Question: comment that by focusing on ROMI, Veronica can help her shareholders move away from the Idea that marketing is an expense that can be deducted

comment that by focusing on ROMI, Veronica can help her shareholders move away from the Idea that marketing is an expense that can be deducted when the

tomasfotoRF

economy is weak. Instead, it is an investment that produces revenue.

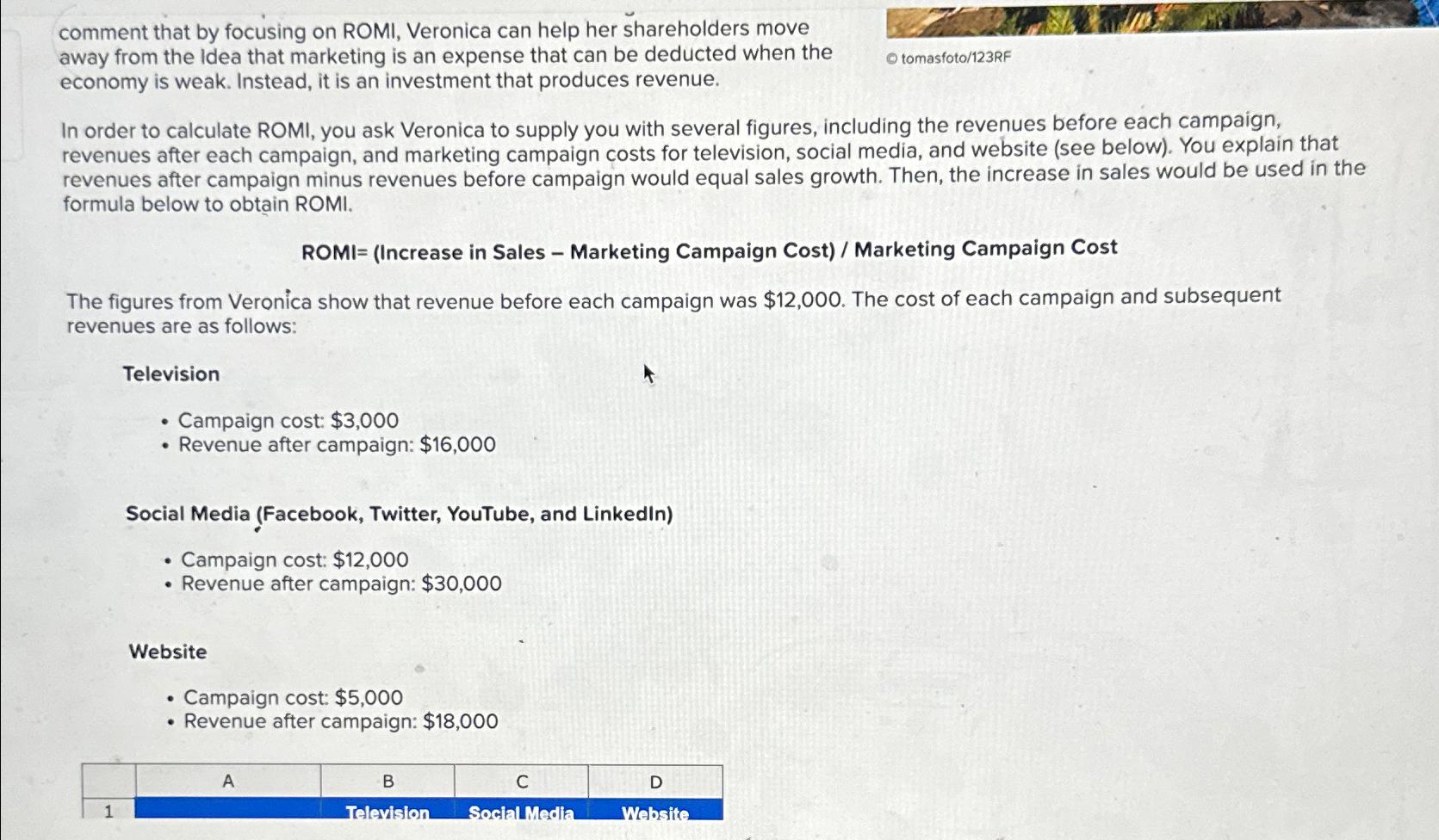

In order to calculate ROMI, you ask Veronica to supply you with several figures, including the revenues before each campaign, revenues after each campaign, and marketing campaign costs for television, social media, and website see below You explain that revenues after campaign minus revenues before campaign would equal sales growth. Then, the increase in sales would be used in the formula below to obtain ROMI.

ROMIIncrease in Sales Marketing Campaign Cost Marketing Campaign Cost

The figures from Veronica show that revenue before each campaign was $ The cost of each campaign and subsequent revenues are as follows:

Television

Campaign cost: $

Revenue after campaign: $

Social Media Facebook Twitter, YouTube, and LinkedIn

Campaign cost: $

Revenue after campaign: $

Website

Campaign cost: $

Revenue after campaign: $

tableABCDTelevision,Social Media,Website

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock