Question: Comparing Inventory Costing Methods Better Bottles, Incorporated uses a periodic inventory system and has provided its current inventory information. The Controller has asked you to

Comparing Inventory Costing Methods

Better Bottles, Incorporated uses a periodic inventory system and has provided its current inventory information. The Controller has

asked you to prepare a comparison of the Ending Inventory and Cost of Goods Sold totals for three different inventory costing

methods: Periodic FIFO, LIFO, and WeightedAverage.

Required:

Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO.

Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO.

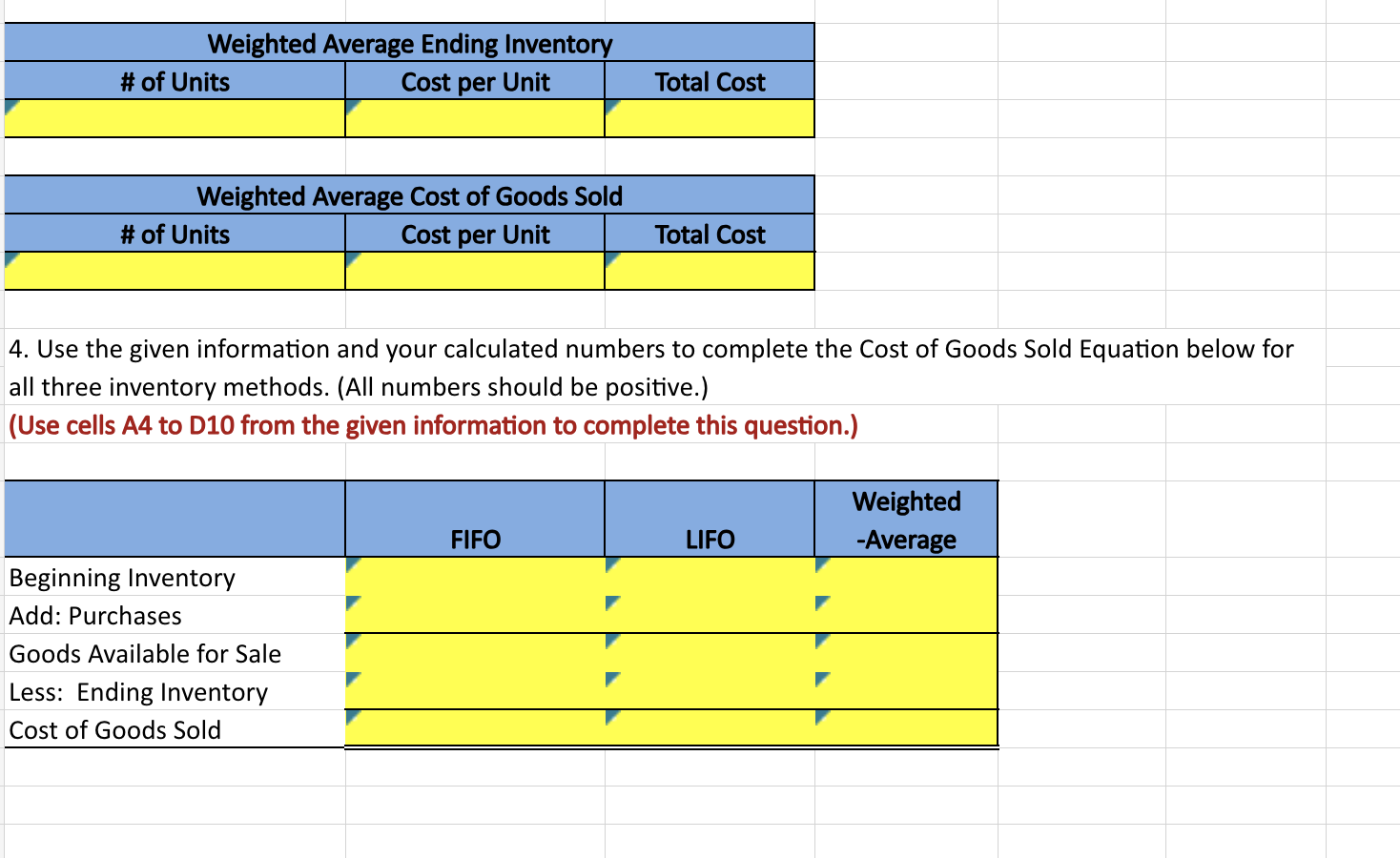

Using Periodic Weighted Average, first calculate the cost per unit using the formula below.

Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold.

Use the given information and your calculated numbers to complete the Cost of Goods Sold Equation below for all three inventory

methods. All numbers should be positive.

Required:

Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO.

Use cells A to D from the given information to complete this question.

Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO.

Use cells A to D from the given information to complete this question.Using Periodic Weighted Average, first calculate the cost per unit using the formula below.

Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold.

Use cells A to D from the given information to complete this question.

Weighted Average Cost per unit Use the given information and your calculated numbers to complete the Cost of Goods Sold Equation below for

all three inventory methods. All numbers should be positive.

Use cells A to D from the given information to complete this question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock