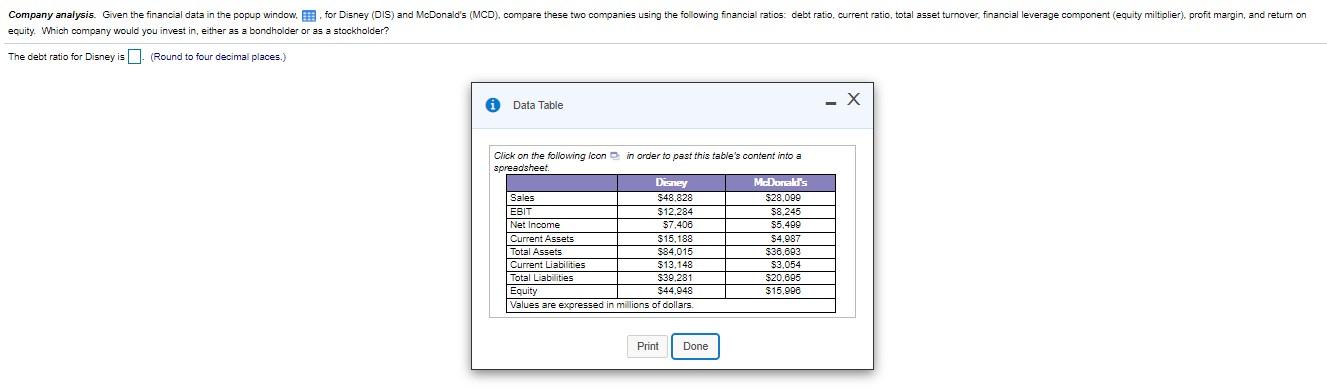

Question: Company analysis. Given the financial data in the popup window for Disney (DIS) and McDonald's (MCD). compare these two companies using the following financial ratios:

Company analysis. Given the financial data in the popup window for Disney (DIS) and McDonald's (MCD). compare these two companies using the following financial ratios: debt ratio, current ratio, total asset turnover, financial leverage component (equity miltiplier), profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The debt ratio for Disney is 1 (Round to four decimal places.) Data Table X $7.406 Click on the following icon in order to past this table's content into a spreadsheet Disney Morali's Sales $48.828 $28,099 EBIT $12,284 $8,245 Net Income 55.499 Current Assets $15,188 $4,087 Total Assets $84.015 2438,683 Current Liabilities $13,148 $3.054 Total Liabilities $39.281 $20.695 Equity $44.948 $15.998 Values are expressed in millions of dollars. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts