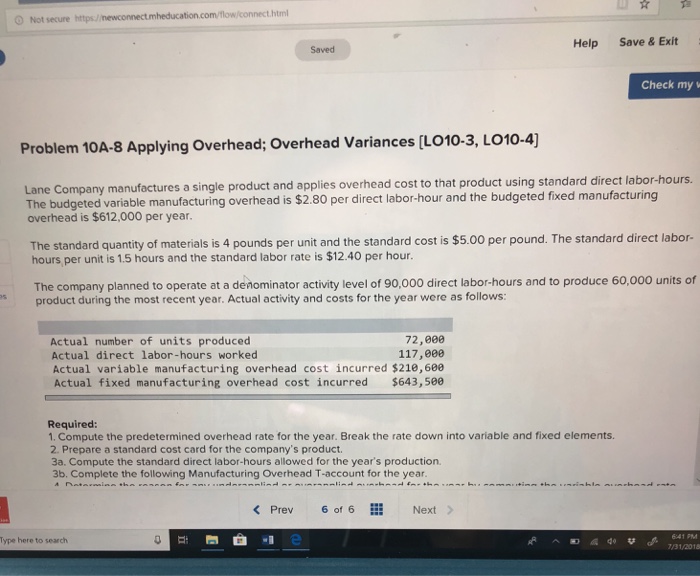

Question: com/flow/connect.html O Not secure https/ Help Save&Exit Saved Check my Problem 10A-8 Applying Overhead; Overhead Variances [L010-3, LO10-4) Lane Company manufactures a single product and

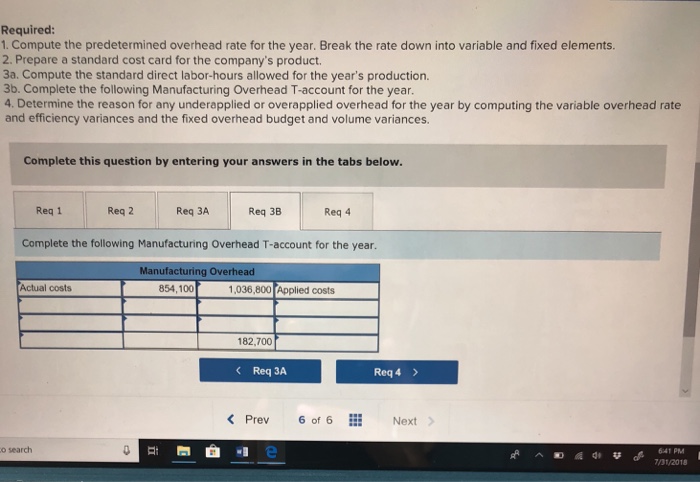

com/flow/connect.html O Not secure https/ Help Save&Exit Saved Check my Problem 10A-8 Applying Overhead; Overhead Variances [L010-3, LO10-4) Lane Company manufactures a single product and applies overhead cost to that product using standard direct labor-hours. The budgeted variable manufacturing overhead is $2.80 per direct labor-hour and the budgeted fixed manufacturing overhead is $612,000 per year. The standard quantity of materials is 4 pounds per unit and the standard cost is $5.00 per pound. The standard direct labor- hours per unit is 1.5 hours and the standard labor rate is $12.40 per hour. The company planned to operate at a denominator activity level of 90,000 direct labor-hours and to produce 60,000 units of product during the most recent year. Actual activity and costs for the year were as follows: 72,800 117,000 Actual number of units produced Actual direct labor-hours worked Actual variable manufacturing overhead cost incurred $210,688 Actual fixed manufacturing overhead cost incurred $643,566 Required 1. Compute the predetermined overhead rate for the year. Break the rate down into variable and fixed elements. 2. Prepare a standard cost card for the company's product. 3a. Compute the standard direct labor-hours allowed for the year's production. 3b. Complete the following Manufacturing Overhead T-account for the year K Prev6 of 6Next Type here to search 31/2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts