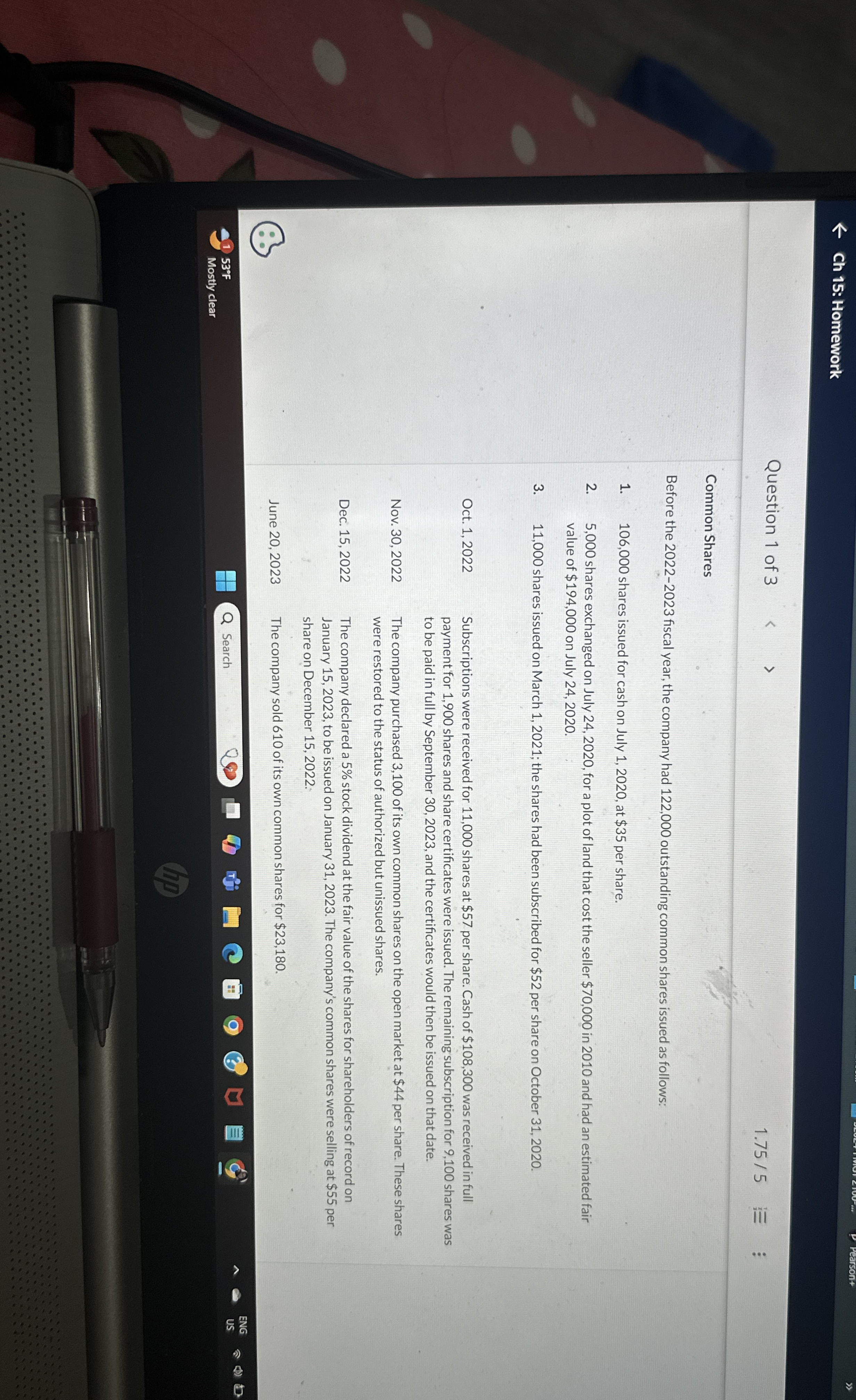

Question: Common Shares Before the 2 0 2 2 - 2 0 2 3 fiscal year, the company had 1 2 2 , 0 0 0

Common Shares

Before the fiscal year, the company had outstanding common shares issued as follows:

shares issued for cash on July at $ per share.

shares exchanged on July for a plot of land that cost the seller $ in and had an estimated fair

value of $ on July

shares issued on March ; the shares had been subscribed for $ per share on October

Oct.

Nov.

Dec.

June

Subscriptions were received for shares at $ per share. Cash of $ was received in full

payment for shares and share certificates were issued. The remaining subscription for shares was

to be paid in full by September and the certificates would then be issued on that date.

The company purchased of its own common shares on the open market at $ per share. These shares

were restored to the status of authorized but unissued shares.

The company declared a stock dividend at the fair value of the shares for shareholders of record on

January to be issued on January The company's common shares were selling at $ per

share on December :

The company sold of its own common shares for $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock