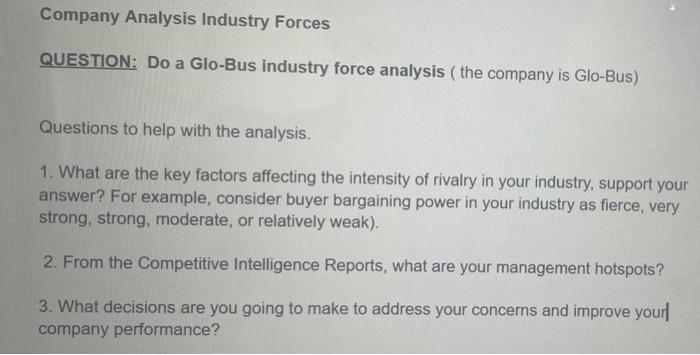

Question: Company Analysis Industry Forces QUESTION: Do a Glo-Bus industry force analysis ( the company is Glo-Bus) Questions to help with the analysis. 1. What are

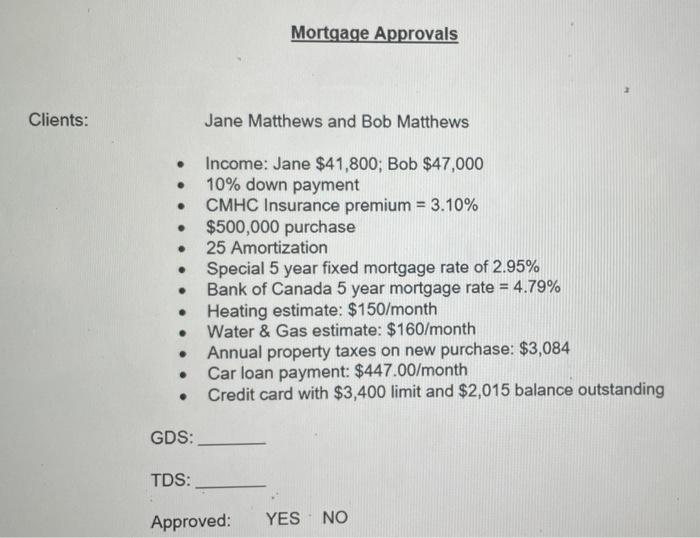

Company Analysis Industry Forces QUESTION: Do a Glo-Bus industry force analysis ( the company is Glo-Bus) Questions to help with the analysis. 1. What are the key factors affecting the intensity of rivalry in your industry, support your answer? For example, consider buyer bargaining power in your industry as fierce, very strong, strong, moderate, or relatively weak). 2. From the Competitive Intelligence Reports, what are your management hotspots? 3. What decisions are you going to make to address your concerns and improve your company performance? Mortgage Approvals Clients: Jane Matthews and Bob Matthews . . . . . Income: Jane $41,800; Bob $47,000 10% down payment CMHC Insurance premium = 3.10% $500,000 purchase 25 Amortization Special 5 year fixed mortgage rate of 2.95% Bank of Canada 5 year mortgage rate = 4.79% Heating estimate: $150/month Water & Gas estimate: $160/month Annual property taxes on new purchase: $3,084 Car loan payment: $447.00/month Credit card with $3,400 limit and $2,015 balance outstanding . . . . . GDS: TDS: Approved: YES NO Company Analysis Industry Forces QUESTION: Do a Glo-Bus industry force analysis ( the company is Glo-Bus) Questions to help with the analysis. 1. What are the key factors affecting the intensity of rivalry in your industry, support your answer? For example, consider buyer bargaining power in your industry as fierce, very strong, strong, moderate, or relatively weak). 2. From the Competitive Intelligence Reports, what are your management hotspots? 3. What decisions are you going to make to address your concerns and improve your company performance? Mortgage Approvals Clients: Jane Matthews and Bob Matthews . . . . . Income: Jane $41,800; Bob $47,000 10% down payment CMHC Insurance premium = 3.10% $500,000 purchase 25 Amortization Special 5 year fixed mortgage rate of 2.95% Bank of Canada 5 year mortgage rate = 4.79% Heating estimate: $150/month Water & Gas estimate: $160/month Annual property taxes on new purchase: $3,084 Car loan payment: $447.00/month Credit card with $3,400 limit and $2,015 balance outstanding . . . . . GDS: TDS: Approved: YES NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts