Question: Companies create accounting systems to improve management decision - making. This case study provides an opportunity to compare different accounting methods for allocating overhead costs.

Companies create accounting systems to improve management decisionmaking. This case study provides an opportunity to compare different accounting methods for allocating overhead costs. Carefully read the case and answer the required questions. Remember to write a memo to the company president.

Traditional vs ActivityBased Costing Methods

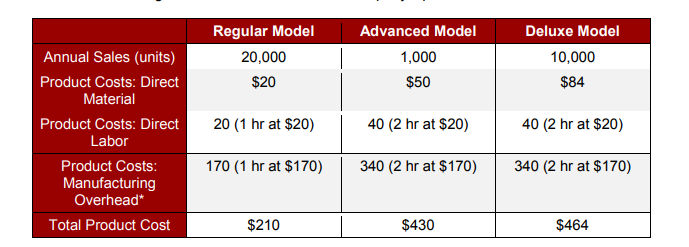

ABC Corporation manufactures electric pumps, offering three models: regular, advanced, and deluxe. The company has been using a joborder costing system to apply manufacturing overhead costs to each model, based on directlabor hours. Below is some relevant information regarding product costs and annual sales.

Predetermined overhead rate: budgeted overhead divided by budgeted directlabor hours

$ divided by hours $ per hour

For the past years, the company has set each models target price at of its full product cost. However, ABC Corporation has faced increasing price pressure from offshore competitors for its regular model pump. As a result, the price for the regular model has been reduced to $

In a recent meeting with the controller, the company president expressed concerns, stating:

Why cant we compete with these other companies? Theyre selling pumps just like our regular model for $ Thats only two dollars more than our production cost. Are we really that inefficient? Whats going on

The controller responded:

I believe this is due to an outdated productcosting system. When I joined the company last year, I flagged this issue, but the decision was made to stick with our current system. In my opinion, our costing system is distorting our product costs. Let me run some numbers to show what I mean.

With approval from the president, the controller gathered data to implement an activitybased costing ABC system. These data are presented in a table, showing the percentages of each cost driver consumed by each product line.

Required:

Calculate the target prices for the three pump models based on the traditional, volumebased productcosting system.

Compute the new product costs for the three products, using the new data collected by the controller round to the nearest cent

Determine a new target price for the three products using the activitybased costing system. Compare this new target price with the current actual selling price for the regular model pump.

Write a memo to the company president explaining the impact of the firm's traditional volumebased productcosting system.

Discuss the strategic options available to management. What do you recommend, and why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock