Question: Comparative balance sheets for 2 0 2 4 and 2 0 2 3 , a statement of income for 2 0 2 4 , and

Comparative balance sheets for and a statement of income for and additional information from the accounting records of Red, Incorporated, are provided below:

RED, INCORPORATED

Comparative Balance Sheets

December and $ in millions

Assets

Cash $ $

Accounts receivable

Prepaid insurance

Inventory

Buildings and equipment

Less: Accumulated depreciation

$ $

Liabilities

Accounts payable $ $

Accrued liabilities

Notes payable

Bonds payable

Shareholders Equity

Common stock

Retained earnings

$ $

RED, INCORPORATED

Statement of Income

For Year Ended December

$ in millions

Revenues

Sales revenue $

Expenses

Cost of goods sold $

Depreciation expense

Operating expenses

Net income $

Additional information from the accounting records:

During $ million of equipment was purchased to replace $ million of equipment depreciated sold at book value.

In order to maintain the usual policy of paying cash dividends of $ million, it was necessary for Red to borrow $ million from its bank.

Required:

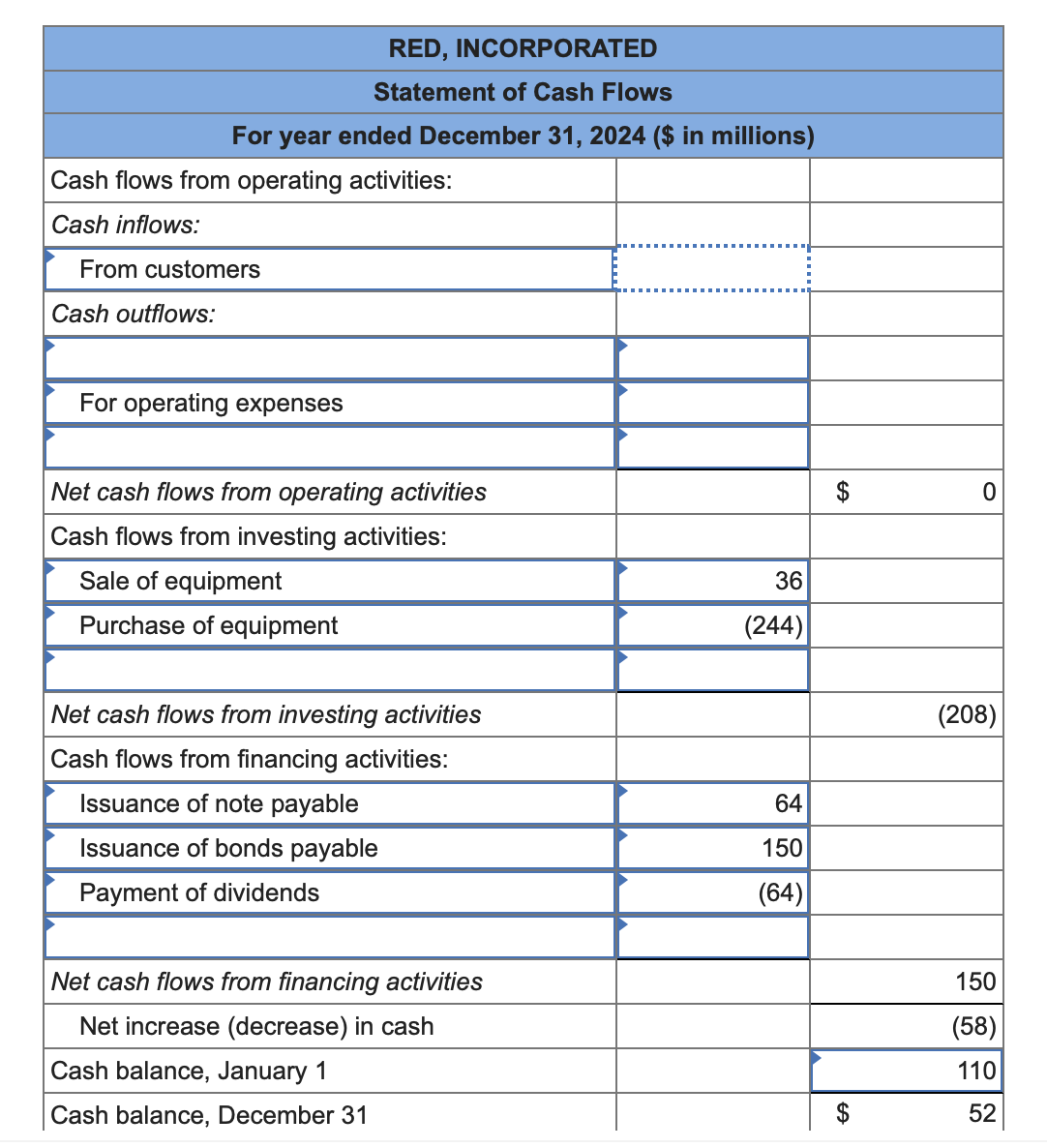

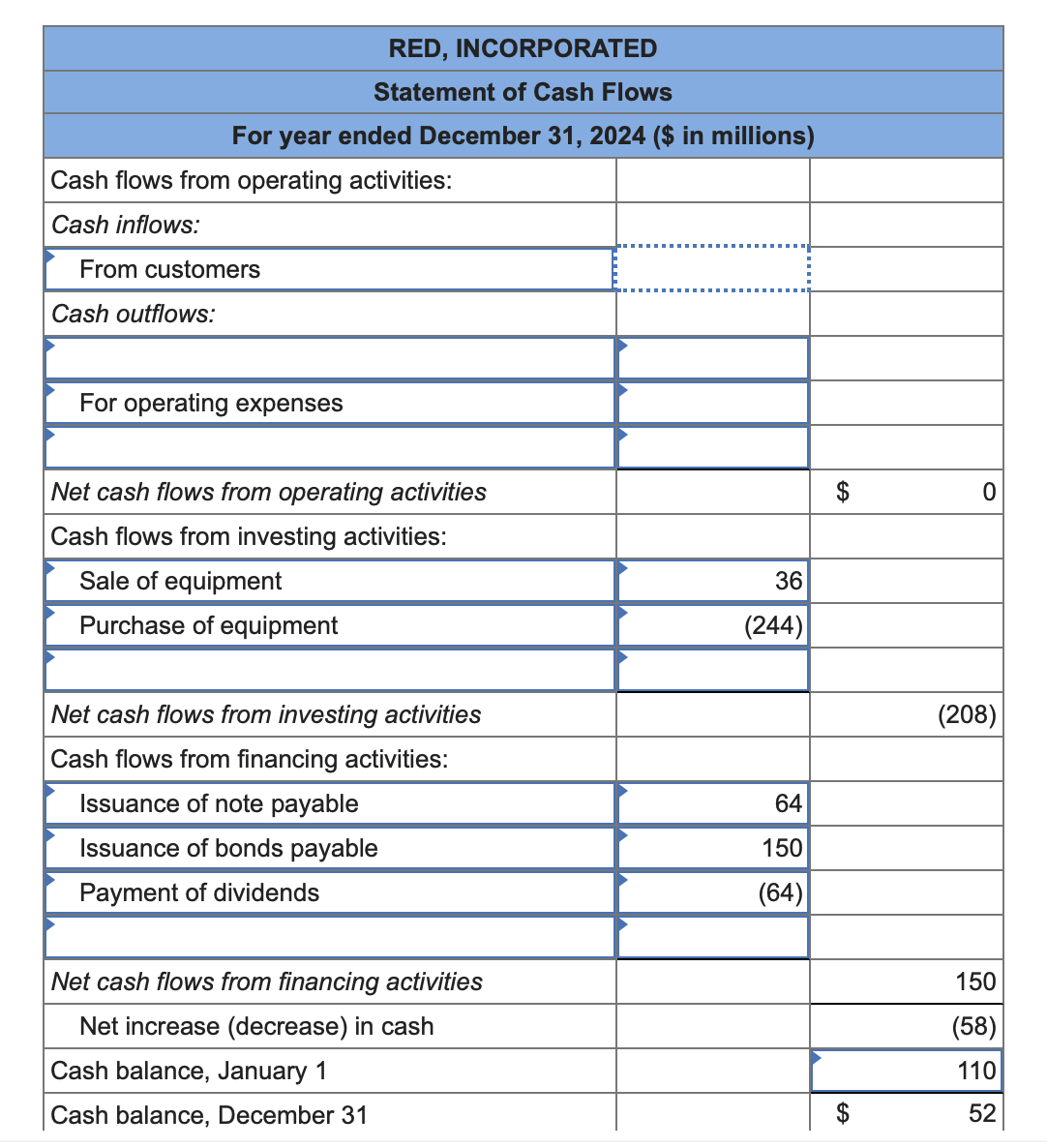

Prepare the statement of cash flows of Red, Incorporated, for the year ended December using the direct method to report operating activities.

Note: Enter your answers in millions ie should be entered as Cash outflows should be indicated with a minus sign.

Here is the fomat for the answer:tableRED INCORPORATEDStatement of Cash Flows,Cash flows from operating activities:,,Cash inflows:,,From customers,,Cash outflows:,,For operating expenses,,$Net cash flows from operating activities,,Cash flows from investing activities:,,Sale of equipment,,Purchase of equipment,,Net cash flows from investing activities,,Cash flows from financing activities:,,Issuance of note payable,,Issuance of bonds payable,Payment of dividends,Net cash flows from financing activities,,Net increase decrease in cash,,Cash balance, January Cash balance, December

The format for the question, and what i have so far is in the image. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock