Question: Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States and several foreign countries. Both subsidiaries are U.S.

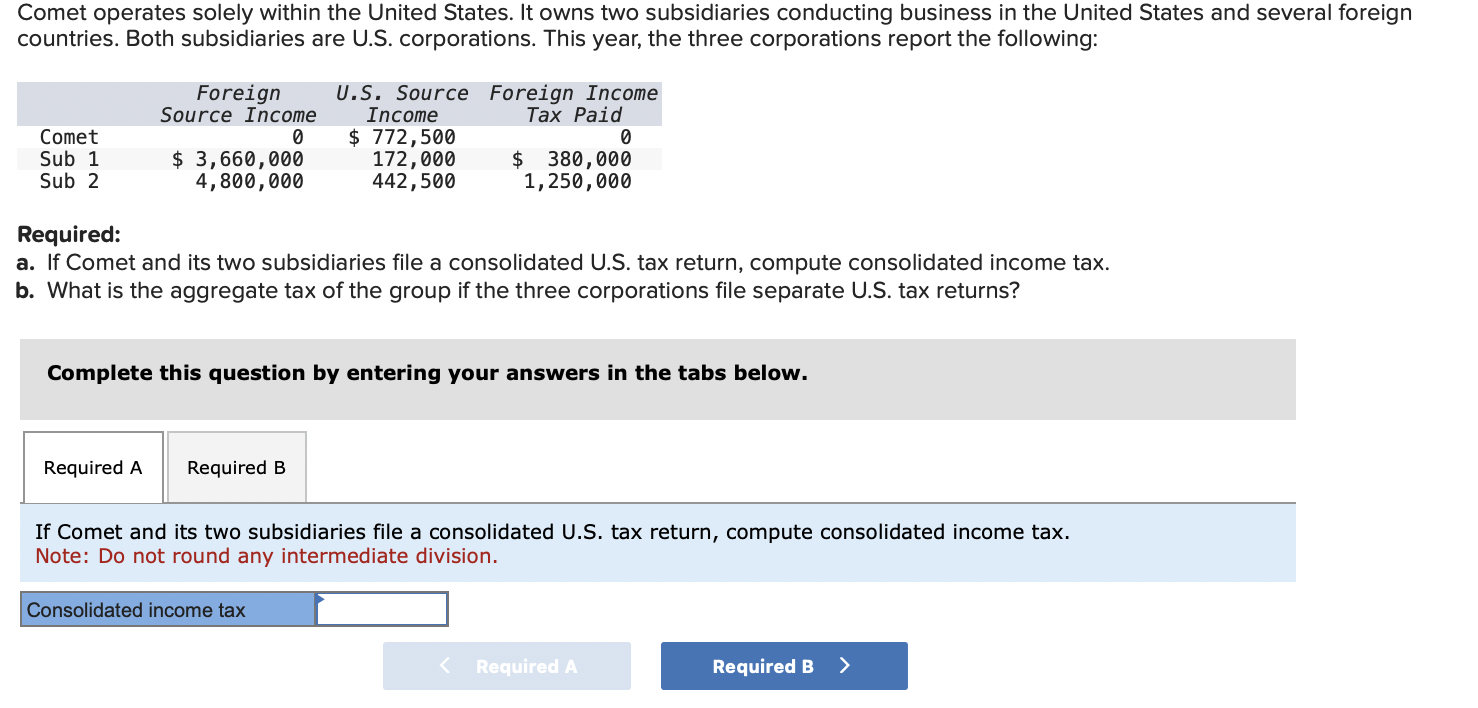

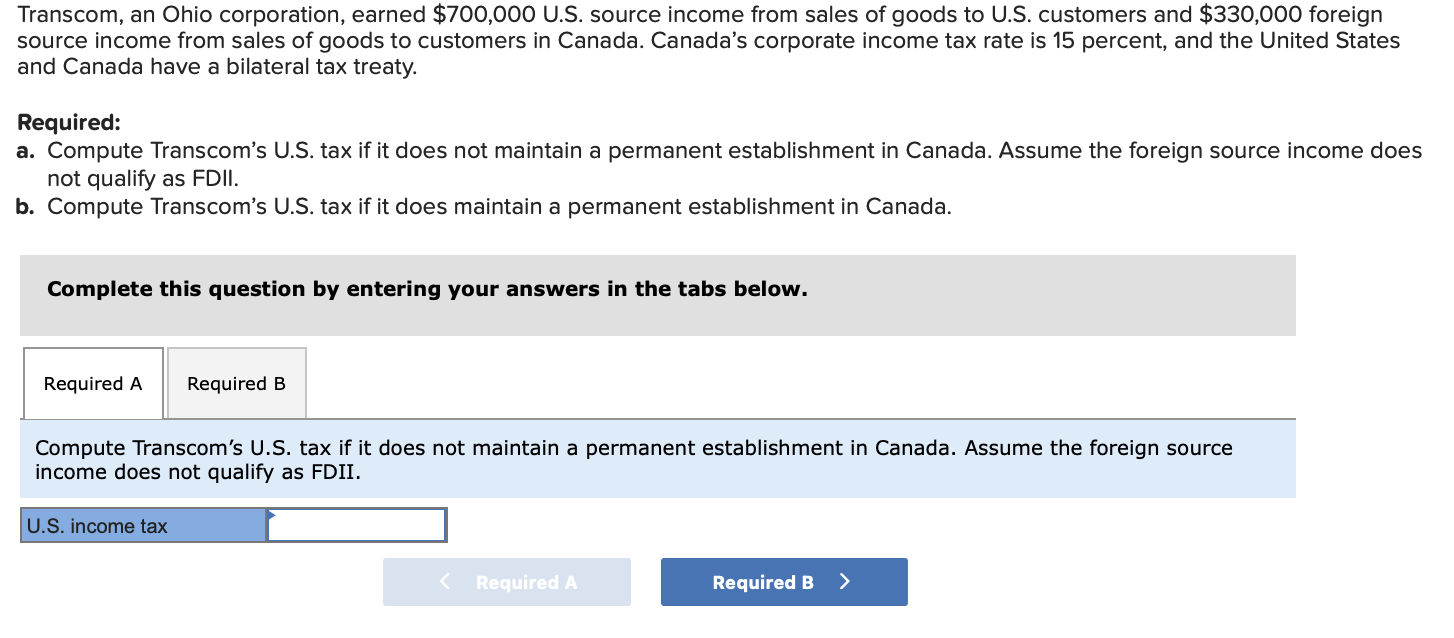

Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States and several foreign countries. Both subsidiaries are U.S. corporations. This year, the three corporations report the following: Required: a. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax. b. What is the aggregate tax of the group if the three corporations file separate U.S. tax returns? Complete this question by entering your answers in the tabs below. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax. Note: Do not round any intermediate division. Transcom, an Ohio corporation, earned $700,000 U.S. source income from sales of goods to U.S. customers and $330,000 foreign source income from sales of goods to customers in Canada. Canada's corporate income tax rate is 15 percent, and the United States and Canada have a bilateral tax treaty. Required: a. Compute Transcom's U.S. tax if it does not maintain a permanent establishment in Canada. Assume the foreign source income does not qualify as FDII. b. Compute Transcom's U.S. tax if it does maintain a permanent establishment in Canada. Complete this question by entering your answers in the tabs below. Compute Transcom's U.S. tax if it does not maintain a permanent establishment in Canada. Assume the foreign source income does not qualify as FDII

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts