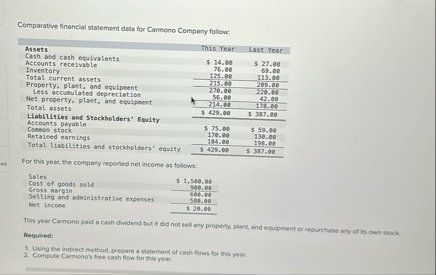

Question: Comparative financial statement data for Carmono Company follow: table [ [ Sisets , This Year,Last Year ] , [ Cash and cash efuivalents ]

Comparative financial statement data for Carmono Company follow:

tableSisetsThis Year,Last YearCash and cash efuivalentsInventorypesTotal current assets,Property plant, and equipment,Less accumulated depreciation,Net property, plant, and equipment,Total assets,Liabilities and Stockholders' Equity,Recounts paryableRetained earnings, c eTotal liabilities and stockholders equity,

For this yeas, the compary reponed net income as follows:

tabletableSalesCost of goods soldGross margintable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock