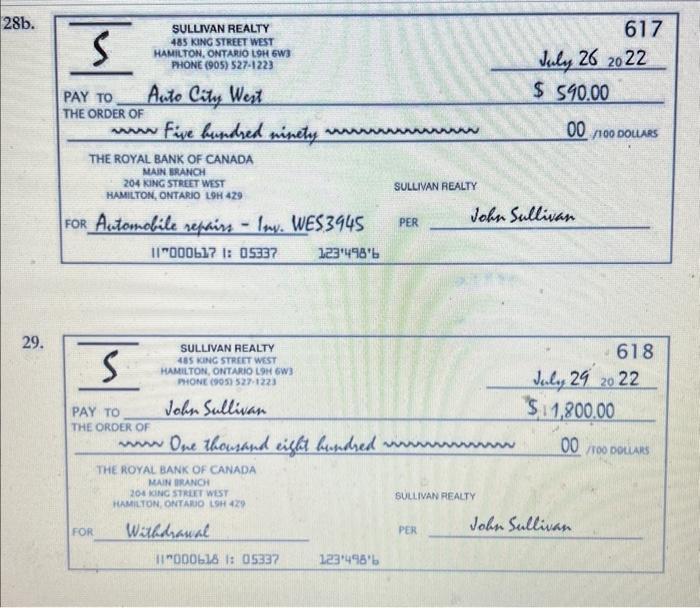

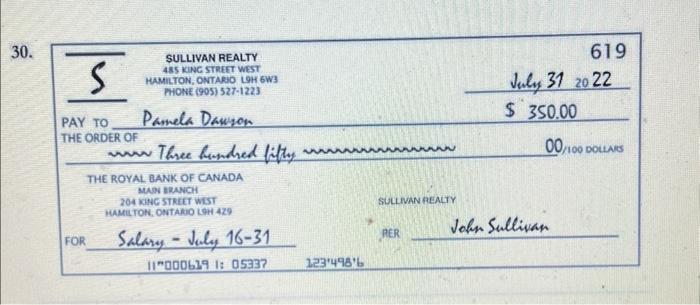

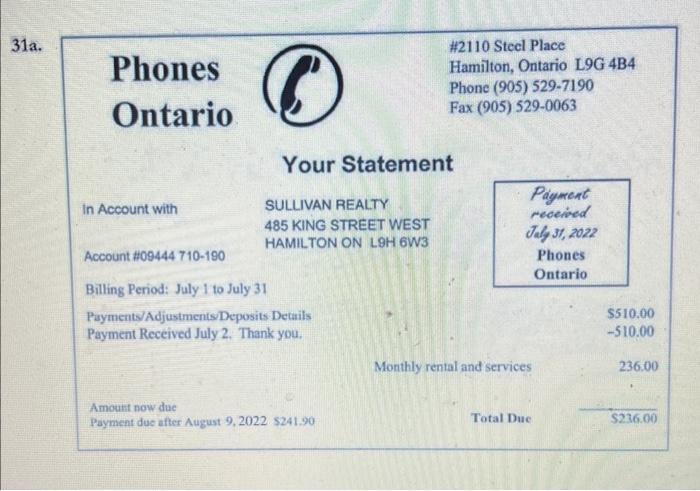

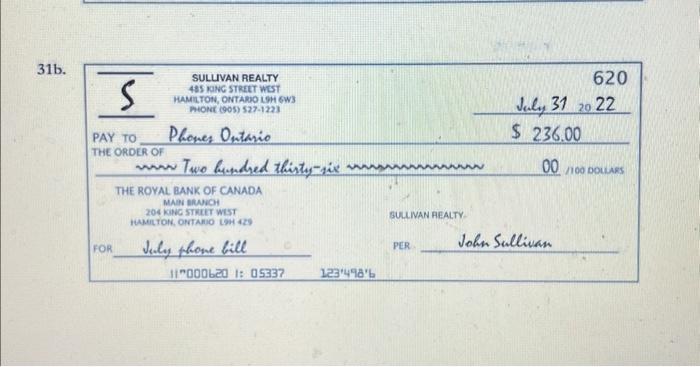

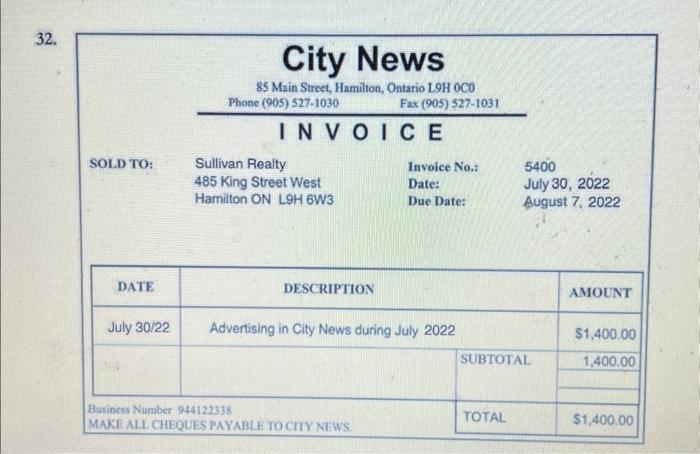

During July, Sullivan Realty completed these transactions: 2022 July #17, p. 248 #18, p. 249 #19, p. 249 # 20a & b, pp. 249 & 250 # 21, p. 250 250 # 22, p. # 23, p. 251 P #24, p. 251 #25, p. 251 # 26a & b, p. 252 #27, p. 252 # 28a & b, p. 253 #29, p. 253 # 30, p. 254 2 Paid for June office supplies purchased on account, $150. Cheque No. 611. 2 2 4 5 9 12 Purchased additional office supplies on account, $700. Paid advertising bill for June. Cheque No. 612. Sold a house and collected a commission, $6,600. Paid for gas for car, $29. Cheque No. 613. Collected commission from sale of building lot on June 18. Paid $300 to send employees to realtor's workshop, Cheque No, 614, 15 Paid the salary of the part-time office secretary, $350. Cheque No. 615. 16 Sold a house and carned a commission of $2,400. Commission to be received August 11. 19 Sold a building lot and collected a commission of $7,000. 23 Sent a cheque for $40 to help sponsor a local road race to aid the poor. (This is not to be considered an advertising expense, but it is a business expense.) Cheque No. 616. 26 Paid for repairs to automobile, $590. Cheque No. 617. 29 John Sullivan withdrew $1,800 from the business to pay personal expenses. Cheque No. 618. 31 Paid the salary of the part-time office secretary, $350. Cheque No. 619.

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Answer 1 First we will journalize the given transactions Date Account Title Debit Credit 02Jul Accounts Payable 150 Cash 150 To record the cash payment 02Jul Office Supplies 700 Accounts payabel 700 T... View full answer

Get step-by-step solutions from verified subject matter experts