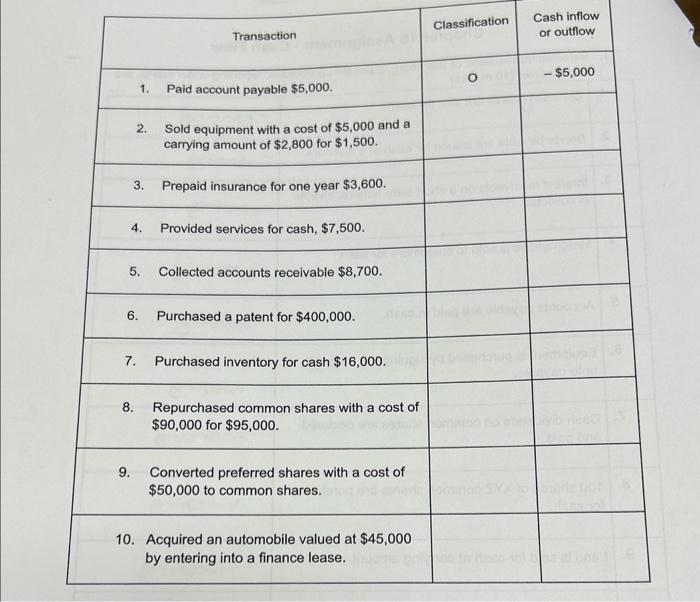

Question: comeplete the table by determining whether each transaction should be classified as a operating expense (O) Investing (I) or Financing (F) activity. And determine yhe

\begin{tabular}{|c|c|c|} \hline Transaction & Classification & \begin{tabular}{l} Cash inflow \\ or outhlow \end{tabular} \\ \hline 1. Paid account payable $5,000. & o & $5,000 \\ \hline \begin{tabular}{l} 2. Sold equipment with a cost of $5,000 and a \\ carrying amount of $2,800 for $1,500. \end{tabular} & & \\ \hline 3. Prepaid insurance for one year $3,600. & & \\ \hline 4. Provided services for cash, $7,500. & & \\ \hline 5. Collected accounts receivable $8,700. & & \\ \hline 6. Purchased a patent for $400,000. & ria & \\ \hline 7. Purchased inventory for cash $16,000. & & \\ \hline \begin{tabular}{l} 8. Repurchased common shares with a cost of \\ $90,000 for $95,000. \end{tabular} & & \\ \hline \begin{tabular}{l} 9. Converted preferred shares with a cost of \\ $50,000 to common shares. \end{tabular} & & \\ \hline \begin{tabular}{l} 10. Acquired an automobile valued at $45,000 \\ by entering into a finance lease. \end{tabular} & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts