Question: compare between ratios 2019 and 2020 icrease or dicrease what are items add and delet in 2019 and 2020 ? 11:19 Introduction Align Technology, Inc.

compare between ratios 2019 and 2020 icrease or dicrease

what are items add and delet in 2019 and 2020 ?

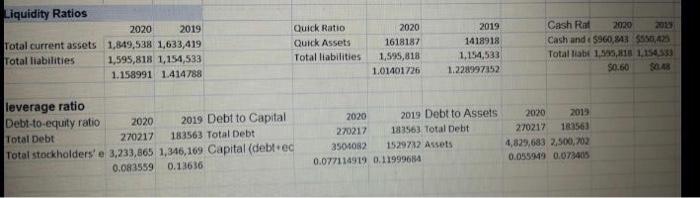

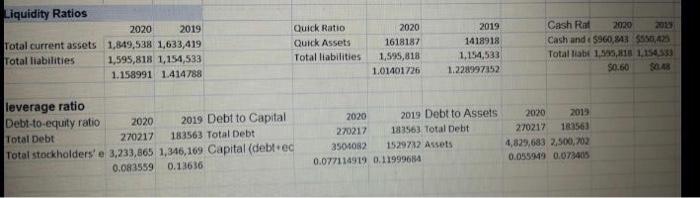

11:19 Introduction Align Technology, Inc. designs, produces, and sells orthodontics, restorative dentistry, and cosmetic dentistry products. It operates across three segments: Transparent Aligner, Detector, and Facilities. Invisalign complete, teen, and assist products, as well as vivera retainers for malocclusion treatment, make up the Clear Aligner category. Intraoral scanning devices, such as single hardware platforms and restorative or orthodontic software options, ancillary products, and other related additional services, are included in the Scanner and Services section. Zia Chishti, Brian Freyburger, and Kelsey Wirth founded the company in March 1997, and it is based in Tempe, Arizona. Our aim is to assist doctors in entering a new and larger market by investing in creative products and creating brands that will draw millions of new patients to their practise. We've revolutionised the orthodontic industry by combining advanced 3D modelling for digital treatment preparation, shape- engineering based on biomechanical concepts, mass-customization, and 3D printing. The goal is to provide patients of all ages with the smiles they desire. Our smile-altering technologies and inventions was developed to meet the needs of today's patients by offering care choices that are easy, comfortable, and accessible, all while improving overall oral health. Our vision is to bring clear aligner orthodontic treatment to the masses. Cash ratio = (Cash + Marketable Securities) / Current Liabilities Quick ratio = (Cash + Marketable Securities + Receivables) / Current Liabilities Current ratio = (Cash + Marketable Securities + Receivables + Inventory)/ Current Liabilities most commonly used leverage ratios: 1. Debt-to-Assets Ratio = Total Debt / Total Assets 2. Debt-to-Equity Ratio = Total Debt / Total Equity 3. Debt-to-Capital Ratio = Today Debt / (Total Debt + Total Equity) L Liquidity ratio for align Technologies is good its total current assets is more than its total current liabilities so ideal ratio is 2 ratio 1 company ratio is 1. 15 company can fibre bi more current assets or reduce its current liabilities to maintain the ideal ratio that is 2 is to 1 in 2020 20 cash ratio is 0.6 which is above the minimum ideal ratio of cash ratio but in 2019 it was 0.48 which is below the ideal cash ratio quick ratio is 1.01 which is far from Ideal ratio of 2 is to 1 Leverage ratio of align technology FY2020 is bad because company have less debt over its equity Companies using more equity over lomg tern debt. company in 2020 it should have to attach assets ratio debt to Capital ratio is lower than the ideal ratio for the the company

2000 Liquidity Ratios 2020 2019 Total current assets 1,849,538 1,633,419 Total liabilities 1,595,818 1,154,533 1.158991 1.414788 Quick Ratio Quick Assets Total liabilities 2020 1618187 1.595,818 1.01401726 2019 1418918 1,154,533 1.228997352 Cash Rol Cash and (5960, $55,423 Total liabi 1,945,18 1,154531 $0.60 leverage ratio Debt-to-equity ratio 2020 2019 Debt to Capital Total Debt 270217 183563 Total Debt Total stockholders' e 3,233,865 1,346,169 Capital (debtiec 0.083559 0.13636 2020 2019 Debt to Assets 270217 183563 Total Debt 350 102 1529712 Assets 0.077114919 0.11999684 2020 2013 270217 13563 4,829,683 2,500,202 0.05549 0.072405 2000 Liquidity Ratios 2020 2019 Total current assets 1,849,538 1,633,419 Total liabilities 1,595,818 1,154,533 1.158991 1.414788 Quick Ratio Quick Assets Total liabilities 2020 1618187 1.595,818 1.01401726 2019 1418918 1,154,533 1.228997352 Cash Rol Cash and (5960, $55,423 Total liabi 1,945,18 1,154531 $0.60 leverage ratio Debt-to-equity ratio 2020 2019 Debt to Capital Total Debt 270217 183563 Total Debt Total stockholders' e 3,233,865 1,346,169 Capital (debtiec 0.083559 0.13636 2020 2019 Debt to Assets 270217 183563 Total Debt 350 102 1529712 Assets 0.077114919 0.11999684 2020 2013 270217 13563 4,829,683 2,500,202 0.05549 0.072405