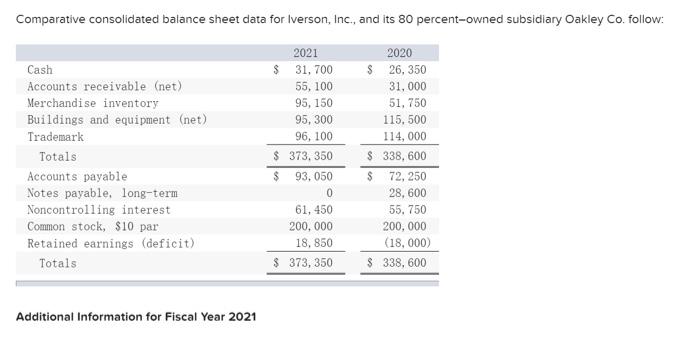

Question: Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percentowned subsidiary Oakley Co. follow: 2021 2020 Cash $ 31,700 $ 26,350 Accounts receivable

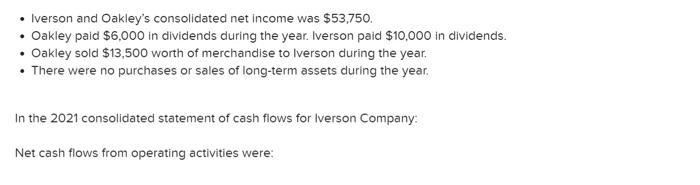

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary Oakley Co. follow: Cash Accounts receivable (net) Merchandise inventory Buildings and equipment (net) Trademark Totals Accounts payable Notes payable, long-term Noncontrolling interest Common stock, $10 par Retained earnings (deficit) Totals 2021 $ 31, 700 55, 100 95, 150 95, 300 96, 100 $ 373, 350 $ 93,050 0 61, 450 200,000 18,850 $ 373, 350 2020 $ 26, 350 31,000 51, 750 115.500 114,000 $ 338,600 $ 72,250 28, 600 55.750 200,000 (18,000) $ 338, 600 Additional Information for Fiscal Year 2021 Iverson and Oakley's consolidated net income was $53,750. Oakley paid $6,000 in dividends during the year. Iverson paid $10,000 in dividends. Oakley sold $13,500 worth of merchandise to Iverson during the year. There were no purchases or sales of long-term assets during the year. In the 2021 consolidated statement of cash flows for Iverson Company Net cash flows from operating activities were: Multiple Choice $8.600. $20.800. $41,600 $45,150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts