Question: 1. Comparing 4 companies using these attributes. Provide potential explanations for any differences discovered. Which company would you recommend as the best company to invest

1. Comparing 4 companies using these attributes. Provide potential explanations for any differences discovered. Which company would you recommend as the best company to invest in? Explain your reasoning.

2. Read the company’s financial statement note regarding long-term debt and commitments and contingencies. Does the company have any significant amounts coming due in the next five years?

- Suncor Energy Inc

For Long-term debt, Suncor has $1,444,000,000 in notes coming due in 2021, as well as $968,000,000 coming due in 2024.

For commitments and contingencies, Suncor has significant amounts coming due each year for the next five years for Product Transportation and Storage commitments averaging in the amount of about $1,050,600,000 per year. Suncor also has significant amounts coming due each year for the next five years for Other Commitments averaging in the amount of about $212,800,000 per year.

- Amplify Energy Corp

The company is having a minimum purchase commitment of $4,365 thousand and a minimum volume commitment is $11,781 thousand in the next five years.

- Ultra Petroleum Corporation

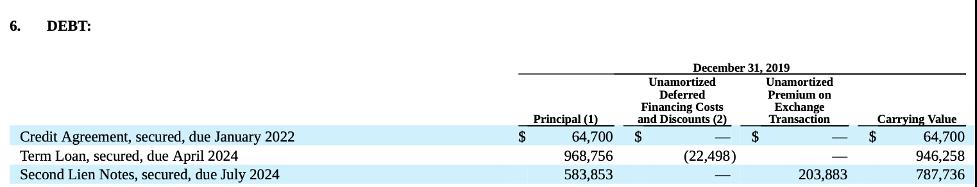

It has a Credit Agreement worth $64,700 due January 2022, a Term Loan worth $946,258 due April 2024, and a Second Lien Note worth $787,736 due July 2024.

- Nabors Industries Ltd

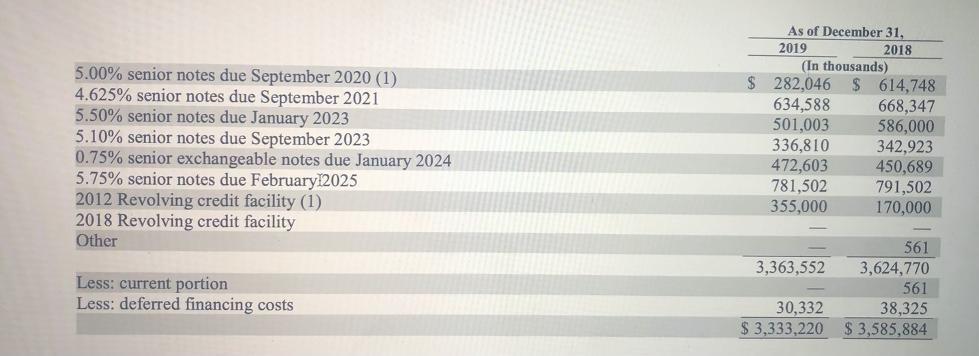

Nabor’s Long Term Debt is currently standing as the greatest liability for the company. Debt payable in the next five years are as followed;

Nabor’s Long Term Debt is currently standing as the greatest liability for the company. Debt payable in the next five years are as followed;

6. DEBT: December 31, 2019 Unamortized Deferred Financing Costs and Discounts (2) Unamortized Premium on Exchange Transaction Principal (1) Carrying Value Credit Agreement, secured, due January 2022 Term Loan, secured, due April 2024 Second Lien Notes, secured, due July 2024 64,700 946,258 787,736 2$ 64,700 968,756 583,853 (22,498) 203,883

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

The debt position of Suncore Energy Inc is as under Long Term Debt Notes due in 2021 1444000000 Notes due in 2024 968000000 TOTAL 2412000000 To meet the above commitments and contingencies Suncore Ene... View full answer

Get step-by-step solutions from verified subject matter experts