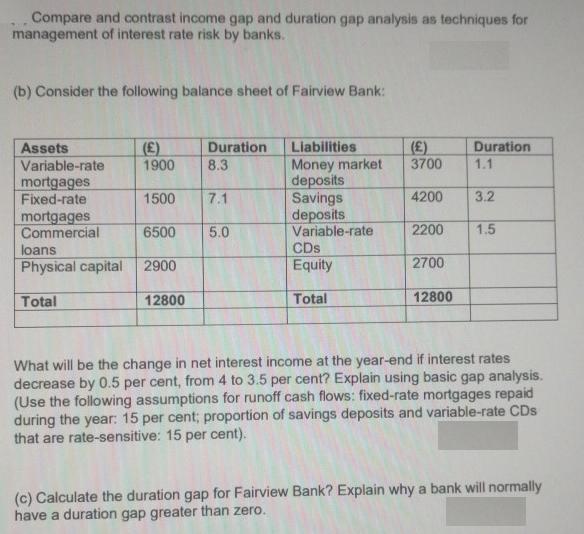

Question: Compare and contrast income gap and duration gap analysis as techniques for management of interest rate risk by banks. (b) Consider the following balance

Compare and contrast income gap and duration gap analysis as techniques for management of interest rate risk by banks. (b) Consider the following balance sheet of Fairview Bank: (E) 1900 Duration 8.3 Liabilities () 3700 Duration Assets Variable-rate mortgages Fixed-rate mortgages Commercial loans Physical capital 1.1 Money market deposits Savings deposits Variable-rate CDs Equity 1500 7.1 4200 3.2 6500 5.0 2200 1.5 2900 2700 Total 12800 Total 12800 What will be the change in net interest income at the year-end if interest rates decrease by 0.5 per cent, from 4 to 3.5 per cent? Explain using basic gap analysis. (Use the following assumptions for runoff cash flows: fixed-rate mortgages repaid during the year: 15 per cent; proportion of savings deposits and variable-rate CDs that are rate-sensitive: 15 per cent). (c) Calculate the duration gap for Fairview Bank? Explain why a bank will normally have a duration gap greater than zero.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

A A gap analysis is the process companies use to compare their current performance with their desired expected performance This analysis is used to determine whether a company is meeting expectations ... View full answer

Get step-by-step solutions from verified subject matter experts