Question: Compare Jimenez's ratios below, with the industry average data, and comment briefly on Jimenez's projected strengths and weaknesses. Jimenez's ratios: Quick ratio = 0.8; CA/CL

Compare Jimenez's ratios below, with the industry average data, and comment briefly on Jimenez's projected strengths and weaknesses.

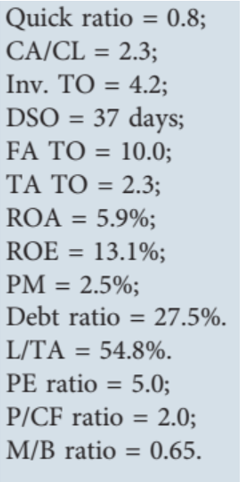

Jimenez's ratios:

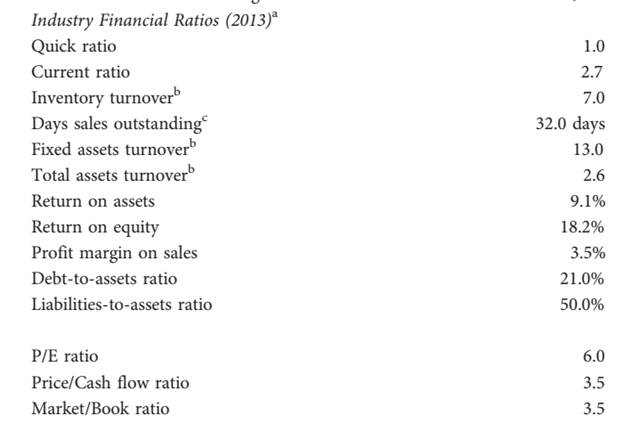

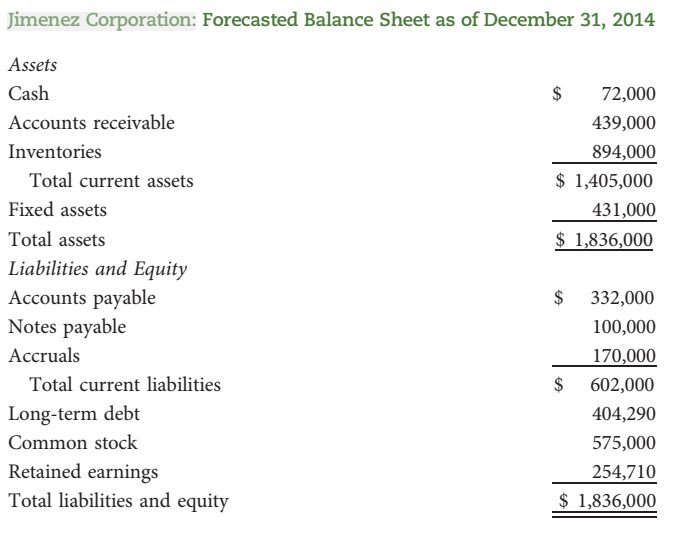

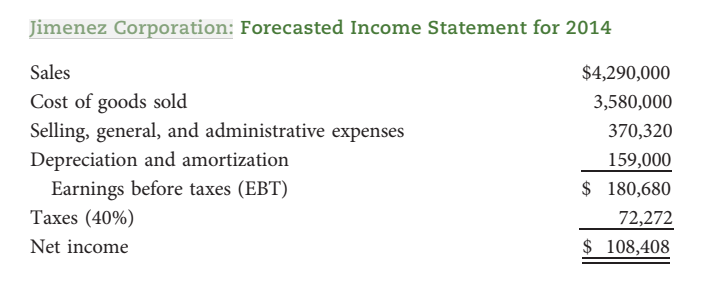

Quick ratio = 0.8; CA/CL = 2.3; Inv. TO = 4.2; DSO = 37 days; FA TO = 10.0; TA TO = 2.3; ROA = 5.9%; ROE = 13.1%; PM = 2.5%; Debt ratio = 27.5%. L/TA = 54.8%. PE ratio = 5.0; P/CF ratio = 2.0; M/B ratio = 0.65.Industry Financial Ratios (2013) Quick ratio 1.0 Current ratio 2.7 Inventory turnover 7.0 Days sales outstanding" 32.0 days Fixed assets turnover 13.0 Total assets turnover 2.6 Return on assets 9.1% Return on equity 18.2% Profit margin on sales 3.5% Debt-to-assets ratio 21.0% Liabilities-to-assets ratio 50.0% P/E ratio 6.0 Price/Cash flow ratio 3.5 Market/Book ratio 3.5Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2014 Assets Cash $ 72,000 Accounts receivable 439,000 Inventories 894,000 Total current assets $ 1,405,000 Fixed assets 431,000 Total assets $ 1,836,000 Liabilities and Equity Accounts payable $ 332,000 Notes payable 100,000 Accruals 170,000 Total current liabilities $ 602,000 Long-term debt 404,290 Common stock 575,000 Retained earnings 254,710 Total liabilities and equity $ 1,836,000Jimenez Corporation: Forecasted Income Statement for 2014 Sales $4,290,000 Cost of goods sold 3,580,000 Selling, general, and administrative expenses 370,320 Depreciation and amortization 159,000 Earnings before taxes (EBT) $ 180,680 Taxes (40%) 72,272 Net income $ 108,408

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts