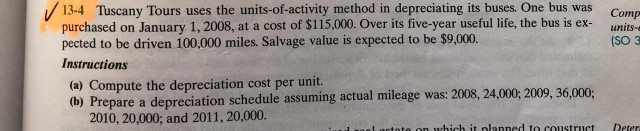

Question: Comp (SO3 13-4 Tuscany Tours uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2008, at a cost of

Comp (SO3 13-4 Tuscany Tours uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2008, at a cost of $115,000. Over its five-year useful life, the bus is ex- pected to be driven 100,000 miles. Salvage value is expected to be $9,000. Instructions (a) Compute the depreciation cost per unit. (6) Prepare a depreciation schedule assuming actual mileage was: 2008, 24,000; 2009, 36,000: 2010, 20,000; and 2011, 20,000. total de

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts