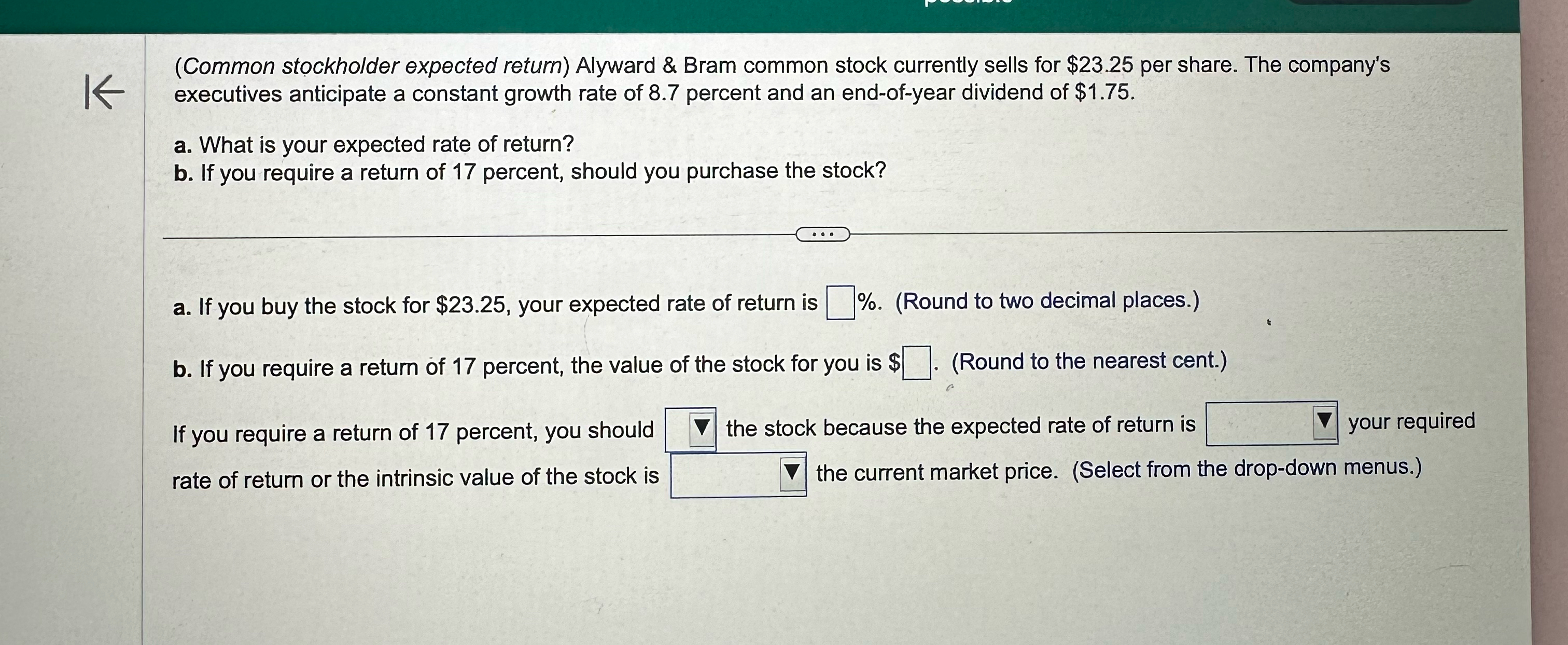

Question: ( Common stockholder expected return ) Alyward & Bram common stock currently sells for $ 2 3 . 2 5 per share. The company's executives

Common stockholder expected return Alyward & Bram common stock currently sells for $ per share. The company's executives anticipate a constant growth rate of percent and an endofyear dividend of $

a What is your expected rate of return?

b If you require a return of percent, should you purchase the stock?

a If you buy the stock for $ your expected rate of return is Round to two decimal places.

b If you require a return of percent, the value of the stock for you is $ Round to the nearest cent.

If you require a return of percent, you should the stock because the expected rate of return is your required rate of return or the intrinsic value of the stock is the current market price. Select from the dropdown menus.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock