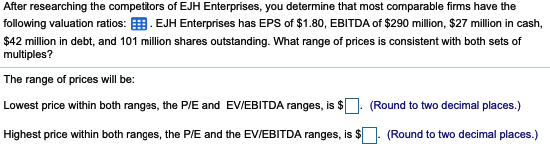

Question: Comp 1 Comp 2 Comp 3 Comp 4 EV/EBITDA 12 11 12.5 10 P/E 19 18 20 17 After researching the competitors of EJH Enterprises,

Comp 1 Comp 2 Comp 3 Comp 4 EV/EBITDA 12 11 12.5 10 P/E 19 18 20 17

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios:

LOADING...

. EJH Enterprises has EPS of

$1.80,

EBITDA of

$290

million,

$27

million in cash,

$42

million in debt, and

101

million shares outstanding. What range of prices is consistent with both sets of multiples?

The range of prices will be:

Lowest price within both ranges, the P/E and EV/EBITDA ranges, is

$nothing.

(Round to two decimal places.)Highest price within both ranges, the P/E and the EV/EBITDA ranges, is

$nothing.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts