Company X is rated A and has 3 bonds issued 2 years ago. All the bonds...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

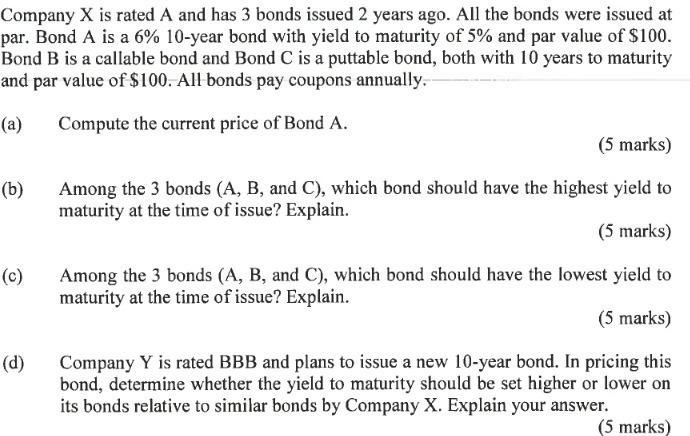

Company X is rated A and has 3 bonds issued 2 years ago. All the bonds were issued at par. Bond A is a 6% 10-year bond with yield to maturity of 5% and par value of $100. Bond B is a callable bond and Bond C is a puttable bond, both with 10 years to maturity and par value of $100. All bonds pay coupons annually. (a) Compute the current price of Bond A. (b) (c) (d) (5 marks) Among the 3 bonds (A, B, and C), which bond should have the highest yield to maturity at the time of issue? Explain. (5 marks) Among the 3 bonds (A, B, and C), which bond should have the lowest yield to maturity at the time of issue? Explain. (5 marks) Company Y is rated BBB and plans to issue a new 10-year bond. In pricing this bond, determine whether the yield to maturity should be set higher or lower on its bonds relative to similar bonds by Company X. Explain your answer. (5 marks) Company X is rated A and has 3 bonds issued 2 years ago. All the bonds were issued at par. Bond A is a 6% 10-year bond with yield to maturity of 5% and par value of $100. Bond B is a callable bond and Bond C is a puttable bond, both with 10 years to maturity and par value of $100. All bonds pay coupons annually. (a) Compute the current price of Bond A. (b) (c) (d) (5 marks) Among the 3 bonds (A, B, and C), which bond should have the highest yield to maturity at the time of issue? Explain. (5 marks) Among the 3 bonds (A, B, and C), which bond should have the lowest yield to maturity at the time of issue? Explain. (5 marks) Company Y is rated BBB and plans to issue a new 10-year bond. In pricing this bond, determine whether the yield to maturity should be set higher or lower on its bonds relative to similar bonds by Company X. Explain your answer. (5 marks)

Expert Answer:

Answer rating: 100% (QA)

a To compute the current price of Bond A we need to use the formula for present value of a bond PV C1 r1 C1 r2 C1 rn F1 rn where PV is the present value C is the coupon payment r is the yield to matur... View the full answer

Related Book For

Introduction To Corporate Finance

ISBN: 9781118300763

3rd Edition

Authors: Laurence Booth, Sean Cleary

Posted Date:

Students also viewed these finance questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

A coupon bond that pays interest semiannually has a par value of $1000, matures in 3 years, and has a yield to maturity of 3%. If the coupon rate is 9%, the value of the bond today will be 1b- A...

-

Hansel Electronics has the following: If Hansel has 7,000 units on hand at December 31, the cost of ending inventory under the average-cost method is: (a) $84,000. (b) $70,000. (c) $56,000. (d)...

-

1. What is a fixture? 2. What could Freeman have done to avoid this?

-

a. Create a class named Sandwich. Data fields include a String for the main ingredient (such as tuna), a String for bread type (such as wheat), and a double for price (such as 4.99). Include methods...

-

The instrument that measures the displacement of a vibrating body is called a(n) a. seismometer b. transducer c. accelerometer

-

Moore, Aiken, and Payne is a dental clinic serving the needs of the general public on a first-come, first-served basis. The clinic has three dental chairs, each staffed by a dentist. Patients arrive...

-

Provide the missing data in the following table for a distributor of martial arts products: (Round "Turnover" and "ROI" answers to 1 decimal place.) Alpha Division Bravo Division Charlie Division...

-

For each scenario below, identify which sampling method was used. Explain your reasoning. a) A dean decided to assess students' views on the school cafeteria's food. To do so, the dean randomly...

-

Leland Manufacturing produced 3,700 units of finished product, using 15,000 pounds of raw material. Sixteen thousand pounds were purchased for $158,400. The material standards for the product are 4...

-

What is the essential purpose of the physical design phase? Who must be involved in this phase, and who may be involved? What are the two philosophies of physical design on the different ends of the...

-

In our methodology, as well as most system methodologies, system owners and system designers do not participate in the requirements analysis phase. What do you think the reason is for this?

-

Projects at times are canceled or abandoned, sometimes by choice, sometimes not. Research the Web for articles on project abandonment strategies, and select two of them. a. What articles did you...

-

You are a new project manager and have been assigned responsibility for an enterprise information systems project that touches every division in your organization. The chief executive officer stated...

-

Beatrice is an excellent managershe is very capable of managing the bureaucratic process and following the business rules in her corporation. She is a by the book person who can always be counted on...

-

For this assignment, you will be reading about a case that appeared in the news in early 2019. You will then write a response to this case in which you demonstrate an understanding of the basic...

-

CRUZ, INC. Comparative Balance Sheets December 31, 2015 CRUZ, INC. Income Statement For Year Ended December 31, 2015 Required Use the indirect method to prepare the cash provided or used from...

-

As the CFO of your company, it falls to you to make the final decision on large expenditures. Recently, your controller has proposed purchasing a new computer system at a cost of $50,000. He believes...

-

Public corporations have no fixed lifespan; as such, they are often viewed as entities that will pay dividends to their shareholders in perpetuity. Suppose a firm pays a dividend of $2 per share...

-

State the drawbacks of the payback period and discounted payback period.

-

Stroboscope a. produces light pulses intermittently b. has high output and is insensitive to temperature c. frequently used in velocity pickups d. has high sensitivity and frequency range e....

-

The water tank shown in Fig. 14.33 is supported by a hollow circular steel column. The tank, made of steel, is in the form of a thin-walled pressure vessel and has a capacity of 40,000 litres. Design...

-

Using the third-order Runge-Kutta method, solve Problem 11.15. Data From Problem 11.15:- Using the second-order Runge-Kutta method, solve the differential equation \(\ddot{x}+1000 x=0\) with the...

Study smarter with the SolutionInn App