Question: Commute the Income Statement below : Segment Cement are a supplier of building materials Historic Forecast+1 Forecast +2 Over the next 2 years the company

Commute the Income Statement below :

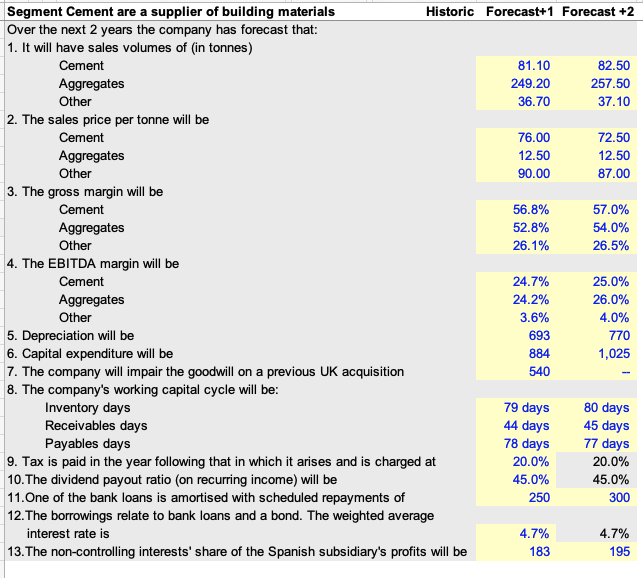

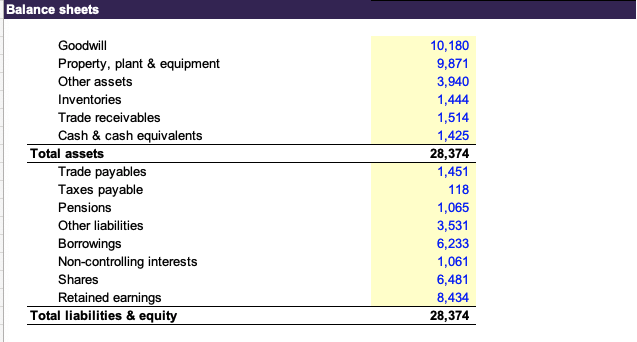

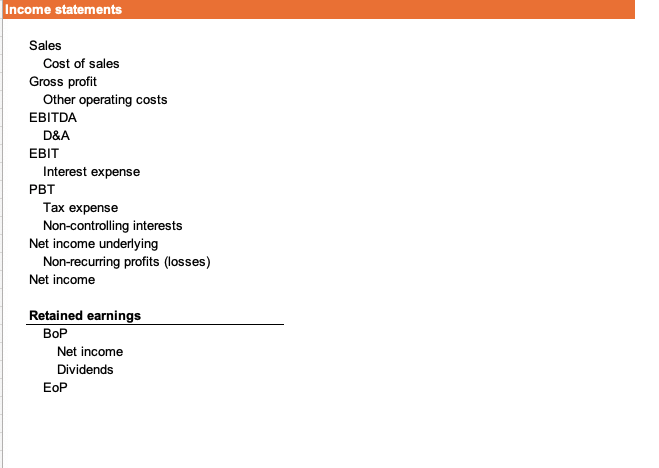

Segment Cement are a supplier of building materials Historic Forecast+1 Forecast +2 Over the next 2 years the company has forecast that: 1. It will have sales volumes of (in tonnes) Cement 81.10 82.50 Aggregates 249.20 257.50 Other 36.70 37.10 2. The sales price per tonne will be Cement 76.00 72.50 Aggregates 12.50 12.50 Other 90.00 87.00 3. The gross margin will be Cement 56.8% 57.0% Aggregates 52.8% 54.0% Other 26.1% 26.5% 4. The EBITDA margin will be Cement 24.7% 25.0% Aggregates 24.2% 26.0% Other 3.6% 4.0% 5. Depreciation will be 693 770 6. Capital expenditure will be 884 1,025 7. The company will impair the goodwill on a previous UK acquisition 540 8. The company's working capital cycle will be: Inventory days 79 days 80 days Receivables days 44 days 45 days Payables days 78 days 77 days 9. Tax is paid in the year following that in which it arises and is charged at 20.0% 20.0% 10. The dividend payout ratio (on recurring income) will be 45.0% 45.0% 11. One of the bank loans is amortised with scheduled repayments of 250 300 12. The borrowings relate to bank loans and a bond. The weighted average interest rate is 4.7% 4.7% 13. The non-controlling interests' share of the Spanish subsidiary's profits will be 183 195 Balance sheets Goodwill Property, plant & equipment Other assets Inventories Trade receivables Cash & cash equivalents Total assets Trade payables Taxes payable Pensions Other liabilities Borrowings Non-controlling interests Shares Retained earnings Total liabilities & equity 10,180 9,871 3,940 1,444 1,514 1,425 28,374 1,451 118 1,065 3,531 6,233 1,061 6,481 8,434 28,374 Income statements Sales Cost of sales Gross profit Other operating costs EBITDA D&A EBIT Interest expense PBT Tax expense Non-controlling interests Net income underlying Non-recurring profits (losses) Net income Retained earnings BOP Net income Dividends EOP Segment Cement are a supplier of building materials Historic Forecast+1 Forecast +2 Over the next 2 years the company has forecast that: 1. It will have sales volumes of (in tonnes) Cement 81.10 82.50 Aggregates 249.20 257.50 Other 36.70 37.10 2. The sales price per tonne will be Cement 76.00 72.50 Aggregates 12.50 12.50 Other 90.00 87.00 3. The gross margin will be Cement 56.8% 57.0% Aggregates 52.8% 54.0% Other 26.1% 26.5% 4. The EBITDA margin will be Cement 24.7% 25.0% Aggregates 24.2% 26.0% Other 3.6% 4.0% 5. Depreciation will be 693 770 6. Capital expenditure will be 884 1,025 7. The company will impair the goodwill on a previous UK acquisition 540 8. The company's working capital cycle will be: Inventory days 79 days 80 days Receivables days 44 days 45 days Payables days 78 days 77 days 9. Tax is paid in the year following that in which it arises and is charged at 20.0% 20.0% 10. The dividend payout ratio (on recurring income) will be 45.0% 45.0% 11. One of the bank loans is amortised with scheduled repayments of 250 300 12. The borrowings relate to bank loans and a bond. The weighted average interest rate is 4.7% 4.7% 13. The non-controlling interests' share of the Spanish subsidiary's profits will be 183 195 Balance sheets Goodwill Property, plant & equipment Other assets Inventories Trade receivables Cash & cash equivalents Total assets Trade payables Taxes payable Pensions Other liabilities Borrowings Non-controlling interests Shares Retained earnings Total liabilities & equity 10,180 9,871 3,940 1,444 1,514 1,425 28,374 1,451 118 1,065 3,531 6,233 1,061 6,481 8,434 28,374 Income statements Sales Cost of sales Gross profit Other operating costs EBITDA D&A EBIT Interest expense PBT Tax expense Non-controlling interests Net income underlying Non-recurring profits (losses) Net income Retained earnings BOP Net income Dividends EOP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts