Question: Comparing a Traditional Costing System to an Activity - Based Costing System Marider Industries makes two types of windbreaker jackets: one for spring and one

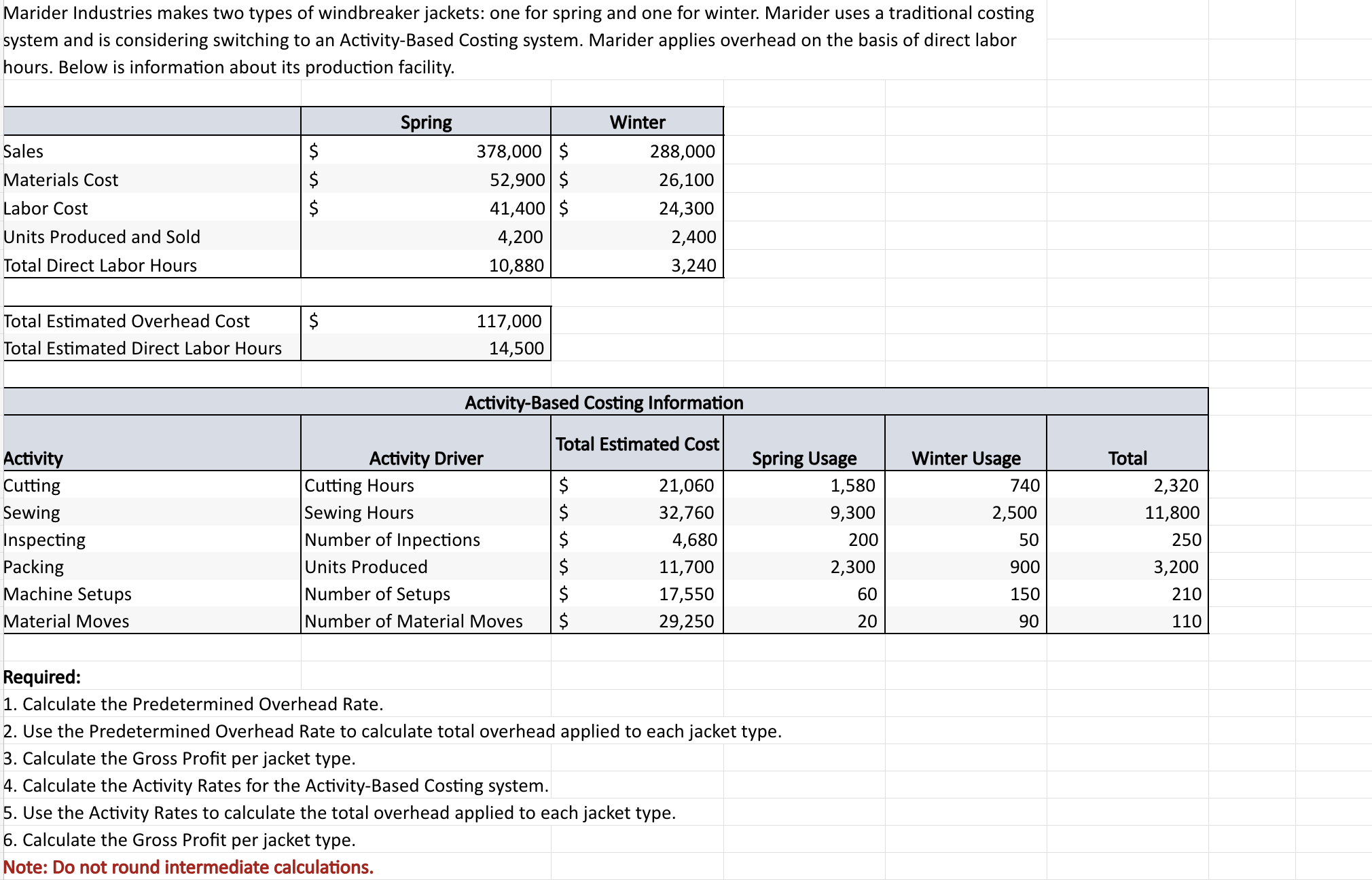

Comparing a Traditional Costing System to an ActivityBased Costing System Marider Industries makes two types of windbreaker jackets: one for spring and one for winter. Marider uses a traditional costing system and is considering switching to an ActivityBased Costing system. Marider applies overhead on the basis of direct labor hours. Below is information about its production facility. SpringWinterSales$ $ Materials Cost$ $ Labor Cost$ $ Units Produced and SoldTotal Direct Labor Hours Total Estimated Overhead Cost$ Total Estimated Direct Labor Hours ActivityBased Costing InformationActivityActivity DriverTotal Estimated CostSpring UsageWinter UsageTotalCuttingCutting Hours$ SewingSewing Hours$ InspectingNumber of Inpections$ PackingUnits Produced$ Machine SetupsNumber of Setups$ Material MovesNumber of Material Moves$ Required: Calculate the Predetermined Overhead Rate. Use the Predetermined Overhead Rate to calculate total overhead applied to each jacket type. Calculate the Gross Profit per jacket type. Calculate the Activity Rates for the ActivityBased Costing system. Use the Activity Rates to calculate the total overhead applied to each jacket type. Calculate the Gross Profit per jacket type. Indicate whether the traditional costing system overcosted or undercosted the jackets. Note: Do not round intermediate calculations. Navigation: Use theOpen Excel in New Tabbutton to launch this question. When finished in Excel, use theSave and Return to Assignmentbutton in the lower right to return to Connect. Marider Industries makes two types of windbreaker jackets: one for spring and one for winter. Marider uses a traditional costing system and is considering switching to an ActivityBased Costing system. Marider applies overhead on the basis of direct labor hours. Below is information about its production facility.

Required:

Calculate the Predetermined Overhead Rate.

Use the Predetermined Overhead Rate to calculate total overhead applied to each jacket type.

Calculate the Gross Profit per jacket type.

Calculate the Activity Rates for the ActivityBased Costing system.

Use the Activity Rates to calculate the total overhead applied to each jacket type.

Calculate the Gross Profit per jacket type.

Note: Do not round intermediate calculations.

Gross Profit per unit

Indicate whether the traditional costing system overcosted or undercosted the jackets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock