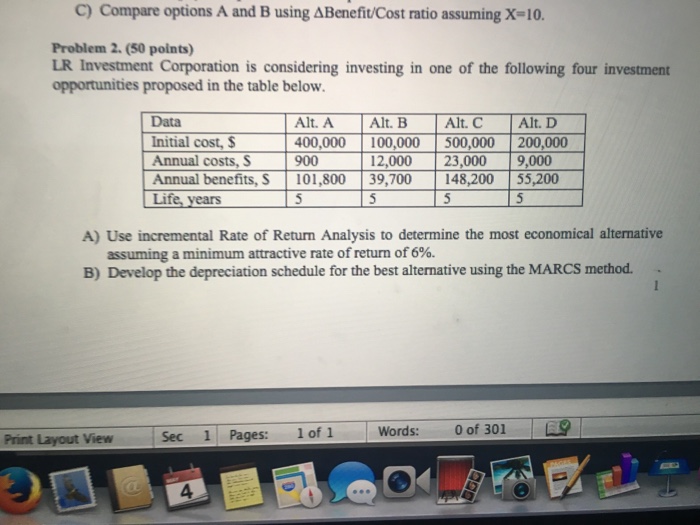

Question: Compare options A and B using delta Benefit/Cost ratio assuming X=10. LR Investment Corporation is considering investing in one of the following four investment opportunities

Compare options A and B using delta Benefit/Cost ratio assuming X=10. LR Investment Corporation is considering investing in one of the following four investment opportunities proposed in the table below. Use incremental Rate of Return Analysis to determine the most economical alternative assuming a minimum attractive rate of return of 6%. Develop the depreciation schedule for the best alternative using the MARES method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts