Question: Company Comparison between Apple (first column) and Alphabet (second column). The comparison of the ratios is an important part of the project. A good approach

Company Comparison between Apple (first column) and Alphabet (second column). The comparison of the ratios is an important part of the project. A good approach is to briefly explain what the ratio tells us. Indicate whether a higher or lower ratio is better. Then compare the two companies on this basis. Remember that each ratio below requires a comparison.

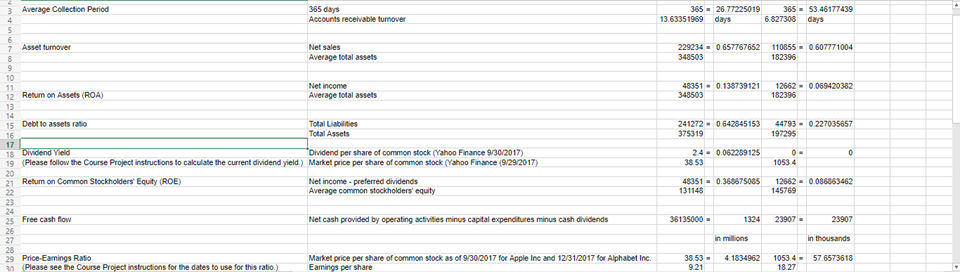

Average Collection Period 365 days Accounts receivable turnover 365 = 26.77225019 13.63351969 days 365 - 53.46177439 6.827308 days 5 Asset turnover Net sales Average total assets 229234 - 0.657767652 348503 110855 0.607771004 182396 48351 -0.138739121 348503 12662 - 0.069420382 182396 10 11 Net income 12 Return on Assets (ROA) Average total assets 13 14 15 Debt to assets ratio Total Liabilities 16 Total Assets 17 18 Dividend Yield *Dividend per share of common stock (Yahoo Finance 9/30/2017) 19 (Please follow the Course Project instructions to calculate the current dividend yield) Market price per share of common stock (Yahoo Finance (9/29/2017) 20 21 Return on Common Stockholders' Equity (ROE) Net income-preferred dividends Average common stockholders' equity 241272 - 0.642845153 375319 44793 - 0 227035657 197295 24 - 0.062289125 38.53 0 0- 10534 48351 - 0.368675085 131148 12662 - 0.086863462 145769 ANASAS Free cash flow Net cash provided by operating activities minus capital expenditures minus cash dividends 36135000 - 1324 23907- 23907 in millions in thousands 29 Price-Earings Ratio 30 Please see the Course Project instructions for the dates to use for this ratio) Market price per share of common stock as of 9/30/2017 for Apple Inc and 12/31/2017 for Alphabet Inc. 4.1834962 38.53 9.21 1053.4 - 57.6573618 18.27 Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts