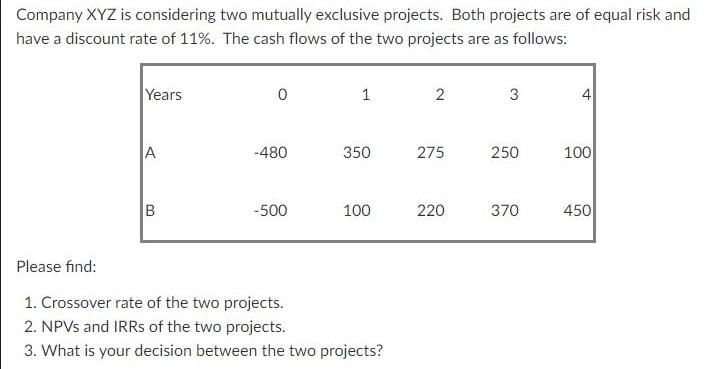

Question: Company XYZ is considering two mutually exclusive projects. Both projects are of equal risk and have a discount rate of 11%. The cash flows

Company XYZ is considering two mutually exclusive projects. Both projects are of equal risk and have a discount rate of 11%. The cash flows of the two projects are as follows: Years A B 0 -480 -500 1 350 100 Please find: 1. Crossover rate of the two projects. 2. NPVs and IRRs of the two projects. 3. What is your decision between the two projects? 2 275 220 3 250 370 4 100 450

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

To find the crossover rate of the two projects we need to determine the discount rate at which the n... View full answer

Get step-by-step solutions from verified subject matter experts