Question: Commercial Banking: Using the data from table 2 and the following four new pieces of information, Use the following information from table 2 to answer

Commercial Banking: Using the data from table 2 and the following four new pieces of information,

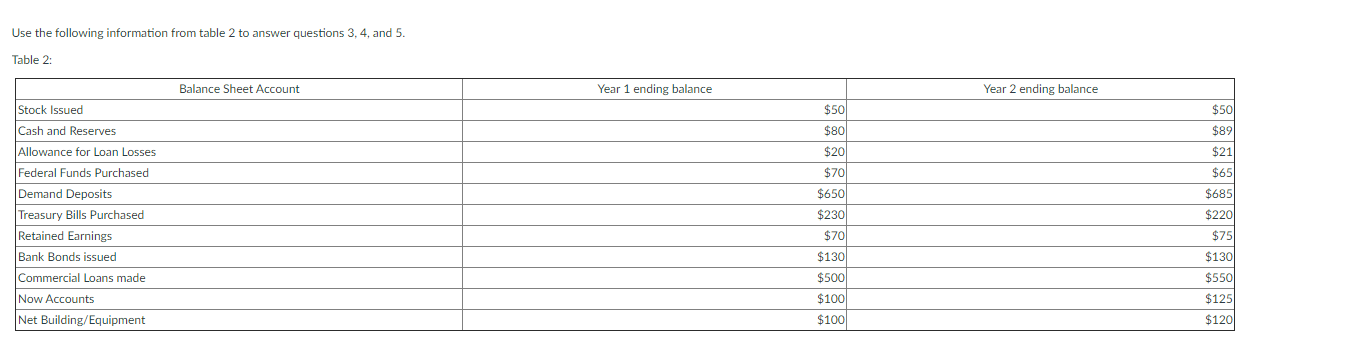

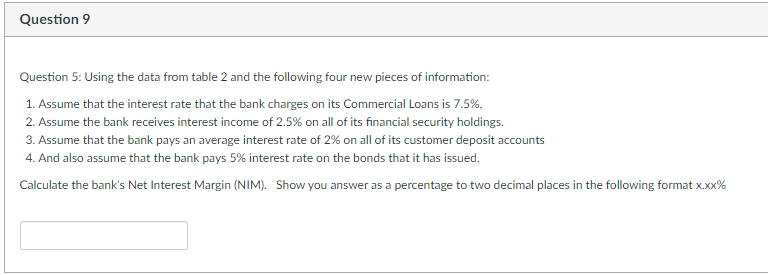

Use the following information from table 2 to answer questions 3, 4, and 5. Table 2: Balance Sheet Account Year 1 ending balance Year 2 ending balance Stock Issued Cash and Reserves Allowance for Loan Losses Federal Funds Purchased Demand Deposits Treasury Bills Purchased Retained Earnings Bank Bonds issued Commercial Loans made Now Accounts Net Building/Equipment $50 $80 $20 $70 $650 $230 $70 $130 $500 $100 $100 $501 $891 $21 $65 $685 $220 $75 $130 $550 $125 $1201 Question 9 Question 5: Using the data from table 2 and the following four new pieces of information: 1. Assume that the interest rate that the bank charges on its Commercial Loans is 7.5%, 2. Assume the bank receives interest income of 2.5% on all of its financial security holdings. 3. Assume that the bank pays an average interest rate of 2% on all of its customer deposit accounts 4. And also assume that the bank pays 5% interest rate on the bonds that it has issued. Calculate the bank's Net Interest Margin (NIM). Show you answer as a percentage to two decimal places in the following format x.xx% Use the following information from table 2 to answer questions 3, 4, and 5. Table 2: Balance Sheet Account Year 1 ending balance Year 2 ending balance Stock Issued Cash and Reserves Allowance for Loan Losses Federal Funds Purchased Demand Deposits Treasury Bills Purchased Retained Earnings Bank Bonds issued Commercial Loans made Now Accounts Net Building/Equipment $50 $80 $20 $70 $650 $230 $70 $130 $500 $100 $100 $501 $891 $21 $65 $685 $220 $75 $130 $550 $125 $1201 Question 9 Question 5: Using the data from table 2 and the following four new pieces of information: 1. Assume that the interest rate that the bank charges on its Commercial Loans is 7.5%, 2. Assume the bank receives interest income of 2.5% on all of its financial security holdings. 3. Assume that the bank pays an average interest rate of 2% on all of its customer deposit accounts 4. And also assume that the bank pays 5% interest rate on the bonds that it has issued. Calculate the bank's Net Interest Margin (NIM). Show you answer as a percentage to two decimal places in the following format x.xx%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts