Question: Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $302,200. The equipment was expected to have a useful life of three

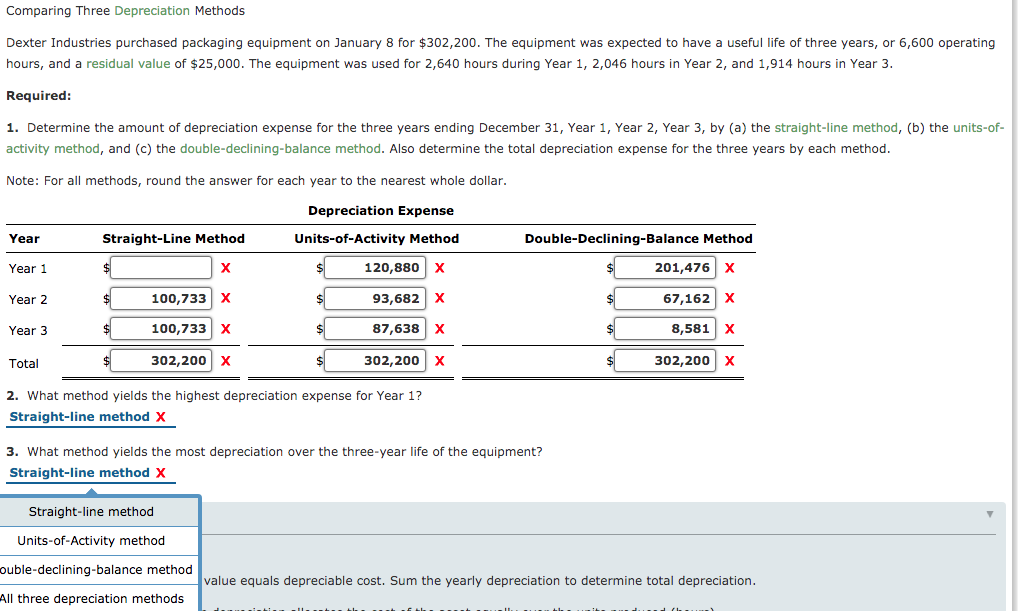

Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $302,200. The equipment was expected to have a useful life of three years, or 6,600 operating hours, and a residual value of $25,000. The equipment was used for 2,640 hours during Year 1, 2,046 hours in Year 2, and 1,914 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the three years ending December 31, Year 1, Year 2, Year 3, by (a) the straight-line method, (b) the units-of- activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. Note: For all methods, round the answer for each year to the nearest whole dollar. Depreciation Expense Units-of-Activity Method Year Straight-Line Method Double-Declining-Balance Method Year 1 $ 120,880 X 201,476 x Year 2 $ 100,733 X 93,682 X 67,162 x Year 3 $ 100,733 x 87,638 x 8,581 x Total 302,200 x 302,200 x 302,200 x 2. What method yields the highest depreciation expense for Year 1? Straight-line method X 3. What method yields the most depreciation over the three-year life of the equipment? Straight-line method X Straight-line method Units-of-Activity method ouble-declining-balance method value equals depreciable cost. Sum the yearly depreciation to determine total depreciation. All three depreciation methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts