Question: Comment on whether this is feasible and if not, why not? 10-3 Cost of Debt Calculate the annual after-tax cost (in dollars) of debt given

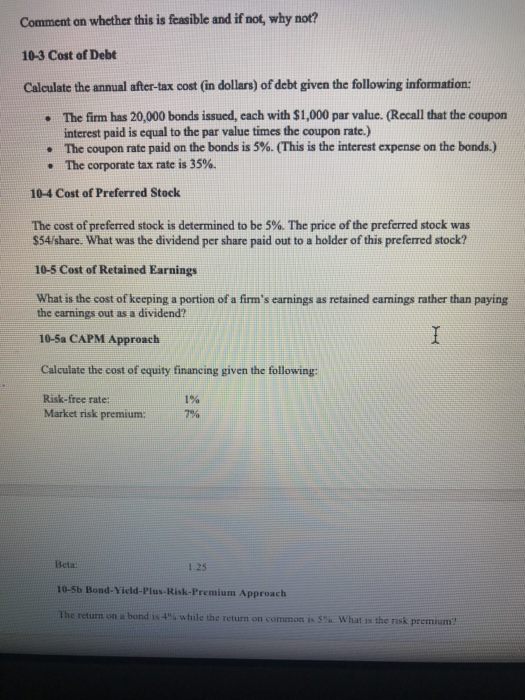

Comment on whether this is feasible and if not, why not? 10-3 Cost of Debt Calculate the annual after-tax cost (in dollars) of debt given the following information: The firm has 20,000 bonds issued, each with $1,000 par value. (Recall that the coupon interest paid is equal to the par value times the coupon rate.) The coupon rate paid on the bonds is 5%. (This is the interest expense on the bonds.) The corporate tax rate is 35%. . . 10-4 Cost of Preferred Stock The cost of preferred stock is determined to be 5%. The price of the preferred stock was $54/share. What was the dividend per share paid out to a holder of this preferred stock? 10-5 Cost of Retained Earnings What is the cost of keeping a portion of a firm's earnings as retained earnings rather than paying the earnings out as a dividend? 10-5a CAPM Approach Calculate the cost of equity financing given the following: Risk-free rate: Market risk premium: 1% 7% Beta: 1.25 10-5b Bond-Yield-Plus-Risk-Premium Approach he return oa bond is 4% while the return on common is 5%, what is the risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts