Question: Common stock represents the - Select. position in a firm, and is valued as the present value of its expected future - Selectstream. Common stock

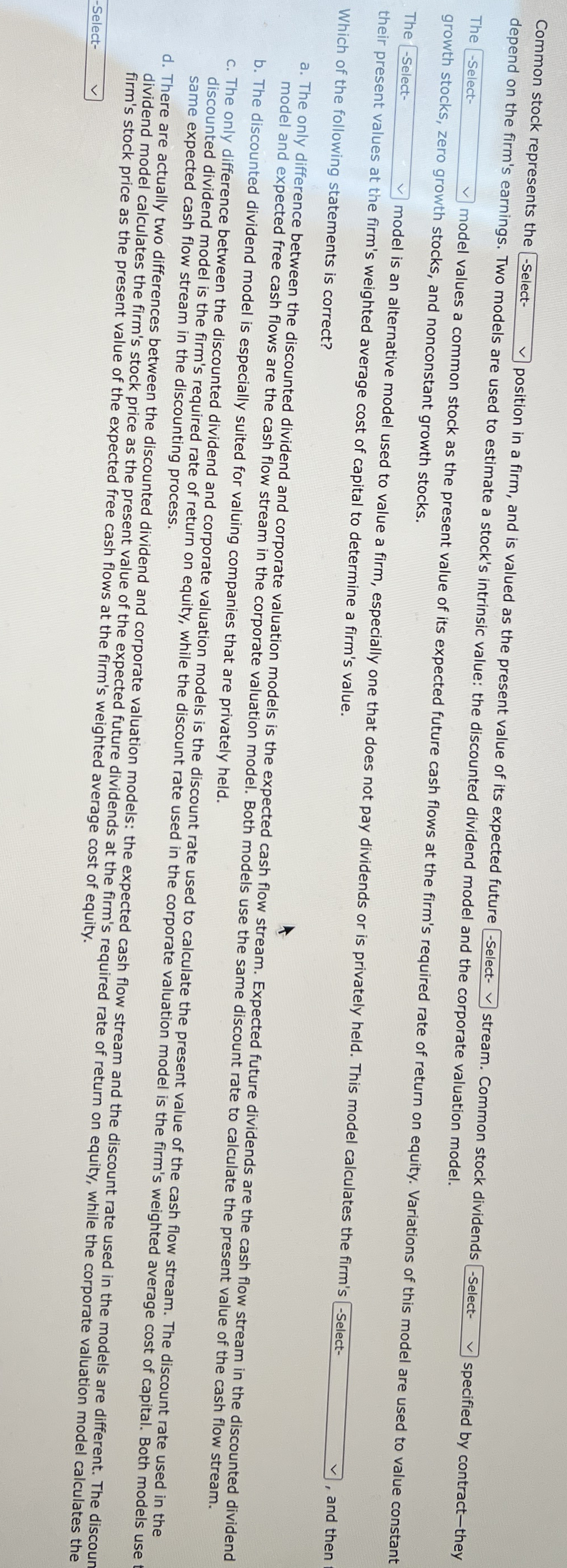

Common stock represents the Select. position in a firm, and is valued as the present value of its expected future Selectstream. Common stock dividends depend on the firm's earnings. Two models are used to estimate a stock's intrinsic value: the discounted dividend model and the corporate valuation model. The model values a common stock as the prese

th stocks, and nonconstant growth stocks.

The their present values at the firm's weighted average cost of caralue a firm, especially one that does not pay dividends or is privately held. This model calculates the firm's

Which of the following statements is correct? and then

a The only difference between the discounted dividend and corporate valuation models is the expected cash flow stream. Expected future dividends are the cash flow stream in the discounted dividend model and expected free cash flows are the cash flow stream in the corporate valuation model. Bote

models use the same discount rate to calculate the present value of the cash flow stream,

c The only difference between the discounted dividend and corporate valuation models is the discount rate used to calculate the present value of the cash flow stream. The discount rate used in the discounted dividend model is the firm's required rate of return on equity, while the discount rate used in the corporate valuation model is the firm's weighted average cost of capital. Both models use

d There are actually two differences between the discounted dividend and corporate valuation models: the expected cash flow stream and the discount rate used in the models are different. The discoun firm's stock price as the the firm's stock price as the prese cash flows at the firm's future dividends at the firm's required rate of return on equity, while the corporate valuation model calculates the

Select

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock