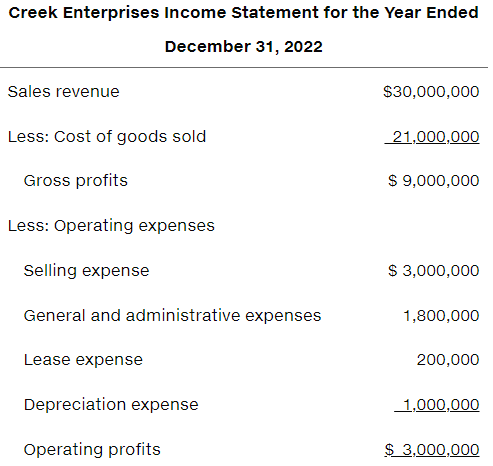

Question: Common-size statement analysis A common-size income statement for Creek Enterprises 2021 operations follows. Using the firms 2022 income statement presented in Problem 316, develop the

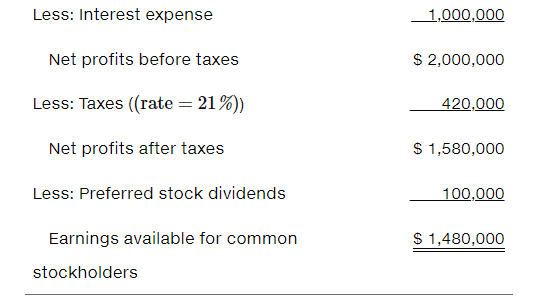

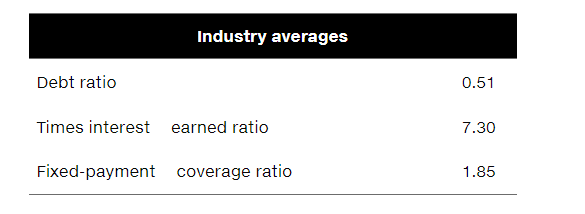

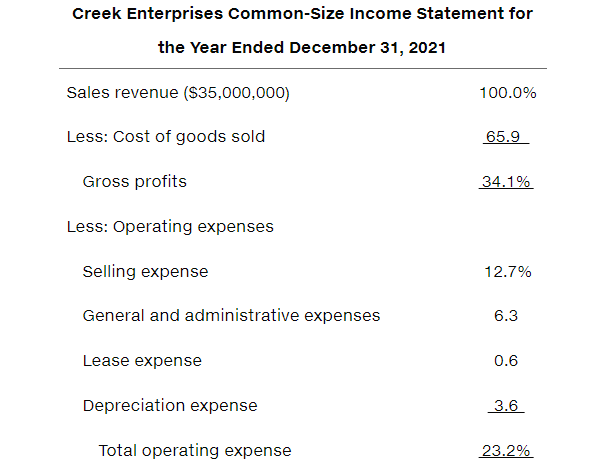

Common-size statement analysis A common-size income statement for Creek Enterprises 2021 operations follows. Using the firms 2022 income statement presented in Problem 316, develop the 2022 common-size income statement and compare it with the 2021 common-size statement. Which areas require further analysis and investigation?

(income statement presented in Problem 316)

(2021 common-size statement)

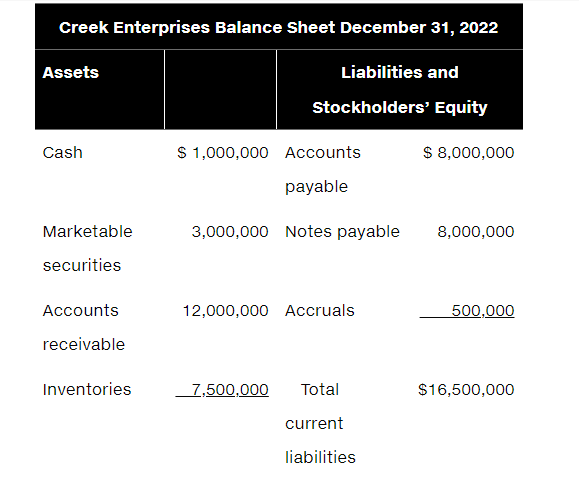

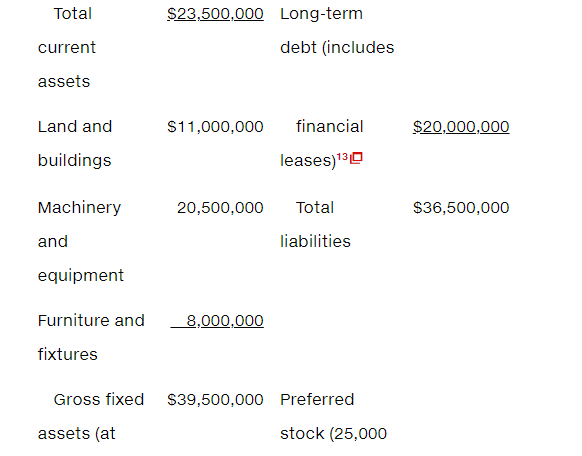

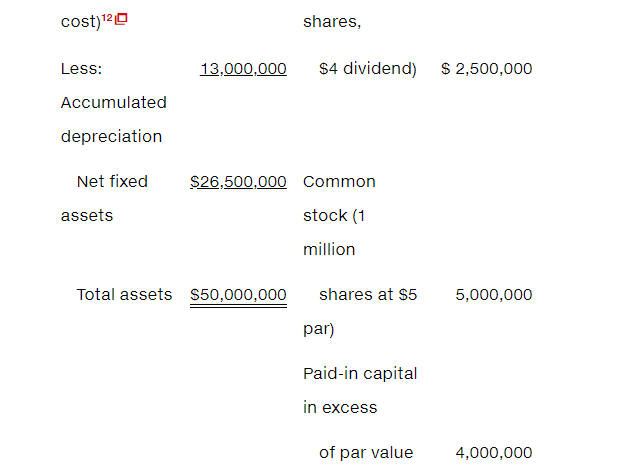

The firm has a four-year lease requiring annual beginning-of-year payments of $200,000. Three years of the lease have yet to run. Required annual principal payments are $800,000.

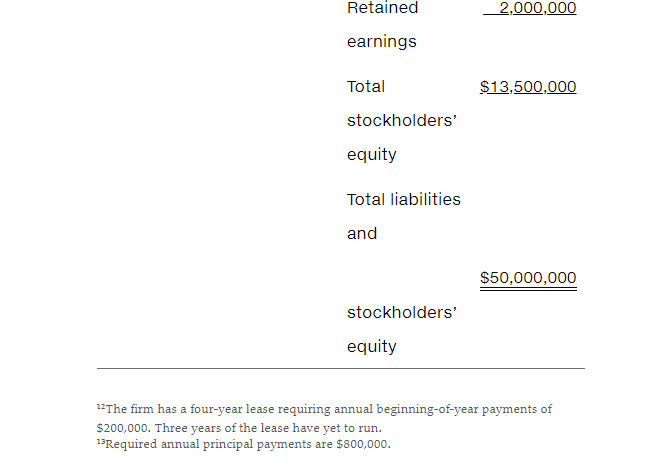

Industry averages Debt ratio0.51 Times interest earned ratio7.30 Fixed-payment coverage ratio1.85

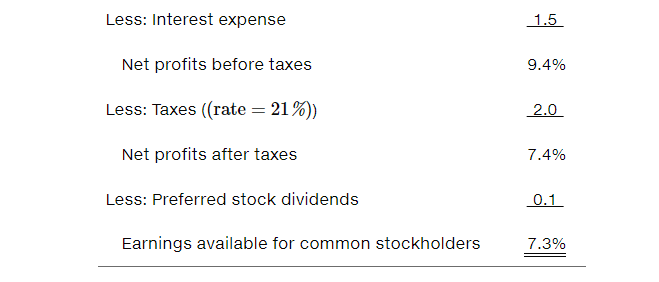

Creek Enterprises Balance Sheet December 31, 2022 Assets Cash $1,000,000 $1,000,000 Liabilities and Stockholders' Equity Accounts payable Marketable 3,000,000 Notes payable 8,000,000 securities Accounts receivable Inventories 12,000,000 Accruals Total current liabilities \begin{tabular}{llc} \hline \multicolumn{2}{c}{ Industry averages } \\ \hline Debt ratio & & 0.51 \\ Times interest earned ratio & 7.30 \\ Fixed-payment & coverage ratio & 1.85 \\ \hline \end{tabular} Less: Interest expense Net profits before taxes Less: Taxes (( rate =21%)) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 1,000,000 $2,000,000 420,000 $1,580,000 100,000 $1,480,000 Creek Enterprises Income Statement for the Year Ended December 31, 2022 SalesrevenueLess:CostofgoodssoldGrossprofitsLess:OperatingexpensesSellingexpenseGeneralandadministrativeexpensesLeaseexpenseDepreciationexpenseOperatingprofits$30,000,00021,000,000$9,000,000$3,000,0001,800,000200,0001,000,000$3,000,000 12 The firm has a four-year lease requiring annual beginning-of-year payments of $200,000. Three years of the lease have yet to run. 13 Required annual principal payments are $800,000. Less:InterestexpenseNetprofitsbeforetaxesLess:Taxes((rate=21%))NetprofitsaftertaxesLess:PreferredstockdividendsEarningsavailableforcommonstockholders1.59.4%2.07.4%0.17.3% Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2021 Sales revenue ($35,000,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense 100.0% 65.9 34.1% 12.7% 6.3 0.6 3.6 23.2% Creek Enterprises Balance Sheet December 31, 2022 Assets Cash $1,000,000 $1,000,000 Liabilities and Stockholders' Equity Accounts payable Marketable 3,000,000 Notes payable 8,000,000 securities Accounts receivable Inventories 12,000,000 Accruals Total current liabilities \begin{tabular}{llc} \hline \multicolumn{2}{c}{ Industry averages } \\ \hline Debt ratio & & 0.51 \\ Times interest earned ratio & 7.30 \\ Fixed-payment & coverage ratio & 1.85 \\ \hline \end{tabular} Less: Interest expense Net profits before taxes Less: Taxes (( rate =21%)) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 1,000,000 $2,000,000 420,000 $1,580,000 100,000 $1,480,000 Creek Enterprises Income Statement for the Year Ended December 31, 2022 SalesrevenueLess:CostofgoodssoldGrossprofitsLess:OperatingexpensesSellingexpenseGeneralandadministrativeexpensesLeaseexpenseDepreciationexpenseOperatingprofits$30,000,00021,000,000$9,000,000$3,000,0001,800,000200,0001,000,000$3,000,000 12 The firm has a four-year lease requiring annual beginning-of-year payments of $200,000. Three years of the lease have yet to run. 13 Required annual principal payments are $800,000. Less:InterestexpenseNetprofitsbeforetaxesLess:Taxes((rate=21%))NetprofitsaftertaxesLess:PreferredstockdividendsEarningsavailableforcommonstockholders1.59.4%2.07.4%0.17.3% Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2021 Sales revenue ($35,000,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense 100.0% 65.9 34.1% 12.7% 6.3 0.6 3.6 23.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts