Question: Company A uses an accelerated depreciation method while Company B uses the straightline method for an asset of the same cost and useful life. Which

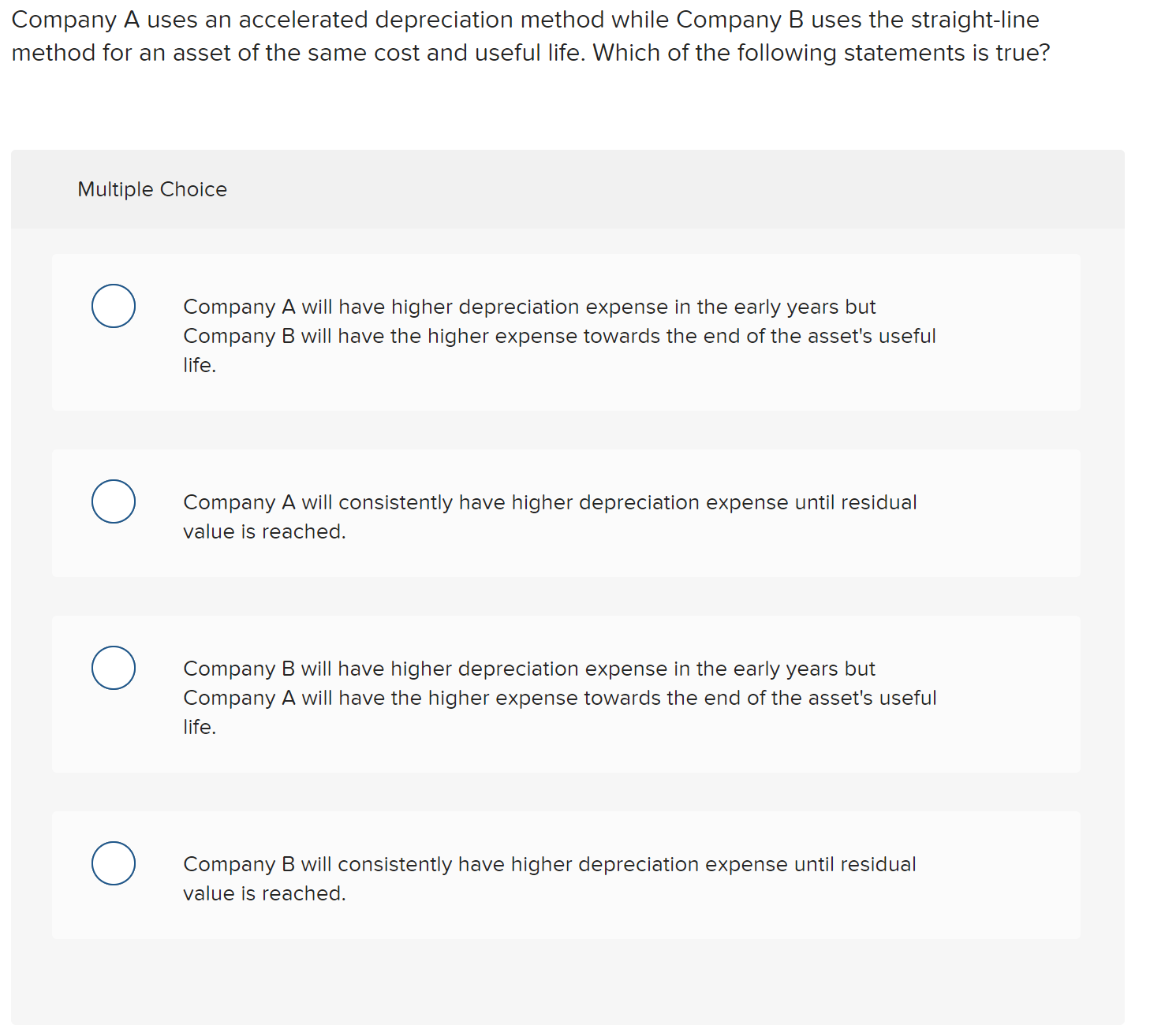

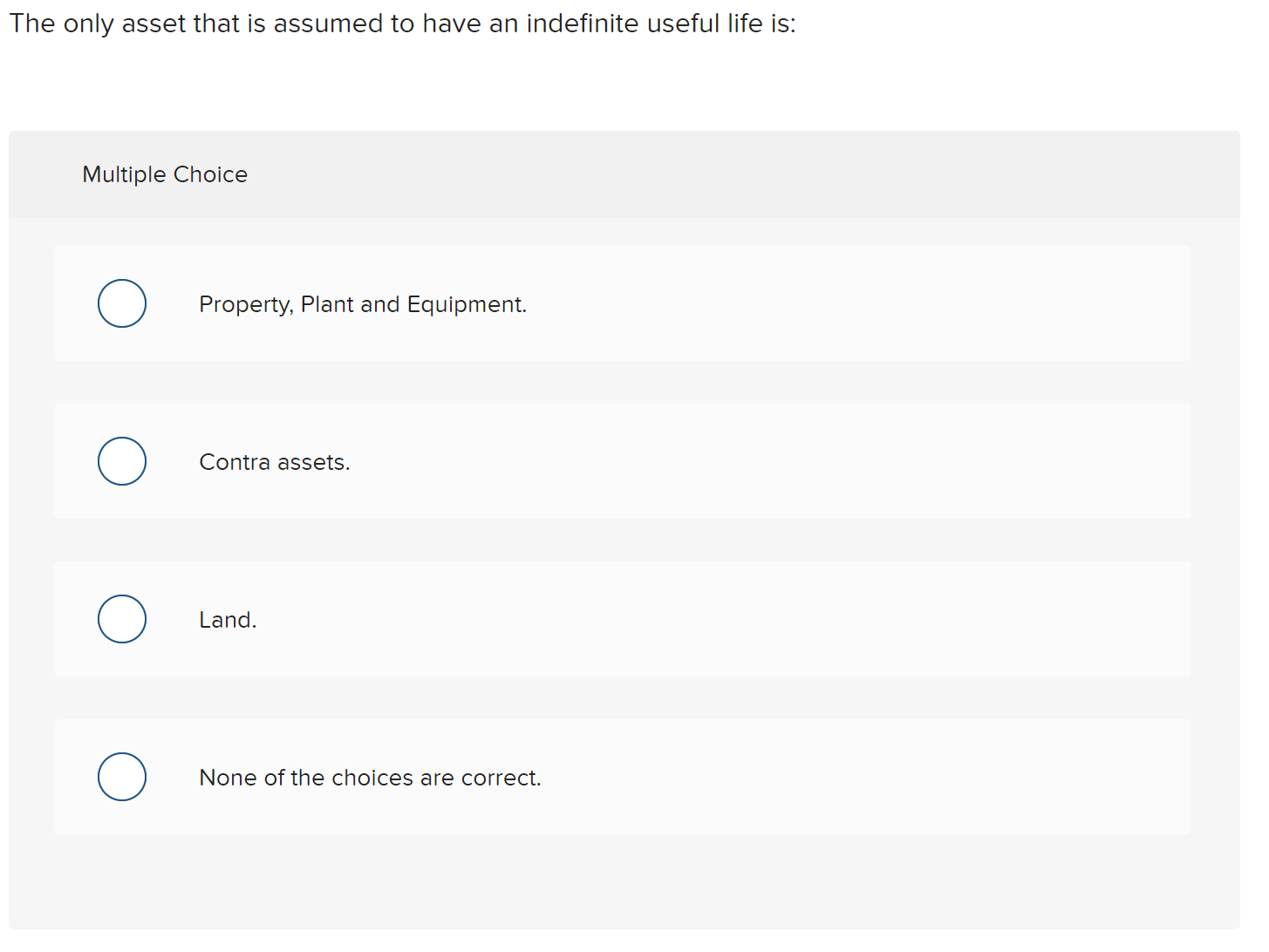

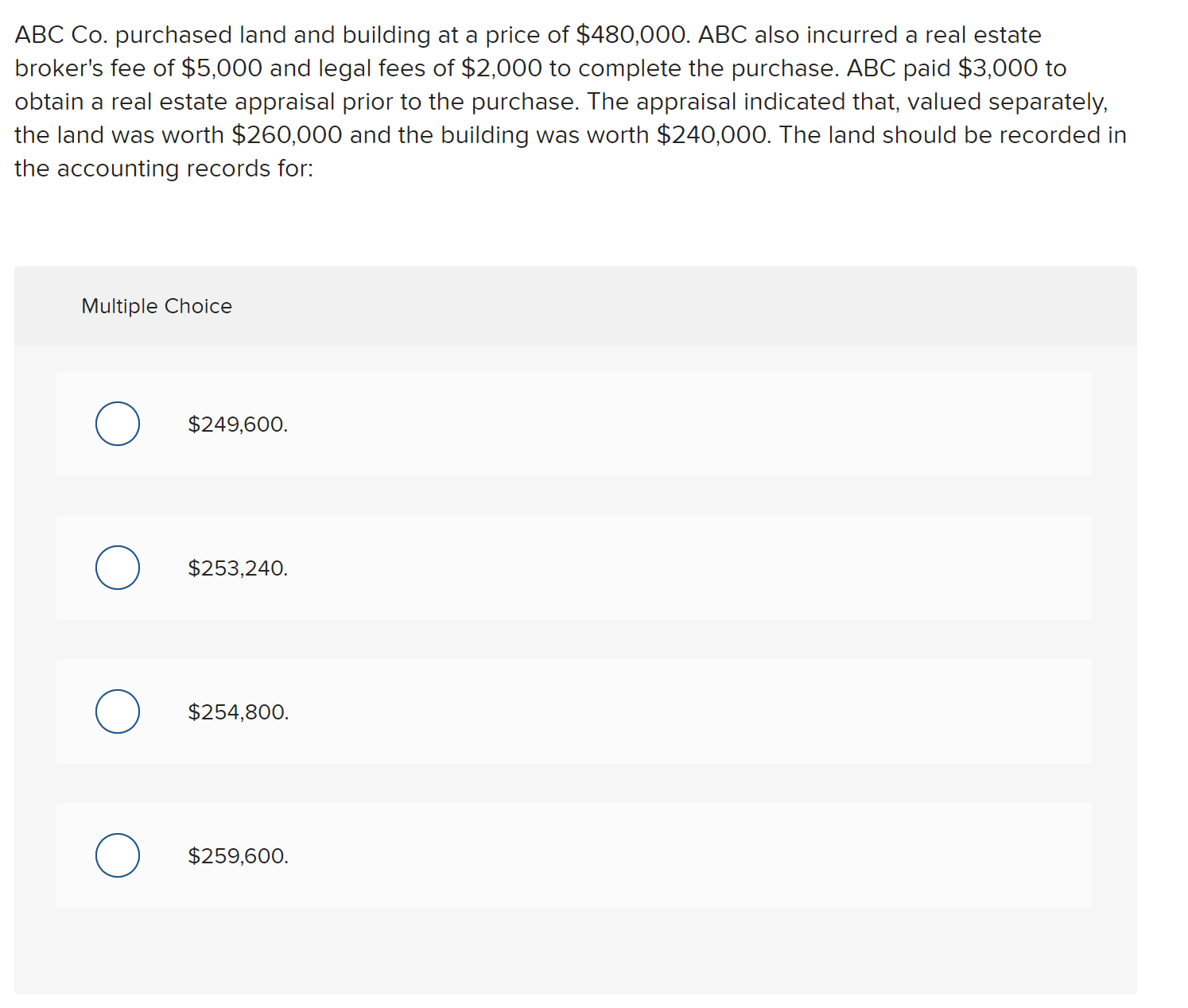

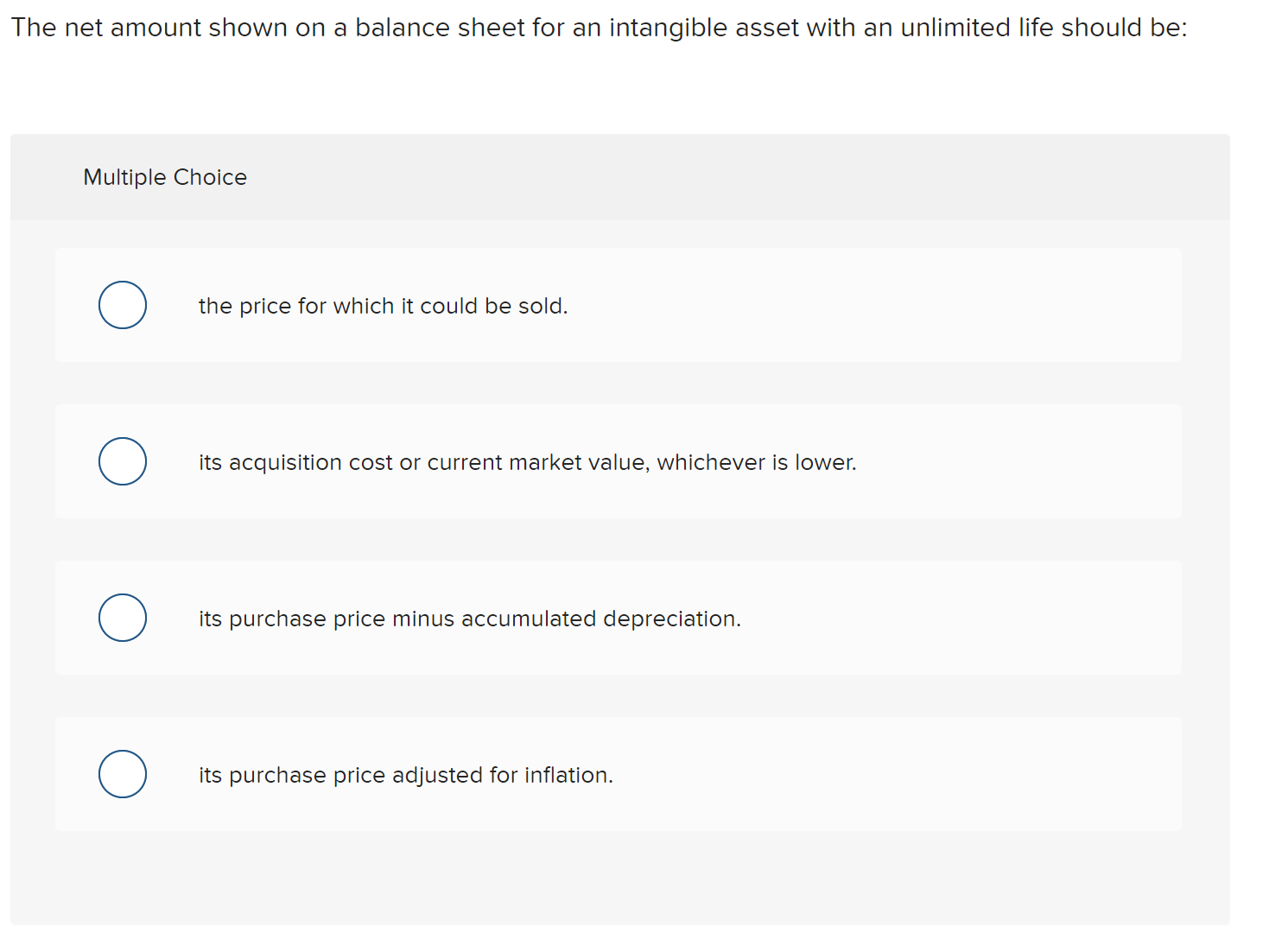

Company A uses an accelerated depreciation method while Company B uses the straightline method for an asset of the same cost and useful life. Which of the following statements is true? Multiple Choice O Company A will have higher depreciation expense in the early years but Company B will have the higher expense towards the end of the asset's useful life. 0 Company A will consistently have higher depreciation expense until residual value is reached. O Company B will have higher depreciation expense in the early years but Company A will have the higher expense towards the end of the asset's useful life. O Company B will consistently have higher depreciation expense until residual value is reached. The only asset that is assumed to have an indefinite useful life is: Multiple Choice O Property, Plant and Equipment. O Contra assets. O Land. O None of the choices are correct.ABC Co. purchased land and building at a price of $480,000. ABC also incurred a real estate broker's fee of $5,000 and legal fees of $2,000 to complete the purchase. ABC paid $3,000 to obtain a real estate appraisal prior to the purchase. The appraisal indicated that, valued separately, the land was worth $260,000 and the building was worth $240,000. The land should be recorded in the accounting records for: Multiple Choice O $249,600. O $253,240. O $254,800. O $259,600. The net amount shown on a balance sheet for an intangible asset with an unlimited life should be: Multiple Choice O the price for which it could be sold. 0 its acquisition cost or current market value, whichever is lower. O its purchase price minus accumulated depreciation. 0 its purchase price adjusted for inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts