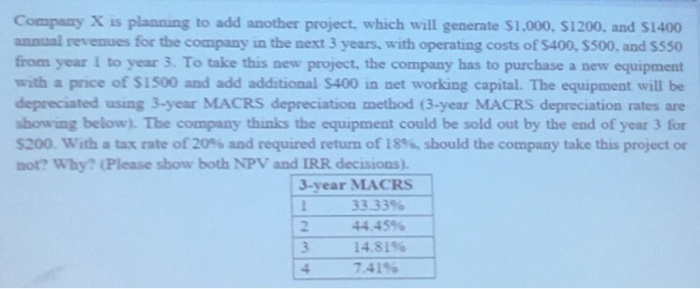

Question: Compaay X is planning to add another project, which will generate $1,000, $1200, and $1400 annual revenues for the company in the next 3 years,

Compaay X is planning to add another project, which will generate $1,000, $1200, and $1400 annual revenues for the company in the next 3 years, with operating costs of $400, $500, and S550 from year I to year 3. To take this new project, the company bas to purchase a new equipment with a price of $1500 and add additional S400 in net working capital. The equipment will be depreciated using 3-year MACRS depreciation method (3-year MACRS depreciation rates are showing below). The company thinks the equipment could be sold out by the end of year 3 for $200, with a tax rate of 20% and required return of 18%, should the company take this project or not? Why? (Please show both NPV and IRR decisions) 3-year MACRS 33.33% 44.45% 14.81% 741% 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts