Question: Compare three projects: Write out your solution, by hand (except for the chart), in terms of Interest Factors then with equations/values then with the numerical

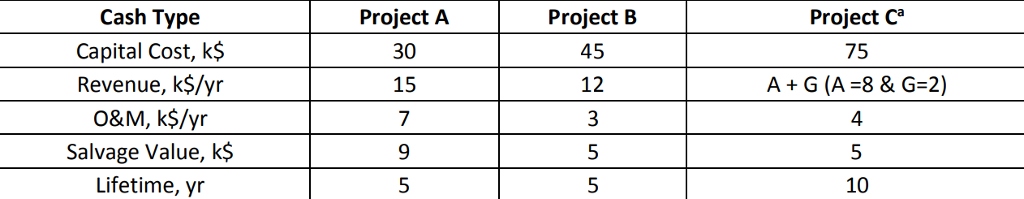

Compare three projects: Write out your solution, by hand (except for the chart), in terms of Interest Factors then with equations/values then with the numerical value of the interest factor. Of course, once this is done for a given interest factor--e.g., (P/F,0.05,5)--you can go directly from interest factor to final value in subsequent calculations. Use an effective annual interest rate of 5%. You are encouraged to check your answers with Excel. A. Create a single cash flow table for the three projects described below (5,5, and 10 years, respectively). Also include 10 year cash flows for A and B. That is 6 columns, including End of Year.  aProject C Revenue = 8,000 first year & increases 2000/year thereafter (i.e., 8,000, 10,000, 12,000,) B. Determine the Present Worth of the three alternatives. Use 10 yr cash flows. (Partial Solution: Project A = $20,850) (Check your answers with Excel NPV formula) C. Determine the Annual Cash Flow of each Project. Use the project lifetime cash flow table (but also use the 10 yr cash flow table for Project B to demonstrate that the 5 and 10 year tables give the same answer). (Partial Solution: Project B = $-490) (Check your answers with Excel PMT formula) D. Determine the Rate of Return (i*) of each project by 1st plotting present worth vs interest rate in Excel to obtain an approximate solution and 2 nd using trial & error to determine final answers to the tenth place. Use the equations from part B, but set them equal to zero and make the interest rate a variable. Include a single chart to present your PW vs i plots. Show the excel equation(s) you used to create the project A plot (see the 3rd FAQ @ http://users.rowan.edu/~everett/). (Partial Solution: Project C = 9.4%) (Check your answers with Excel IRR formula) E. Determine the undiscounted payback period for each project. Use the 10-year cash flows. Partial Solution: Project C = Year 8) F. Determine the discounted payback period for each project. Use the 10-year cash flows. (Partial Solution: Project C = Year 9) G. Which project has the maximum net benefit (Present or annual)? Which has the best return rate? The best discounted payback period? Why can these methods give different answers?

aProject C Revenue = 8,000 first year & increases 2000/year thereafter (i.e., 8,000, 10,000, 12,000,) B. Determine the Present Worth of the three alternatives. Use 10 yr cash flows. (Partial Solution: Project A = $20,850) (Check your answers with Excel NPV formula) C. Determine the Annual Cash Flow of each Project. Use the project lifetime cash flow table (but also use the 10 yr cash flow table for Project B to demonstrate that the 5 and 10 year tables give the same answer). (Partial Solution: Project B = $-490) (Check your answers with Excel PMT formula) D. Determine the Rate of Return (i*) of each project by 1st plotting present worth vs interest rate in Excel to obtain an approximate solution and 2 nd using trial & error to determine final answers to the tenth place. Use the equations from part B, but set them equal to zero and make the interest rate a variable. Include a single chart to present your PW vs i plots. Show the excel equation(s) you used to create the project A plot (see the 3rd FAQ @ http://users.rowan.edu/~everett/). (Partial Solution: Project C = 9.4%) (Check your answers with Excel IRR formula) E. Determine the undiscounted payback period for each project. Use the 10-year cash flows. Partial Solution: Project C = Year 8) F. Determine the discounted payback period for each project. Use the 10-year cash flows. (Partial Solution: Project C = Year 9) G. Which project has the maximum net benefit (Present or annual)? Which has the best return rate? The best discounted payback period? Why can these methods give different answers?

Cash Type Capital Cost, k$ Revenue, k$/yr o&M, k$/yr Salvage Value, k$ Lifetime, yr Project A 30 15 7 Project B 45 12 Project Ca 75 A+G(A=8 & G-2) 4 5 5 10 Cash Type Capital Cost, k$ Revenue, k$/yr o&M, k$/yr Salvage Value, k$ Lifetime, yr Project A 30 15 7 Project B 45 12 Project Ca 75 A+G(A=8 & G-2) 4 5 5 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts