Question: Common stock value-Variable growth Personal Finance Problem Home Place Hotels, Inc., is entering into a 3-year remodeling and expansion project. The construction will have a

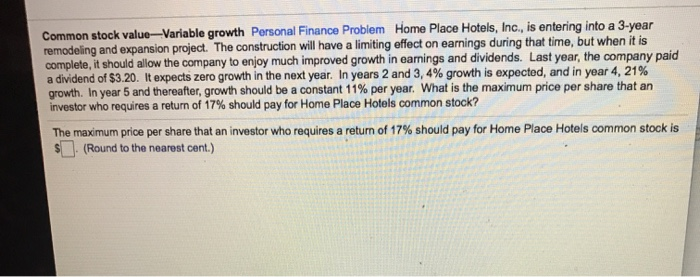

Common stock value-Variable growth Personal Finance Problem Home Place Hotels, Inc., is entering into a 3-year remodeling and expansion project. The construction will have a limiting effect on earnings during that time, but when it complete, it should allow the company to enjoy much improved growth in earnings and dividends. Last year, the company paid a dividend of $3.20. It expects zero growth in the next year. In years 2 and 3, 4% growth is expected, and in year 4, 21% growth. In year 5 and thereafter, growth should be a constant 11% per year. What is the maximum price per share that an investor who requires a return of 17% should pay for Home Place Hotels common stock? The maximum price per share that an investor who requires a return of 17% should pay for Home Place Hotels common stock is (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts