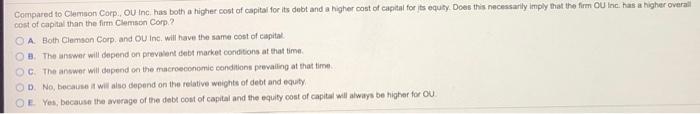

Question: Compared to Clemson Corp., OU Inc. has both a higher cost of capital for its dubt and a higher cost of capital for its equity.

Compared to Clemson Corp., OU Inc. has both a higher cost of capital for its dubt and a higher cost of capital for its equity. Does this necessarily imply that the firm O Inc. has a higher overall cost of capital than the firm Clemson Corp A Both Clemson Corp. and OU Inc. will have the same cost of capital 3. The answer will depend on prevalent de market conditions at that time OC The answer will depend on the macroeconomic conditions prevailing at that time OD. No, because it will also depend on the relative weights of debt and equity OE Yes, because the average of the debt cost of capital and the equity cost of capital will always be higher for OU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts