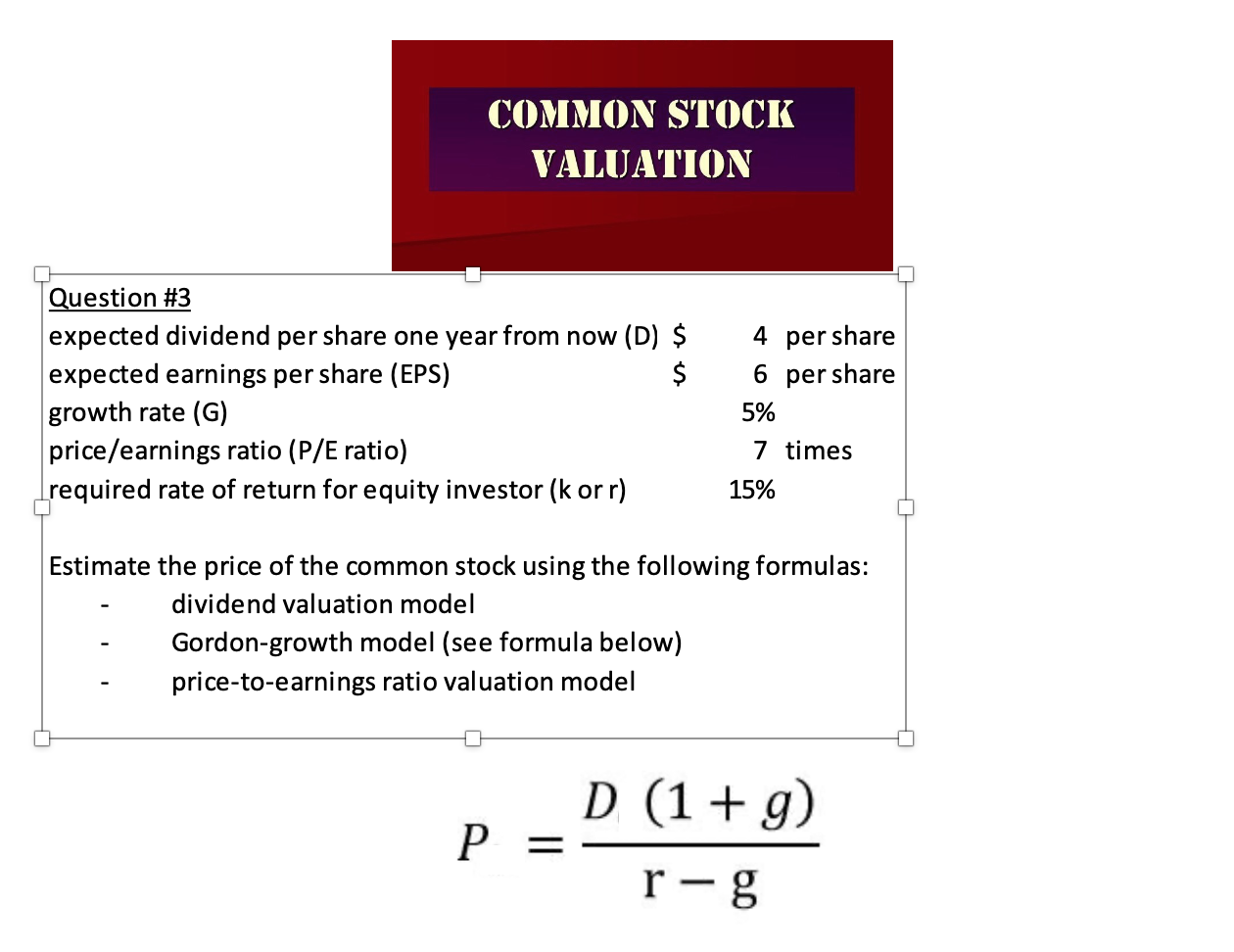

Question: COMMON STOCK VALUATION Question #3 expected dividend per share one year from now (D) $ expected earnings per share (EPS) $ growth rate (G) price/earnings

COMMON STOCK VALUATION Question #3 expected dividend per share one year from now (D) $ expected earnings per share (EPS) $ growth rate (G) price/earnings ratio (P/E ratio) required rate of return for equity investor (k orr) 4 per share 6 per share 5% 7 times 15% - Estimate the price of the common stock using the following formulas: dividend valuation model Gordon-growth model (see formula below) - price-to-earnings ratio valuation model P =- D (1 + g) r-g

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts