Question: Company A needs to raise money and would eventually like to do this by issuing shares. However, its shares are currently unattractive to investors in

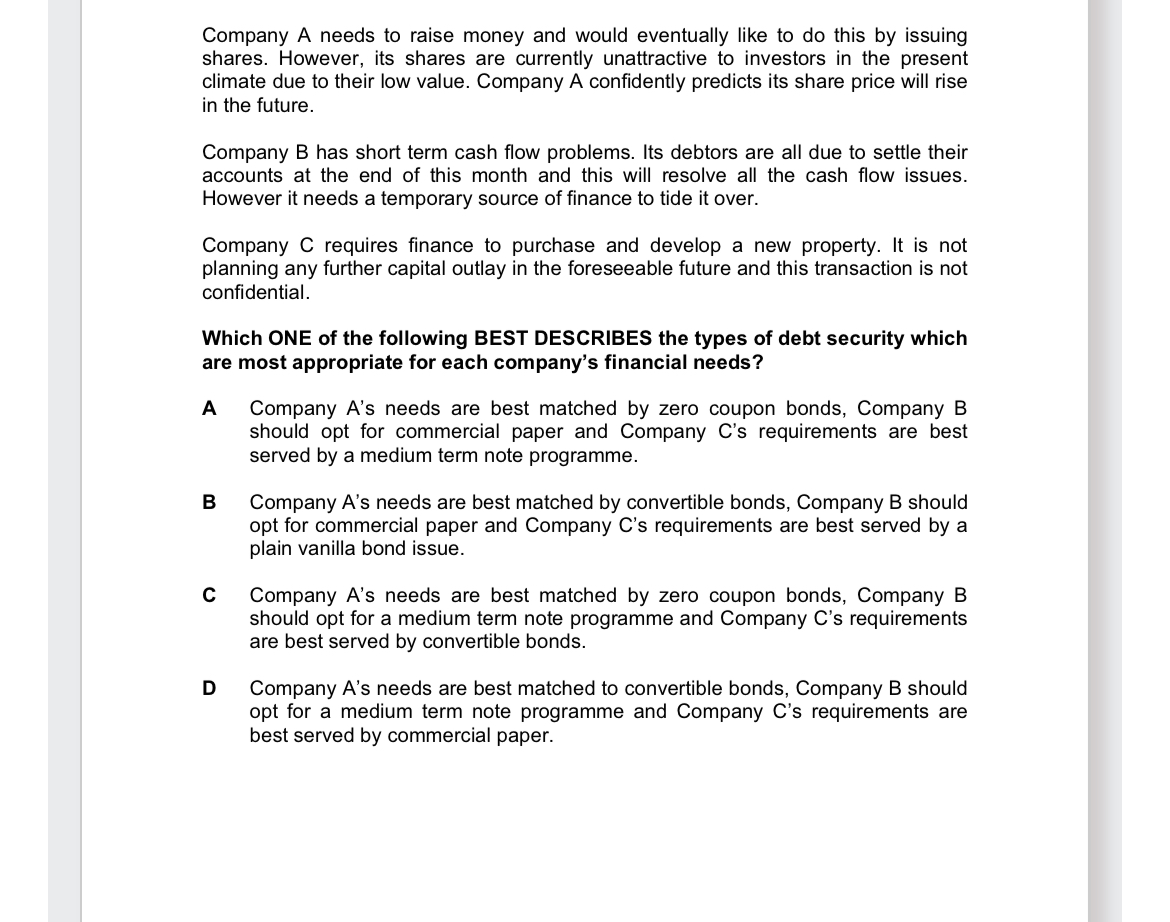

Company A needs to raise money and would eventually like to do this by issuing shares. However, its shares are currently unattractive to investors in the present climate due to their low value. Company A confidently predicts its share price will rise in the future. Company B has short term cash flow problems. Its debtors are all due to settle their accounts at the end of this month and this will resolve all the cash flow issues. However it needs a temporary source of finance to tide it over. Company C requires finance to purchase and develop a new property. It is not planning any further capital outlay in the foreseeable future and this transaction is not confidential. Which ONE of the following BEST DESCRIBES the types of debt security which are most appropriate for each company's financial needs? A Company As needs are best matched by zero coupon bonds, Company B should opt for commercial paper and Company Cs requirements are best served by a medium term note programme. B Company As needs are best matched by convertible bonds, Company B should opt for commercial paper and Company Cs requirements are best served by a plain vanilla bond issue. C Company As needs are best matched by zero coupon bonds, Company B should opt for a medium term note programme and Company Cs requirements are best served by convertible bonds. D Company As needs are best matched to convertible bonds, Company B should opt for a medium term note programme and Company Cs requirements are best served by commercial paper.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock