Question: Company is looking at purchasing a machine. The machine costs $50,000, has a useful life of 4 years and salvage value of $5,000. The

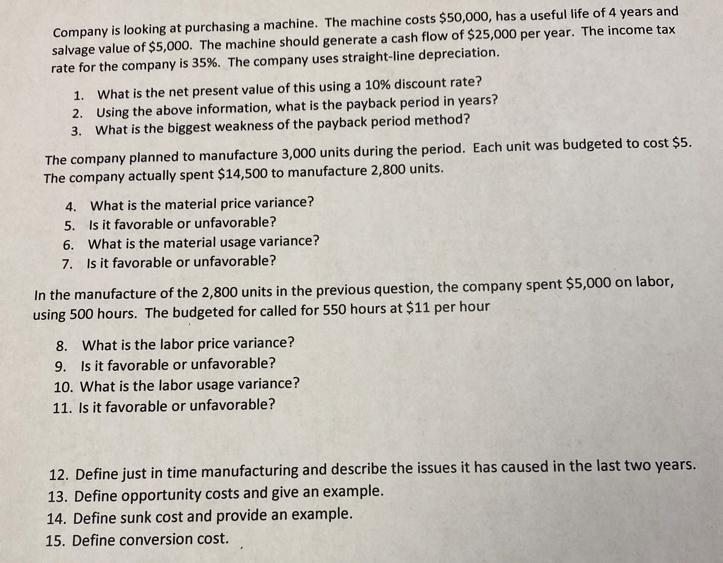

Company is looking at purchasing a machine. The machine costs $50,000, has a useful life of 4 years and salvage value of $5,000. The machine should generate a cash flow of $25,000 per year. The income tax rate for the company is 35%. The company uses straight-line depreciation. 1. What is the net present value of this using a 10% discount rate? 2. Using the above information, what is the payback period in years? 3. What is the biggest weakness of the payback period method? The company planned to manufacture 3,000 units during the period. Each unit was budgeted to cost $5. The company actually spent $14,500 to manufacture 2,800 units. 4. What is the material price variance? 5. Is it favorable or unfavorable? 6. What is the material usage variance? 7. Is it favorable or unfavorable? In the manufacture of the 2,800 units in the previous question, the company spent $5,000 on labor, using 500 hours. The budgeted for called for 550 hours at $11 per hour 8. What is the labor price variance? 9. Is it favorable or unfavorable? 10. What is the labor usage variance? 11. Is it favorable or unfavorable? 12. Define just in time manufacturing and describe the issues it has caused in the last two years. 13. Define opportunity costs and give an example. 14. Define sunk cost and provide an example. 15. Define conversion cost.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

1 The net present value NPV can be calculated by finding the present value of each years cash flow and subtracting the initial investment Using a 10 d... View full answer

Get step-by-step solutions from verified subject matter experts