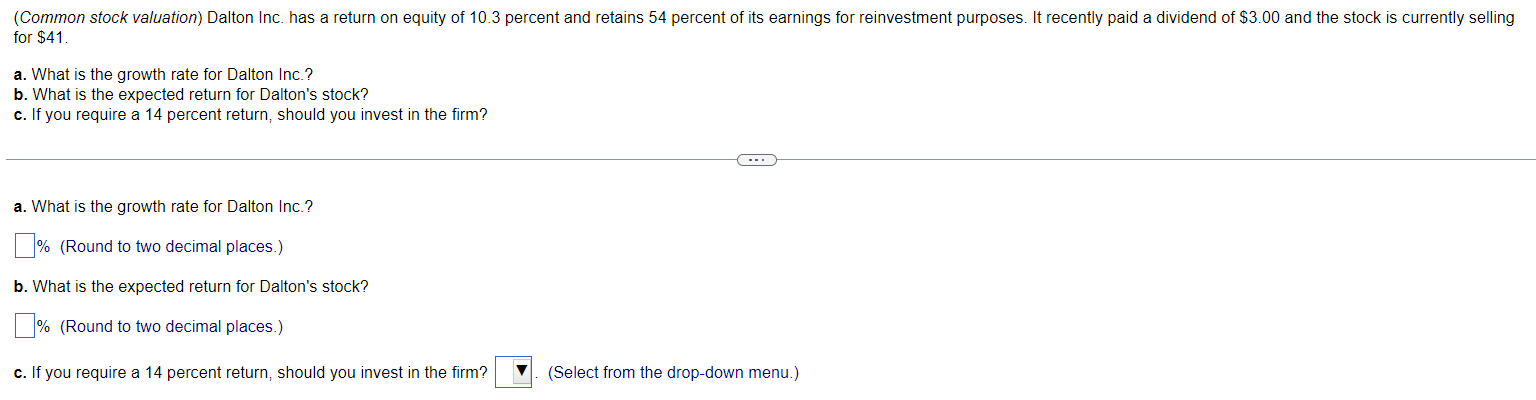

Question: (Common stock valuation) Dalton Inc. has a return on equity of 10.3 percent and retains 54 percent of its earnings for reinvestment purposes. It recently

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts