Question: Company B: Excel sheet assignment: Excel sheet assignment: : Review Cash flow statement as in attachment. Instructions: Need NVP, IRR, NVP Vs IRR in excel

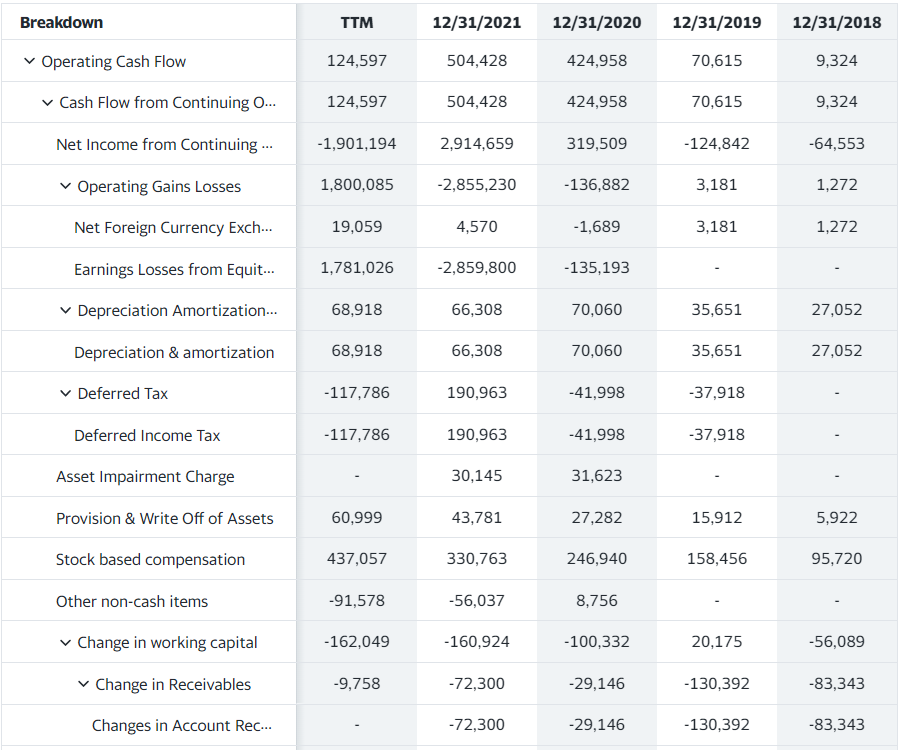

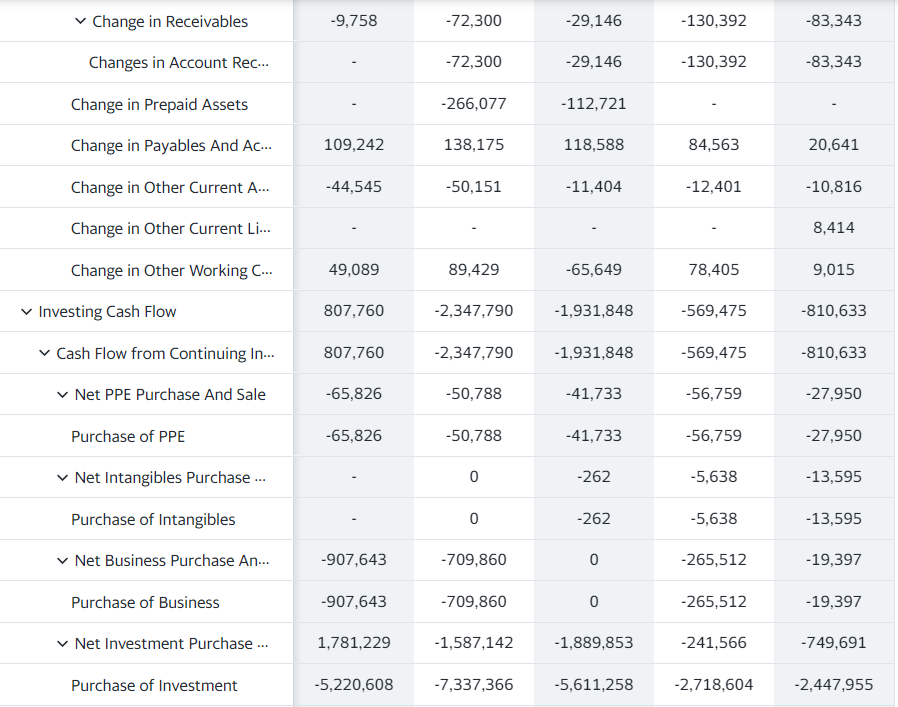

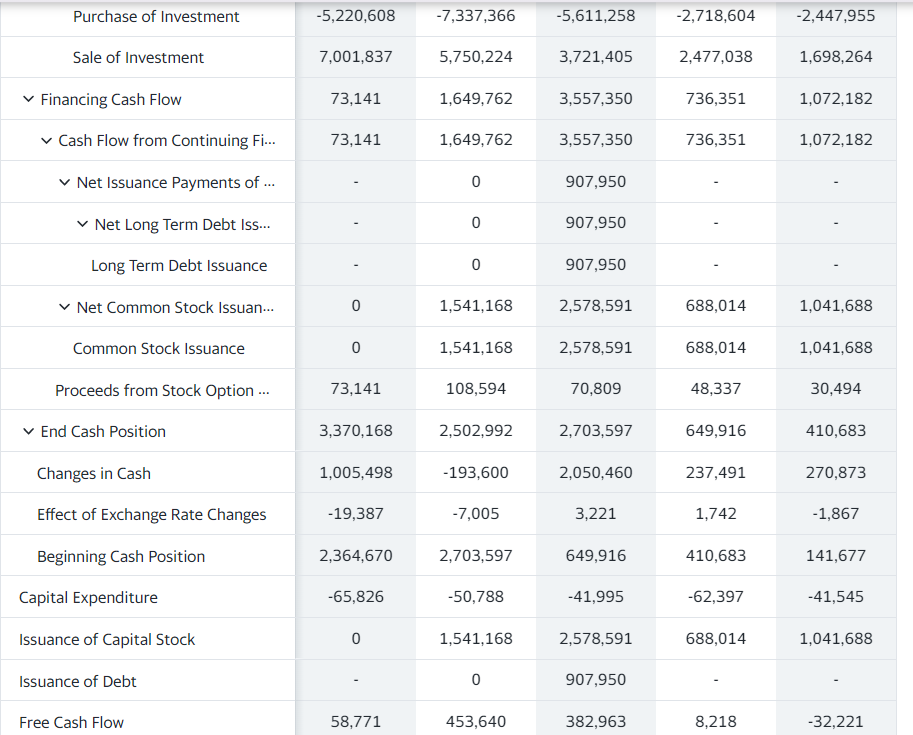

Company B: Excel sheet assignment: Excel sheet assignment: : Review Cash flow statement as in attachment.

Instructions: Need NVP, IRR, NVP Vs IRR in excel sheet

1. Use a required rate of return (hurdle rate) of 8% for the discounting of the future cash flows.

2. An Excel spreadsheet that analyzes the proposals from two vendors using the net present value (NPV) discounted cash flow model. Use Excel's =NPV( ) -costs function to determine which proposal is more financially acceptable. The final part of your assignment will include your justification of why your group's analysis using the NPV method suggests selecting one proposal over the other.

3. Use a required rate of return (hurdle rate) of 8% for the discounting of the future cash flows.

3. Use a required rate of return (hurdle rate) of 8% for the discounting of the future cash flows.

\begin{tabular}{|c|c|c|c|c|c|} \hline Purchase of Investment & 5,220,608 & 7,337,366 & 5,611,258 & 2,718,604 & 2,447,955 \\ \hline Sale of Investment & 7,001,837 & 5,750,224 & 3,721,405 & 2,477,038 & 1,698,264 \\ \hline Financing Cash Flow & 73,141 & 1,649,762 & 3,557,350 & 736,351 & 1,072,182 \\ \hline Cash Flow from Continuing Fi... & 73,141 & 1,649,762 & 3,557,350 & 736,351 & 1,072,182 \\ \hline Net Issuance Payments of & & 0 & 907,950 & & \\ \hline Net Long Term Debt Iss... & & 0 & 907,950 & & \\ \hline Long Term Debt Issuance & & 0 & 907,950 & & \\ \hline Net Common Stock Issuan & 0 & 1,541,168 & 2,578,591 & 688,014 & 1,041,688 \\ \hline Common Stock Issuance & 0 & 1,541,168 & 2,578,591 & 688,014 & 1,041,688 \\ \hline Proceeds from Stock Option & 73,141 & 108,594 & 70,809 & 48,337 & 30,494 \\ \hline V End Cash Position & 3,370,168 & 2,502,992 & 2,703,597 & 649,916 & 410,683 \\ \hline Changes in Cash & 1,005,498 & 193,600 & 2,050,460 & 237,491 & 270,873 \\ \hline Effect of Exchange Rate Changes & 19,387 & 7,005 & 3,221 & 1,742 & 1,867 \\ \hline Beginning Cash Position & 2,364,670 & 2,703,597 & 649,916 & 410,683 & 141,677 \\ \hline Capital Expenditure & 65,826 & 50,788 & 41,995 & 62,397 & 41,545 \\ \hline Issuance of Capital Stock & 0 & 1,541,168 & 2,578,591 & 688,014 & 1,041,688 \\ \hline Issuance of Debt & & 0 & 907,950 & & \\ \hline Cash Flow & 58,771 & 453,640 & 382,963 & 8,218 & 32,221 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts