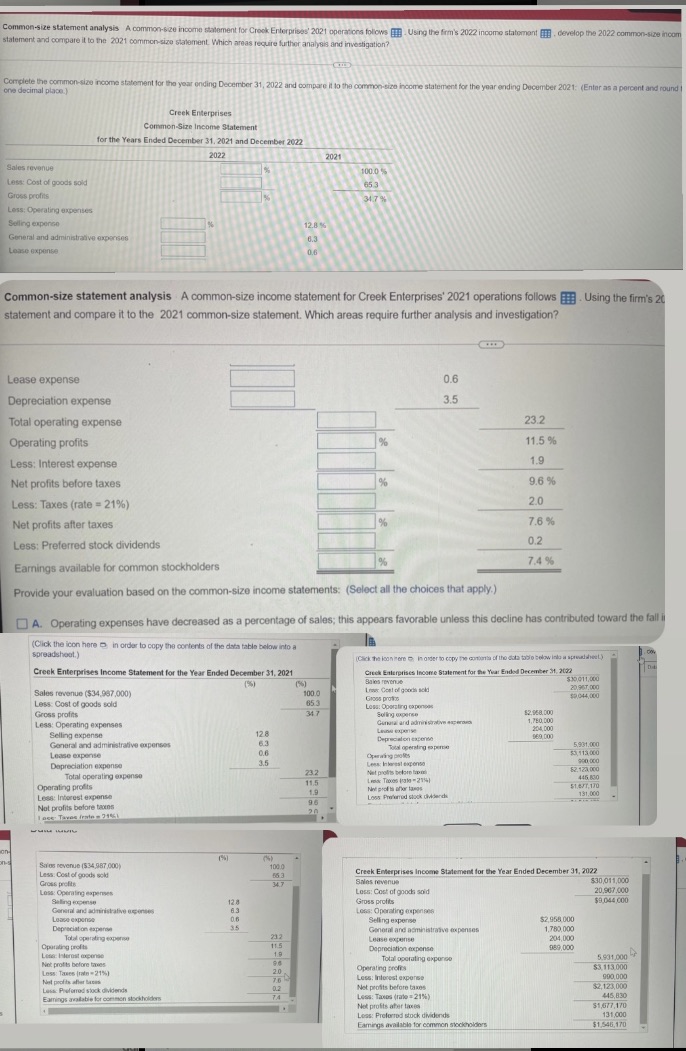

Question: Common-size statement analysis A common-size income statement for Crock Enterprises' 2021 operations follows . Using the firm's 2022 income statement , develop the 2022 common-size

Common-size statement analysis A common-size income statement for Crock Enterprises' 2021 operations follows . Using the firm's 2022 income statement , develop the 2022 common-size incom statement and compare it to the 2021 common-size statement. Which areas require further analysis and investigation? Complete the common-size income statement for the one decimal place.] onding December 31, 2022 and compare it to the common ent for the year ending December 2021: (Enter as a percent and round Creek Enterprises Common-Size Income Statement for the Years Ended December 31. 2021 and December 2022 2022 2021 Sales revenue 100.0 Less: Cost of goods sold 65.3 Gross profits 34.7 Loss: Operating expenses Selling experian 12.8 %% General and administrative exportios 6.3 Lease expense 0.6 Common-size statement analysis A common-size income statement for Creek Enterprises' 2021 operations follows FFF] . Using the firm's 20 statement and compare it to the 2021 common-size statement. Which areas require further analysis and investigation? Lease expense 0.6 Depreciation expense 3.5 Total operating expense 23.2 Operating profits 11.5% Less: Interest expense 1.9 Net profits before taxes 9.6 % Less: Taxes (rate = 21%) 2.0 Net profits after taxes 7.6% Less: Preferred stock dividends 0.2 Earnings available for common stockholders 7.4 % Provide your evaluation based on the common-size income statements: (Select all the choices that apply.) )A. Operating expenses have decreased as a percentage of sales; this appears favorable unless this decline has contributed toward the fall it Click the icon here a in order to copy the contents of the data table below into a spreadshoot.) Check the ican Here . Inorder to copy the contents of the cata tobio below into a spreadsheet) Creek Enterprises Income Statement for the Year Ended December 31, 2021 Crick Enterprises Income Statement for the Year Ended December 31, 2002 Sales revenue $10101 1,090 Sales revenue ($34,987,000) 100.0 Lower Cost of goout sold $2044/030 Less: Cost of goods sold 653 Gross profine Loss: Operating oppoross Gross profits 347 soling mpurse 12148. 090 Less: Operating expenses Constal and administrative superor 1, PEO, DOO 204,000 Selling expense 12 8 63 Depreciation expert 069 000 General and administrative expenses Total operating sopainin 5,931.000 Lease expense 0.8 Dapreciation expanse 2.123,090 Total operating expense 232 445. 830 Operating profits 11.5 Not pool to offer tangs 51.EST, 170 1.9 Less: Intorust expanse Joss Profamed stock dividends 131,000 96 Not profits before towns I ace: Taves frate - 715 Sales revenue (534,987,000) 1060 Less: Cost of goods sold 56.3 Creek Enterprises Incomne Statement for the Year Ended December 31, 2022 Gross profits 34 7 Sales revenue 530/01 1,000 Loss: Operating expenses Loss: Cost of goods sold 20,907,000 Balling expense 128 Gross profits $9 044,000 General and administrative agonies 83 Loss: Operating oxpinata Luzon expense Selling expense $2, 954,000 Depreciation tapered Genotal and administrative expenses 1.760,000 Total operating topen Lease expense 204. DO Operating prolia 115 159,DO0 18 Doprociation expense Total poorating arponce 5.801,000 Not profits before taxes Less: Taxes [rate =21) 2.0 Operating profits $3 113.000 Loss: Interest expense 990,000 Net poolits after Lacus D.2 Net profits before taxes $2,123,000 Loss Preferred stock dividends Earnings available for common stockholders 7A Loss: Taxes (lato = 21%%) 445,830 Net profits aber taxes 31,677,170 Loss: Preformed stock dividends 131,000 Earnings available for common stockholders $1 546,170