Question: Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2018, accounts receivable totaled $695,000. The allowance method is used to

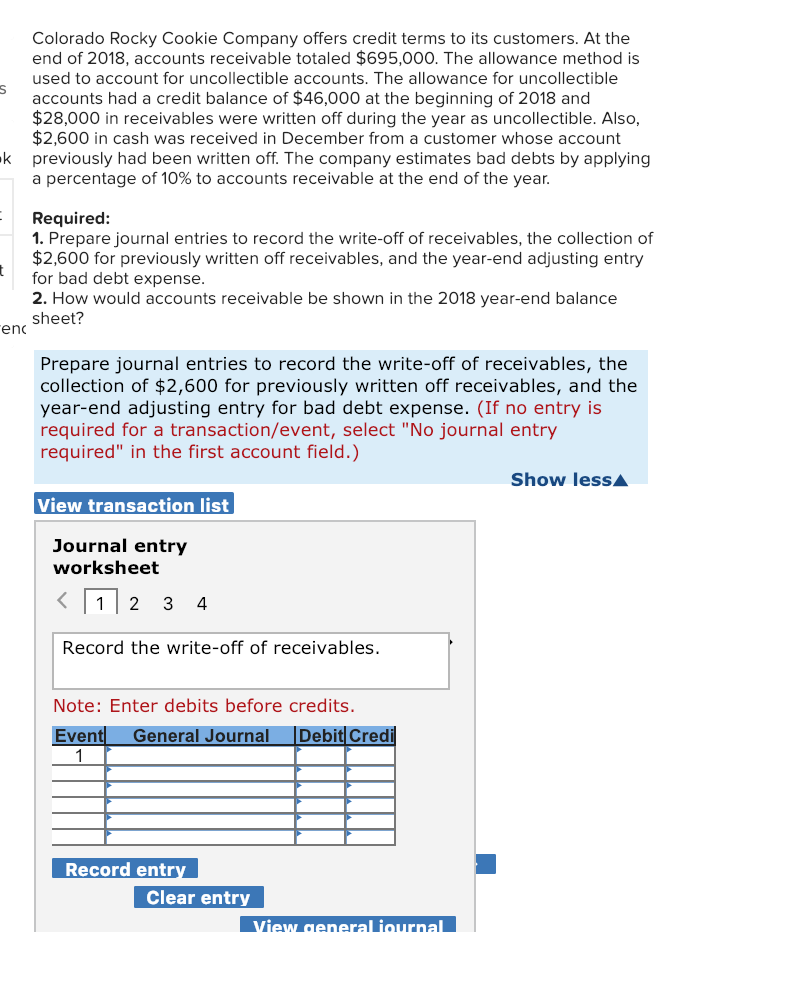

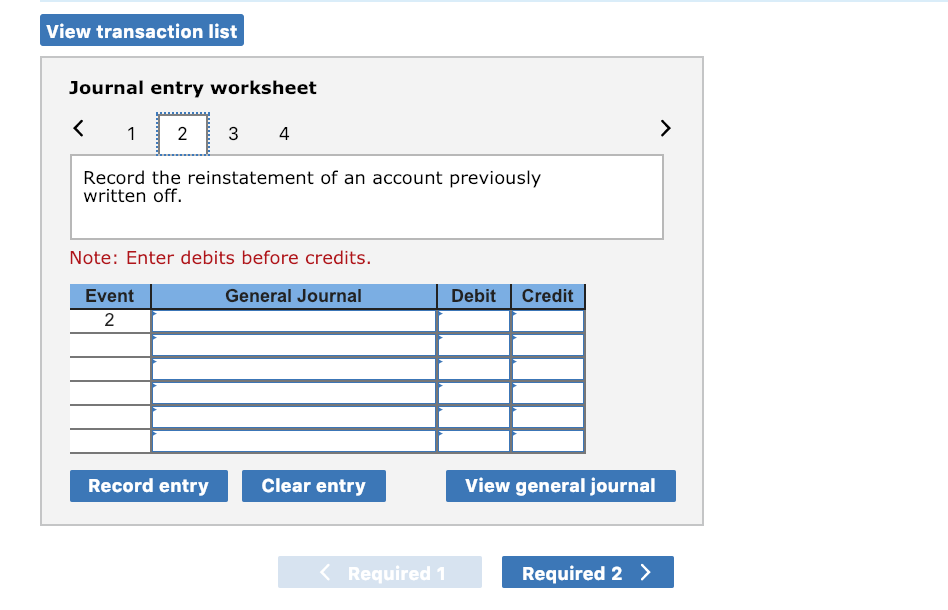

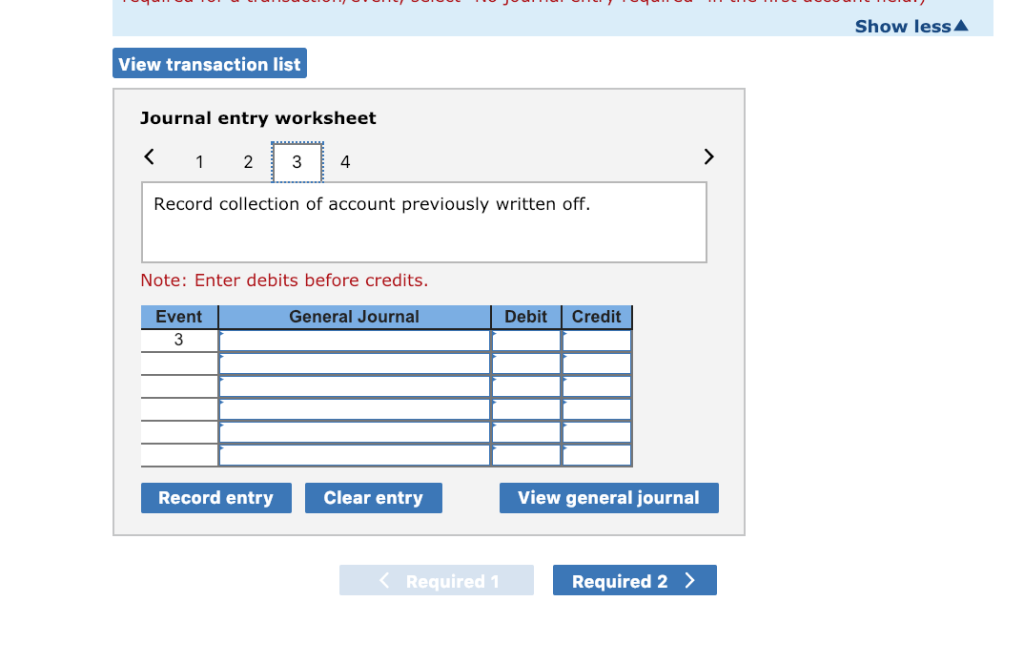

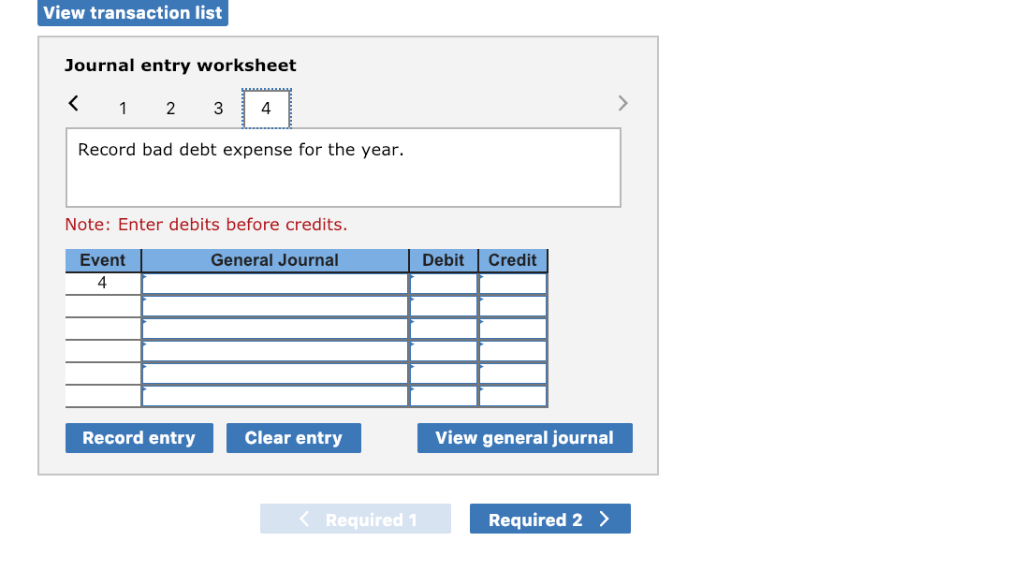

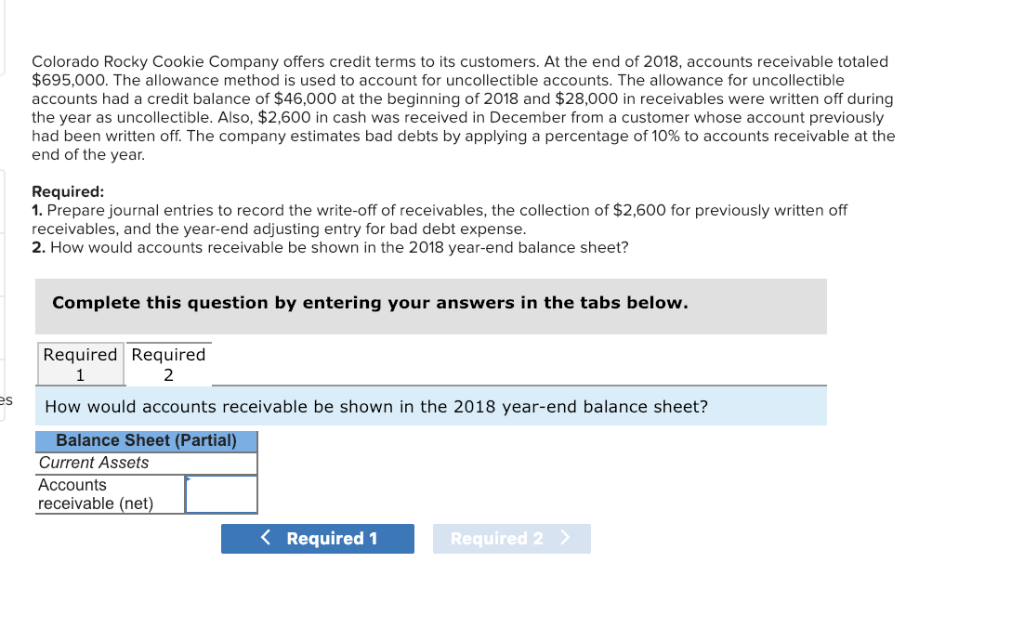

Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2018, accounts receivable totaled $695,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $46,000 at the beginning of 2018 and $28,000 in receivables were written off during the year as uncollectible. Also, $2,600 in cash was received in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts receivable at the end of the year. k Required 1. Prepare journal entries to record the write-off of receivables, the collection of $2,600 for previously written off receivables, and the year-end adjusting entry for bad debt expense 2. How would accounts receivable be shown in the 2018 year-end balance sheet? enc Prepare journal entries to record the write-off of receivables, the collection of $2,600 for previously written off receivables, and the year-end adjusting entry for bad debt expense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show lessA View transaction list Journal entry worksheet Record the write-off of receivables Note: Enter debits before credits Record entr Clear entry View transaction list Journal entry worksheet Record the reinstatement of an account previously written off. Note: Enter debits before credits Debit Credit Event 2 General Journal Record entry Clear entry View general journal Required 1 Required 2 Show less View transaction list Journal entry worksheet Record collection of account previously written off. Note: Enter debits before credits. Debit Credit Event 3 General Journal Record entry Clear entry View general journal Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2018, accounts receivable totaled $695,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $46,000 at the beginning of 2018 and $28,000 in receivables were written off during the year as uncollectible. Also, $2,600 in cash was received in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts receivable at the end of the year. Required 1. Prepare journal entries to record the write-off of receivables, the collection of $2,600 for previously written off receivables, and the year-end adjusting entry for bad debt expense. 2. How would accounts receivable be shown in the 2018 year-end balance sheet? Complete this question by entering your answers in the tabs below Required Required 2 es How would accounts receivable be shown in the 2018 year-end balance sheet? Balance Sheet (Partial) Current Assets Accounts receivable (net) Required 1 Required 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts