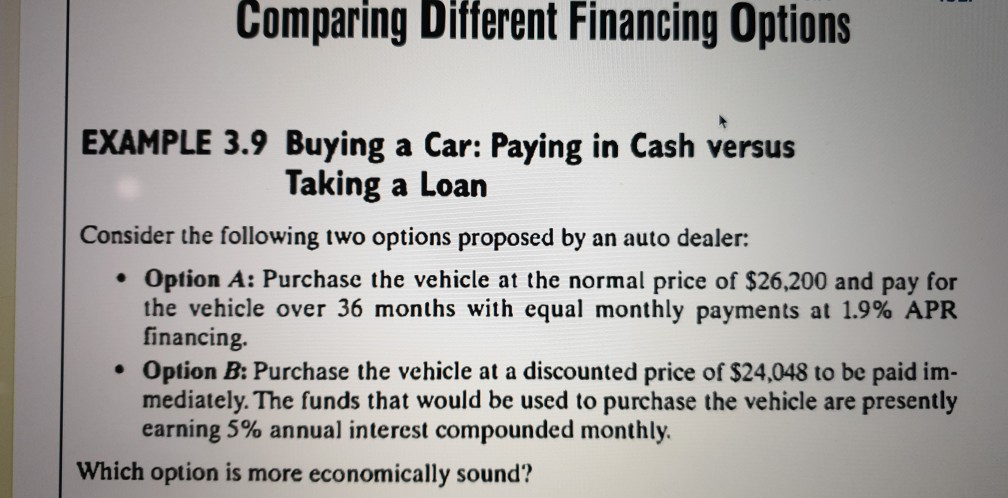

Question: Comparing Different Financing Options EXAMPLE 3.9 Buying a Car: Paying in Cash versus Taking a Loan Consider the following two options proposed by an auto

Comparing Different Financing Options EXAMPLE 3.9 Buying a Car: Paying in Cash versus Taking a Loan Consider the following two options proposed by an auto dealer: Option A: Purchase the vehicle at the normal price of $26,200 and pay for the vehicle over 36 months with equal monthly payments at 1.9% APR financing Option B: Purchase the vehicle at a discounted price of $24,048 to be paid im- mediately. The funds that would be used to purchase the vehicle are presently earning 5% annual interest compounded monthly. Which option is more economically sound

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock