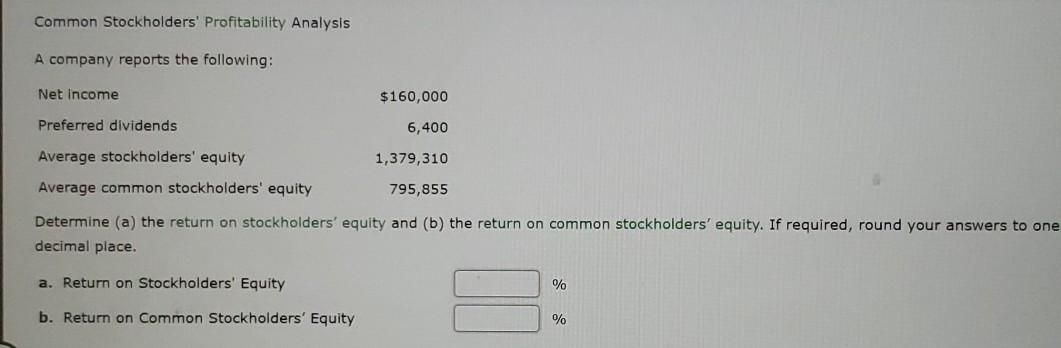

Question: Common Stockholders' Profitability Analysis A company reports the following: Net Income $160,000 Preferred dividends 6,400 Average stockholders' equity 1,379,310 Average common stockholders' equity 795,855 Determine

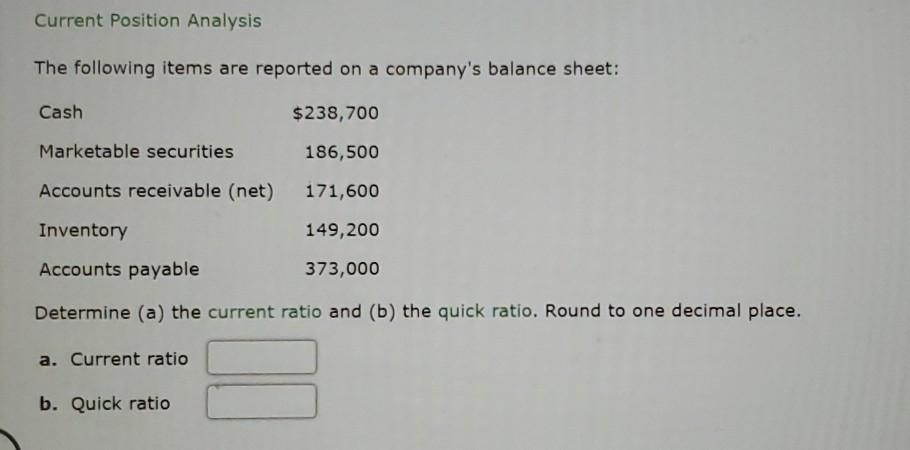

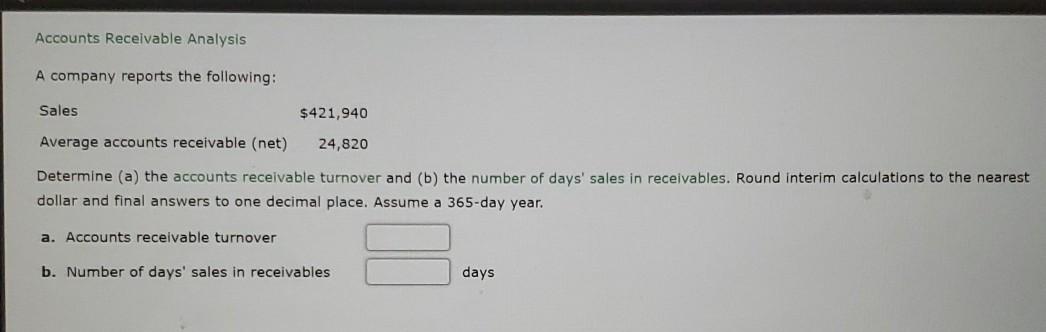

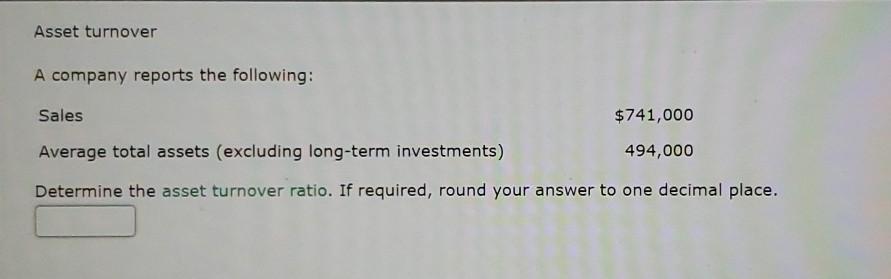

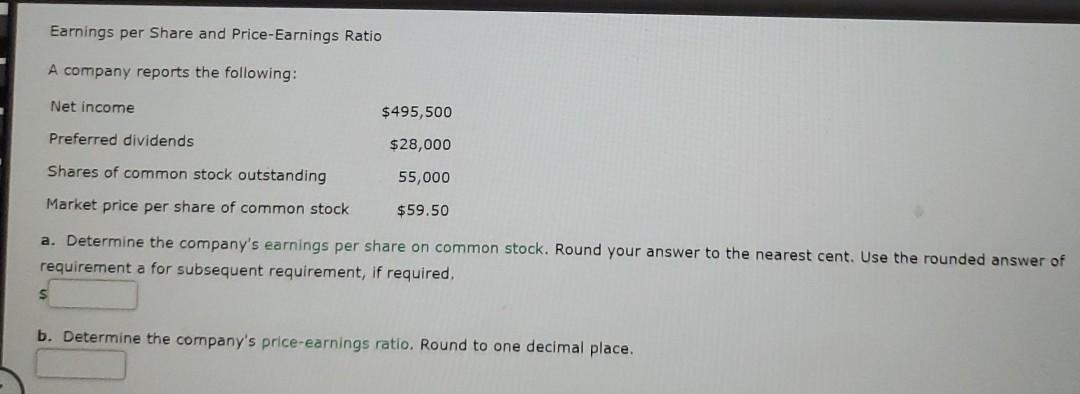

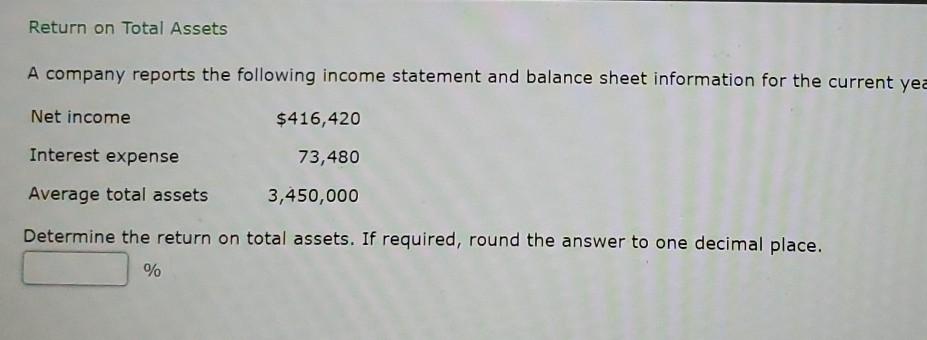

Common Stockholders' Profitability Analysis A company reports the following: Net Income $160,000 Preferred dividends 6,400 Average stockholders' equity 1,379,310 Average common stockholders' equity 795,855 Determine (a) the return on stockholders' equity and (b) the return on common stockholders' equity. If required, round your answers to one decimal place. a. Return on Stockholders' Equity % b. Return on Common Stockholders' Equity % Current Position Analysis The following items are reported on a company's balance sheet: Cash $ 238,700 Marketable securities 186,500 Accounts receivable (net) 171,600 Inventory 149,200 Accounts payable 373,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio b. Quick ratio Accounts Receivable Analysis A company reports the following: Sales $421,940 Average accounts receivable (net) 24,820 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover b. Number of days' sales in receivables days Asset turnover A company reports the following: Sales $741,000 Average total assets (excluding long-term investments) 494,000 Determine the asset turnover ratio. If required, round your answer to one decimal place. Earnings per Share and Price-Earnings Ratio A company reports the following: Net income $495,500 Preferred dividends $28,000 Shares of common stock outstanding 55,000 Market price per share of common stock $59.50 a. Determine the company's earnings per share on common stock. Round your answer to the nearest cent. Use the rounded answer of requirement a for subsequent requirement, if required, b. Determine the company's price-earnings ratio. Round to one decimal place, Return on Total Assets A company reports the following income statement and balance sheet information for the current yea Net income $416,420 Interest expense 73,480 Average total assets 3,450,000 Determine the return on total assets. If required, round the answer to one decimal place. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts