Question: comment on each case B and C and explain whether you agree or disagree with it. Provide calculations and/or entries if needed. B. Nada and

comment on each case B and C and explain whether you agree or disagree with it. Provide calculations and/or entries if needed.

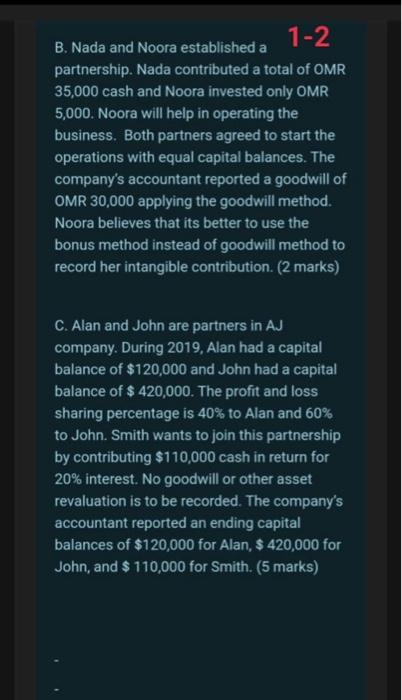

B. Nada and Noora established a 1-2 partnership. Nada contributed a total of OMR 35,000 cash and Noora invested only OMR 5,000 . Noora will help in operating the business. Both partners agreed to start the operations with equal capital balances. The company's accountant reported a goodwill of OMR 30,000 applying the goodwill method. Noora believes that its better to use the bonus method instead of goodwill method to record her intangible contribution. (2 marks) C. Alan and John are partners in AJ company. During 2019, Alan had a capital balance of $120,000 and John had a capital balance of $420,000. The profit and loss sharing percentage is 40% to Alan and 60% to John. Smith wants to join this partnership by contributing $110,000 cash in return for 20% interest. No goodwill or other asset revaluation is to be recorded. The company's accountant reported an ending capital balances of $120,000 for Alan, $420,000 for John, and $110,000 for Smith

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts