Question: Company is Lockheed Martin: Develop a specific recommendation, with supporting rationale , as to whether the assigned company's recent trends and results in financial performance

Company is Lockheed Martin:

Develop a specific recommendation, with supporting rationale, as to whether the assigned company's recent trends and results in financial performance is of sufficient financial strength, will THE COMPANY be financially sustainable over the next two to three years, and which steps should be done to improve its financial stability?

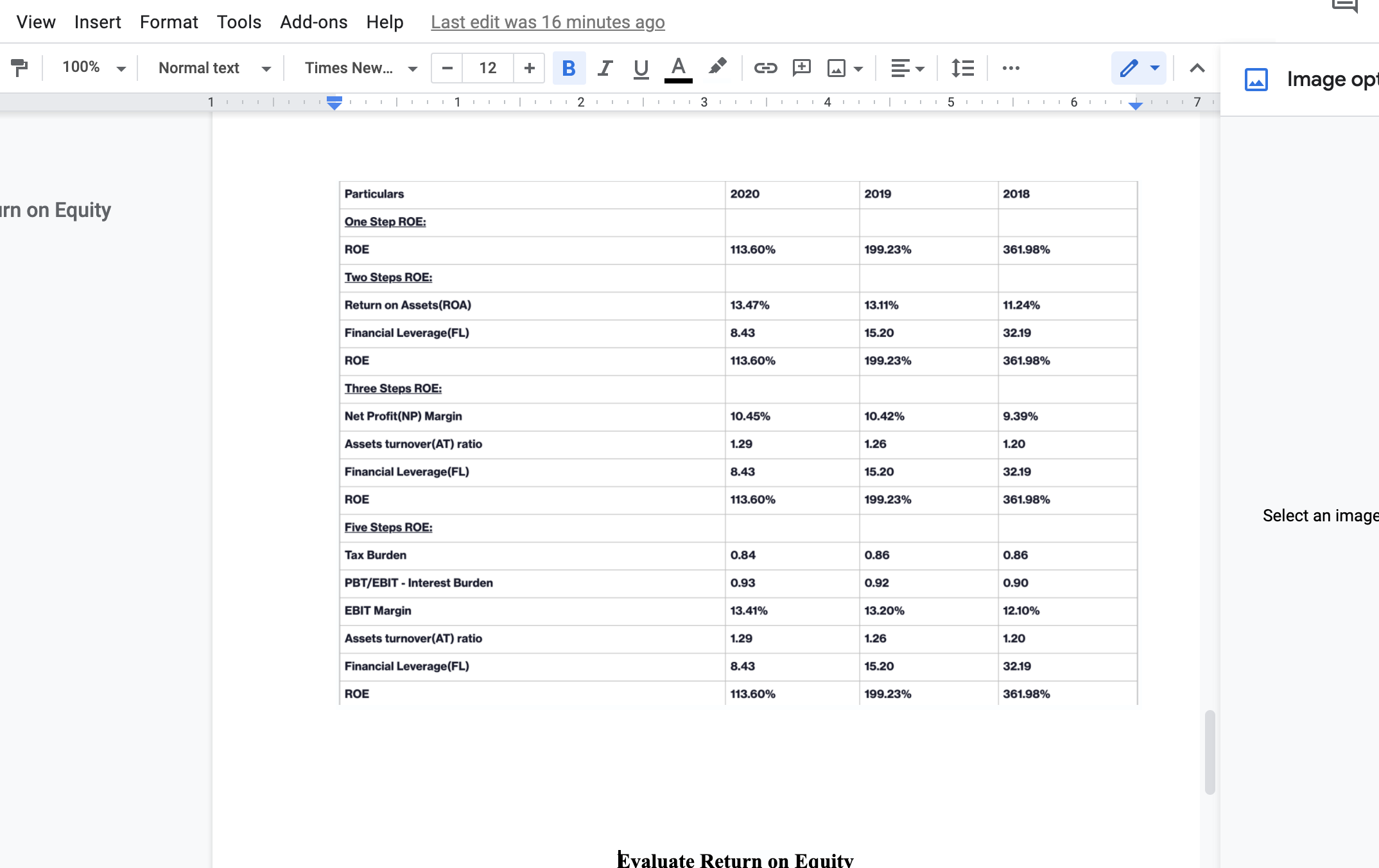

View Insert Format Tools Add-ons Help 100% rn on Equity Normal text 1 I I I T I Times New... I I I I T Particulars ROE | I One Step ROE: I ROE Last edit was 16 minutes ago BI UA - ROE Five Steps ROE: Tax Burden I 1 Two Steps ROE: Return on Assets(ROA) Financial Leverage (FL) I ROE Three Steps ROE: Net Profit(NP) Margin Assets turnover(AT) ratio Financial Leverage (FL) 12 I PBT/EBIT - Interest Burden EBIT Margin Assets turnover (AT) ratio Financial Leverage (FL) I T + I I I 2 I I I | I I I | 2020 113.60% 13.47% 8.43 113.60% 10.45% 1.29 8.43 113.60% 0.84 0.93 13.41% 1.29 8.43 113.60% A I I I 4 I Evaluate Return on Equity I I I 2019 199.23% 13.11% 15.20 199.23% 10.42% 1.26 15.20 199.23% 0.86 0.92 13.20% 1.26 15.20 199.23% I I t= 5 : I | I 2018 361.98% 11.24% 32.19 361.98% 9.39% 1.20 32.19 361.98% 0.86 0.90 I 12.10% 1.20 32.19 361.98% I 6 I I I 7 Image opt Select an image

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

To evaluate the financial strength and sustainability of Lockheed Martin over the next two to three years lets analyze the companys recent trends and results in financial performance particularly focu... View full answer

Get step-by-step solutions from verified subject matter experts