Question: Comparing all methods. Risky Business is looking at a project with the following estimated cash flow. . Risky Business wants to know the payback period.

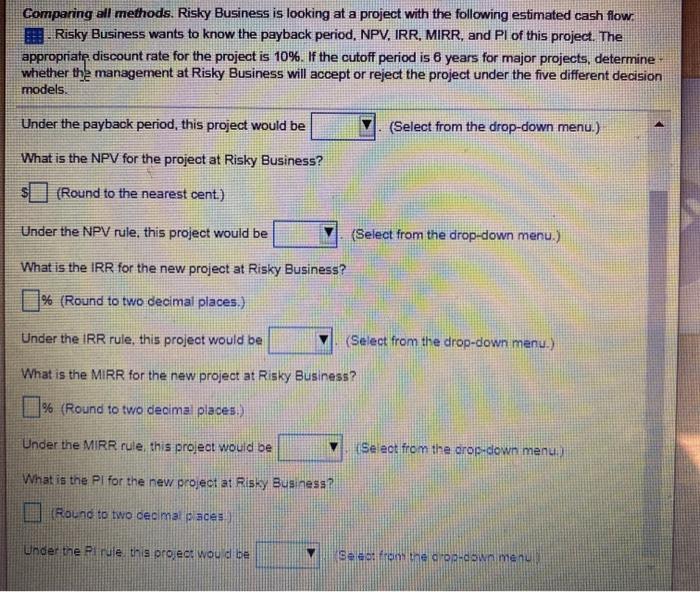

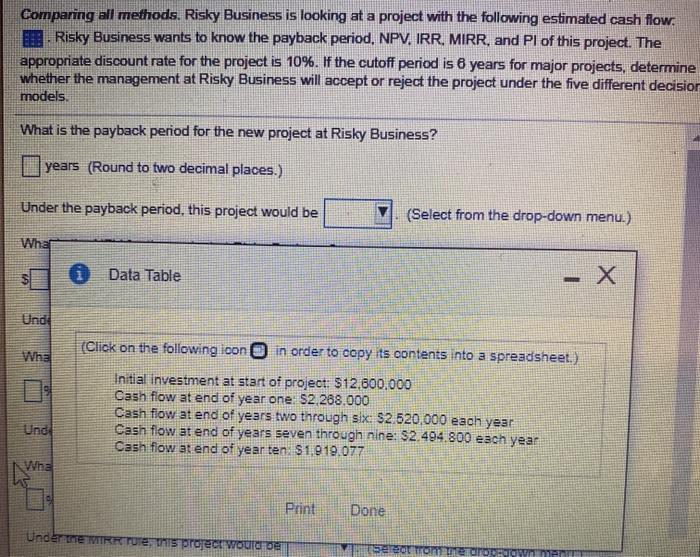

Comparing all methods. Risky Business is looking at a project with the following estimated cash flow. . Risky Business wants to know the payback period. NPV, IRR, MIRR, and Pl of this project. The appropriate discount rate for the project is 10%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business will accept or reject the project under the five different decision models. Under the payback period, this project would be (Select from the drop-down menu.) What is the NPV for the project at Risky Business? (Round to the nearest cent.) Under the NPV rule, this project would be (Select from the drop-down menu.) What is the IRR for the new project at Risky Business? % (Round to two decimal places.) Under the IRR rule, this project would be (Select from the drop-down menu.) What is the MIRR for the new project at Risky Business? % (Round to two decimal places. Under the MIRR rule, this project would be Select from the orop-down menu) What is the PI for the new project at Risky Business (Round to two decimal places Under the Pirule this project would be Select from the grop-down menu Comparing all methods. Risky Business is looking at a project with the following estimated cash flow. EEE . Risky Business wants to know the payback period. NPV. IRR. MIRR, and Pl of this project. The appropriate discount rate for the project is 10%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business will accept or reject the project under the five different decisior models. What is the payback period for the new project at Risky Business? years (Round to two decimal places.) Under the payback period, this project would be (Select from the drop-down menu.) Whal $ Data Table Und Wha (Click on the following icon in order to copy its contents into a spreadsheet.) Initial investment at start of project: $12,600.000 Cash flow at end of year one $2.288.000 Cash flow at end of years two through six: $2.520,000 each year Cash flow at end of years seven through nine: $2.494.800 each year Cash flow at end of year ten: $1.919.077 Unde Wha Print Done Unde TE MIR rore, this project woulder Select om te doen TTT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts